We are all Veblenians now. Our understanding of the way people’s acquisitions and activities advertise their superiority—not least in an era of Facebook show-offs and Instagrammable lives—has roots in work that the economist and social theorist Thorstein Veblen published over a century ago. Behavioral economics finds a precursor in Veblen. So does evolutionary psychology. Our worries about the “financialization” of capital, with its overgrowth of exotic instruments of debt and the institutions that create and trade them? Veblen got there first. Patriarchy as a system centered on warfare, private property, and the control of women’s bodies: this feminist vision, too, was elaborated in his work.

Veblen even presaged the ascent of Trump. “A degree of arrested spiritual and mental development is, in practical effect, no bar against entrance into public office,” he once wrote. “Indeed, a degree of puerile exuberance coupled with a certain truculent temper and boyish cunning is likely to command something of popular admiration and affection.”

Given that Veblen so shaped our view of the world, it’s striking that our view of him has long been so distorted. For generations, he was seen as a “marginal man”—someone raised in penury within an insular immigrant community, who spoke no English until well into his teens, whose eccentric manner branded him as a social outcast and an academic outsider (save when it came to the bedrooms of faculty wives), and who saw through the complacencies of his scholarly age precisely because he never fit into it.

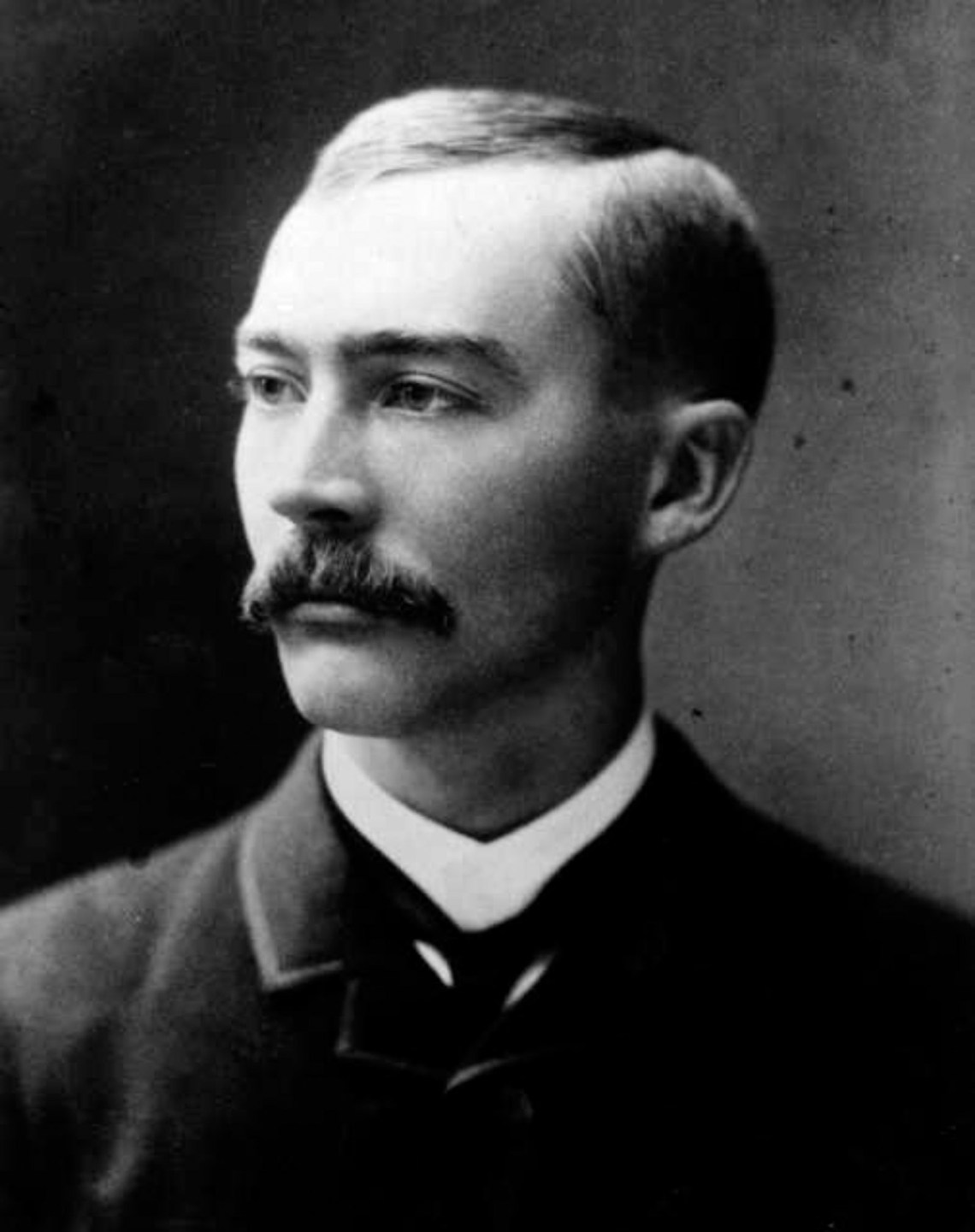

This depiction was put forth in a much-lauded biography that the Columbia economist Joseph Dorfman published in 1934, five years after his subject’s death. It set the tone for later writing on Veblen by such eminences as David Riesman, C. Wright Mills, and Daniel Bell. Only in the 1990s did revisionist scholarship reveal this portrait to be tendentious almost to the point of fraudulence. Charles Camic, a sociologist at Northwestern, pushes the argument further in Veblen: The Making of an Economist Who Unmade Economics, his book about the intellectual background of Veblen’s thought. Evidently he was not only far from a marginal man in his personal life; he was, in his professional life, the “consummate academic insider.”

Some of the biographical confusions are understandable. Veblen’s parents, Thomas and Kari, were immigrants from Norway who arrived in the US in 1847 with little money and less English, and joined other Scandinavians who were turning the northern prairies into croplands. But the industrious Veblens—with the help of the odd bank loan—soon established themselves. Thorstein was born in 1857; when he was eight, the family moved from Wisconsin to Minnesota, having acquired 290 acres there. By 1870 they were the richest farming household in the township. Thomas, a freethinker with literary interests, was an accomplished carpenter as well, and the house he built, now a National Historic Landmark, featured precise wainscoting and faux-graining, a double-deck porch, and walk-in closets.

Veblen had English-speaking playmates and classmates, and grew up in a household that could afford to hire tutors—and to pay in full when he enrolled in nearby Carleton College. It was Veblen’s great good fortune that its faculty included the thirtyish John Bates Clark, who later became the country’s preeminent economic theorist. Clark, in those days, inveighed against the “love of display” of the vulgar rich who ordered their libraries by the linear foot and “shrewd trading men” whose dealings benefited “no one but themselves.” Veblen took half a dozen courses with him; he recognized a first-rate mind when he saw one. So did Clark, who became a lifelong supporter of Veblen’s, even when the two found themselves on opposite sides of a fierce and consequential battle.

An equally fateful encounter was with a younger Carleton student named Ellen Rolfe. She was a niece of both the president of the college and the president of a major midwestern railroad company, and she was described by another student as “easily the most intellectual member” of her class. Having grown up close to great wealth but not quite in possession of it, she was a Ruskinian socialist, with literary ambitions. (“I want most of all to be a poet of the new time,” she wrote.)

A decade elapsed before they were married, in part because she was hesitant to marry anyone at all, and in part because Veblen was away in graduate school—at Johns Hopkins, where he studied philosophy and political economy, and at Yale, where he received a doctorate in philosophy in 1884. He then fell ill with what seems to have been malaria and went home for a years-long convalescence. He may have been recovering, too, from having been dosed with calomel, a mercury compound widely used for such conditions, as Elizabeth and Henry Jorgensen conjecture in Thorstein Veblen: Victorian Firebrand (1998), a ragged but spirited biography that eschews the “marginal man” trope. When Thorstein and Ellen married in 1888, neither was in the pink of health; Ellen had long suffered from thyroid dysfunction (she hid a goiter behind high collars) and was recovering from a breakdown. Still, the newlyweds also shared cultural and political enthusiasms, and were jointly captivated by Edward Bellamy’s just-published Looking Backward, a million-selling, socialist-utopian novel with powers of political conversion unequaled until The Fountainhead arrived to pull impressionable youth in the opposite direction.

Advertisement

The professional course of Veblen’s life was finally set when, in 1891, he went to Cornell and swiftly secured a second doctorate, in economics. (The typical Ph.D. thesis wasn’t the baggy monster it later became.) His work was so impressive that when his adviser was hired away by the University of Chicago the following year, he brought his brilliant protégé with him as a junior colleague. Veblen spent the next decade and a half at Chicago, crafting the arguments for which he became known.

In Veblen, Camic has produced a sort of intellectual biography that largely dispenses with the personal life, while directing intense and illuminating attention to the scholarly milieu in which Veblen emerged. In chapter after chapter, he establishes the continuities between Veblen’s views and those of his professors and peers. Veblen is considered, for example, the progenitor of institutionalism in economics, which sees economic activity as shaped by evolving institutions and customs, rather than simply arising from the aggregation of rational, self-interested individuals. Yet Camic shows that many of Veblen’s instructors, at Hopkins, Yale, and Cornell, were saying much the same thing. Veblen’s evolutionary convictions—“Why Is Economics Not an Evolutionary Science?” was the title of a 1898 paper—were similarly shared by his mentors and colleagues. Even the combination of these interests wasn’t distinctive; some of his most illustrious Chicago colleagues, Camic says, viewed social institutions and evolution as “interlocked concepts.”

And while we may be impressed by Veblen’s regular recourse to the ethnography of distant tribes, Camic notes that Clark, when Veblen was his student, was calling for political economy to be “built on a permanent foundation of anthropological fact.” As for Veblen’s iconoclastic pose and prose? “In the Age of Iconoclasm, mainstream academics were iconoclasts,” Camic writes, pointing out that his main instructors in graduate school all described themselves as rebels. Veblen wasn’t out of the swim of things; he was simply swimming faster and more forcefully than his peers.

To a remarkable degree, the core tenets of Veblen’s thought can be found in his first and most famous book, A Theory of the Leisure Class: An Economic Study of Institutions (1899). The work, for most readers, was the great indictment of the Gilded Age; that’s how William Dean Howells approached it when he published the review that lofted it to fame. “Conspicuous consumption”—which could be “vicarious conspicuous consumption,” as when men required their wives to become women of leisure—put a crisply alliterative label on the habit of competitive display, grouping together fashion, finery, sports, and much more. Skirts appealed precisely because they were “cumbrous” and advertised that the wearer could afford a garment that “incapacitates her for all useful exertion.” Almost everything people did semaphored what Veblen called “invidious comparison.”

Our very aesthetic sense, he argued, was deeply and unconsciously shaped by status concerns: we admired the high gloss on a gentleman’s fancy hat but deplored the shine on a threadbare sleeve. We persuaded ourselves that the handwrought silver spoon was prettier than the machine-made and perfectly shaped aluminum one, though they were equivalent in their “serviceability”—a crucial Veblenian term of value. The canons of taste arose from perceptions of price.

As was then common, Veblen divided the history of mankind into the stages of savagery, barbarism, and civilization, although he was inclined to depict this not so much as progression as decadence. In “peaceable savagery,” we engaged in honest toil to create serviceable goods—responsive to real needs, not wasteful consumer preferences. Only in the barbarian stage did the “predatory habits and aptitudes” of forcible acquisition evolve. The essential thing to acquire was the labor of others, and Veblen thought women were the most productive of laborers. Hence his argument that the “institution of ownership has begun with the ownership of persons, primarily women.”

In our civilized era, these predatory ways became only more pervasive and proficiently exercised under “the pecuniary employments”—anything directed at moneymaking rather than manufacture. Ownership had all the prestige, while the work of making useful things, “industrial employment,” was denigrated. For economists, the chief provocation was in the thesis (still in fledgling form here) that pecuniary pursuits were nonproductive, that the profit motive tended to be at odds with, rather than aligned with, what Veblen thought mattered most: the efficient use of industrial capacity. The problem with industry was that it was in the hands of businessmen.

Advertisement

Both readers who approached A Theory of the Leisure Class as cultural critique and those who approached it as economic theory were struck by its caustic, coruscating prose. Camic says the style was “a standard piece of equipment in the intellectual toolbox handed down to him.” In fact, that style was doing a great deal of work. Veblen, as a social scientist, maintained a pretense that he was making no judgments even as his adjectives constantly rendered their verdicts. “Opinion seems to be divided as to whether I am a knave or a fool, though there are some who make out that the book is a work of genius,” Veblen humble-bragged to his older brother Andrew. Inevitably, the book participated in the economy of prestige it limned. Those who considered themselves sophisticates did well to have a copy in the drawing room, readily visible to their guests.

The professional triumphs were accompanied by personal turmoil. In A Theory of the Leisure Class, Veblen approvingly invoked the “New-Woman movement” and its “double watchword, ‘Emancipation’ and ‘Work.’” He seemed the perfect feminist, his wife the perfect New Woman.

But the two made each other miserable. It didn’t help that Veblen had fallen in love with Sarah Hardy, a brilliant graduate student. This was clearly what we’d now call an “emotional affair,” not a sexual one. (Modern scholars see no evidence that he was ever physically intimate with more than two women, his first and second wives.) The marital froideur was a torment, though, and Ellen responded by throwing herself into real estate, buying and selling properties, erecting shacks, and settling for a while on a remote farm in Idaho.

After Hardy was lost to another man in another city, Veblen decided to confess to his wife his futile love for the young woman (“I can see now that I have been deceiving both myself and you about it”) and ask for a divorce. He declared that “the relation of husband has become untenable,” and ventured that it might have “always been a false one.” Why false? Camic and others, taking note of a pathologist’s report, tell us that Ellen had anatomical anomalies that may have made coitus impossible. In the event, she refused to initiate a divorce, and Veblen wouldn’t pursue one against her wishes.

Curiously, Ellen established warmly cordial relations with the University of Chicago’s president, William Harper—he read the manuscript of a charming children’s book she’d written, The Goosenbury Pilgrims, and it was published with his encouragement—even as Veblen’s relations with him were cooling. The Theory of Business Enterprise, which appeared in 1904, did not please Harper, who sought the patronage of exactly the sort of people it indicted.

The so-called captains of industry, Veblen’s book argued, were really predators whose money-minded manipulations came at the expense of “economies of production and heightened serviceability.” When businesses competed with one another—Veblen always viewed competition with disfavor—they gave up the efficiencies to be gained by coordination and scale. And when rational consolidation had taken place, businesses were inclined to underproduce in order to buoy prices. He was scathing, too, about the pecuniary prevarication represented by salesmanship, advertising, corporate communications, branding—all the intangible elements of what accountants called “goodwill.” The activities of both bankers and businessmen, he maintained, “begin and end with what may broadly be called ‘the higgling of the market.’”

The book’s account of finance capitalism certainly seems prescient. As Veblen saw it, debentures and other instruments of debt were placing traditional capital (a factory, say) on a credit basis, and were reorganizing industrial concerns in a way that blurred the line between capital and credit. “Capital” now meant “capitalized presumptive earning capacity.” If the captains of industry were ultimately parasites, the captains of finance, who simply issued and traded paper, were parasites on parasites. Yet Harper may have been more offended by a section that had been removed from the book. Veblen sent it around for publication as a standalone essay, and a copy evidently reached Harper’s desk. The subject was higher learning in America—and the involvement of businessmen as a bane to it.

Veblen was too prominent to be fired without a high-minded reason. One soon materialized. When Ellen heard rumors that he had an inappropriate relationship with a colleague’s estranged wife, she sent off a letter to Harper, depicting her husband as sexually dissolute. (Scholars now tend to accept Veblen’s insistence that the rumors were unfounded.) Before long, Veblen was informed that his time at Chicago was coming to an end. This is more or less when Camic’s book ends, too, and not unreasonably. The book’s subtitle refers to “the making of an economist,” and by this point Veblen the economist was thoroughly made.

What about the subtitle’s claim that Veblen “unmade economics”? Camic, who says we must recognize what wasn’t original in Veblen in order to see what was, situates him amid the great methodological struggle represented by the “marginal revolution” in economics. Not a few of his colleagues were awoken from their dogmatic slumber—or, as Veblen thought, narcotized into one—by the work of the Austrian scholars Carl Menger and, starting in the late 1880s, his disciples Friedrich von Wieser and Eugen von Böhm-Bawerk.* (In America, Camic finds, the influence of other marginalist schools came later.) Today this work is seen as a forerunner of the neoclassical economics that dominated the century to come.

The so-called Austrian school solved an old problem right away. Why, Adam Smith had wondered, were diamonds more valuable than water, given that we all need water and nobody needs diamonds? For such marginalists, the crucial distinction was between total utility and marginal utility—the value to you of another bucket of water, in a world where water is abundant, versus the value to you of another carat of diamond, in a world where diamonds aren’t. And while the classical economics associated with Smith and David Ricardo supposed that the value of a good reflected, objectively, the paid labor that went into making it, the marginalists thought its worth was, subjectively, whatever people would fork out for another one.

John Bates Clark, for all his youthful leanings toward Christian Socialism, became a stalwart of the new approach. In the “marginal productivity theory of distribution” he advocated, an employee will be paid according to what his labor brings in, its “marginal product.” Clark conceded that the rule was subject to various idealizing counterfactuals. (It assumed, for example, perfect competition and substitutability: a firm was choosing among equivalent workers, the worker among equivalent jobs.) Still, he considered it a “natural law” that, “if it worked without friction, would give to every agent of production the amount of wealth which that agent creates.” Workers, he was inclined to say, got what they deserved.

Veblen blasted away. How could we ever know that your remuneration coincided with the utility of your labor? In Veblen’s terms, “vendibility” (what the market rewarded) seldom squared with serviceability (what the community at large required). Otherwise why did we have poverty and unemployment amid plentiful resources and unmet wants? Business folk, those inveterate “higglers,” could enrich themselves by buying cheap and selling dear, by manipulating prices through letting their factories idle, by puffing up the prices of their goods through deceitful advertising, or through a host of other stratagems, most of which negatively affected social benefit. The best-rewarded people were generally the least productive people. “Friction” wasn’t a sideline issue in the workings of capitalism; it was the whole game.

Veblen’s chief professional contribution, in Camic’s view, was precisely this “novel nonproductivity theory of the distribution of economic rewards.” Classical theorists like Smith and J.S. Mill had discussed unproductive labor—labor that didn’t produce material, serviceable goods—but Veblen’s account of the modern economy put it front and center. In so doing, Camic claims, he was able to undermine the foundations of the Austrian school—along with, by implication, its neoclassical successors—and point toward a sounder alternative.

That it was Veblen who coined the term “neoclassical economics” provides yet another instance of movements baptized by their enemies. Yet it’s hard to turn his critique into a program. For marginalists, concerned not with the servicing of needs but with the satisfying of wants, a distinction between productive and nonproductive labor was hardly tenable. Any activity that produced something people were willing to pay for (a shovel, a tidy house, a night at the theater, a silk cravat) created wealth. Was Veblen’s nonproductivity theory a useful replacement? Certainly the task of trying to say what is and isn’t “serviceable” is not an enviable one. That heirloom tomato on your plate is nutritious, delicious, and status-signaling: you would have to have a very sharp knife to separate out those parts.

Then there’s the question of whether the model of marginal utility, whatever its uses and abuses, was necessarily blind to distributive malignities:

The greater the differences in wealth, the more striking will be the anomalies of production. It will furnish luxuries for the wanton and the glutton, while it is deaf to the wants of the miserable and the poor. It is therefore the distribution of wealth which decides how production is set to work, and induces consumption of the most uneconomic kind: a consumption which wastes upon unnecessary and culpable enjoyment what might have served to heal the wounds of poverty.

The sentiment could be Veblen’s; the words, published a decade before A Theory of the Leisure Class appeared, are from Wieser, the very person who introduced the term “marginal utility” (as his coinage Grenznutzen was translated), along with the concept of opportunity costs.

In taking on the marginalists, Veblen had skewered the model of Homo economicus—an atomistic, ahistorical concept of man as a “lightning calculator of pleasures and pains.” Yet Wieser was perfectly aware that, as he wrote, “the appraisal of even the purely individual need” is in fact “influenced by society,” such that someone “may plunge into excessive disbursements to maintain outer show…for fear of losing caste and of being relegated to a lower social level.”

Mr. Marginal Utility, then, had no problem reconciling his models with talk of processes, social forces, institutions, wasteful display. And government interventions: Wieser was especially proud of having supplied theoretical support for progressive taxation. (Friedrich Hayek later complained that he was “slightly tainted with Fabian socialist sympathies.”) You didn’t need to think that industrial work is the only productive kind in order to see fault in the distribution of rewards. All theories idealize: all stipulate counterfactual conditions or invoke ideal types (as with Veblen’s sharp contrast between the productive and the nonproductive). Precisely because we live in a world of highly imperfect information, we need an array of models; we also need to know when to remodel them.

Veblen, shown the door at Chicago, soon found himself engaged in no little higgling himself. In 1906 he secured a job offer from Stanford’s ambitious founding president, David Starr Jordan. Although the terms were mingy, Veblen improved them through hard bargaining. “I cannot afford to accept any academic rank lower than the highest assigned to any member of the Department, or any salary less than the highest paid to any member of the Department,” he wrote Jordan. “My acceptance of an inferior grade would be looked on by my friends in science as something in the nature of a reduction to the ranks” and “contribute to my discomfort.” It would, in short, be a blow to his status.

Thorstein and Ellen arrived together in Palo Alto—he picked her up from a remote timber claim in Oregon—and she had hopes that she would finally share in the ineffable delights of academic social life in a college town. Once again, however, it became plain that Veblen’s heart belonged to another: this time to Mrs. Ann Bradley Bevans, known as “Babe,” a Eugene Debs–adoring socialist and suffragist. Once again, Ellen threw herself into construction, putting up a two-story house on Sand Hill Road, parts of which she built with her own hands.

Meanwhile, Babe, recently divorced, wrote repeatedly to Ellen, asking her to set her husband free. The attempt misfired. In the spring of 1909 Ellen wrote to Jordan of her concerns, and he asked for more information. Ellen evidently forwarded letters from her husband, and probably some from Bevans. In October Jordan wrote his counterpart at the University of Chicago:

I have been able, with the help of Mrs. Veblen, to find out the truth in detail as to Professor Veblen’s relations. He seems unable to resist the femme mécomprise…. The university cannot condone these matters.

A few days later, Jordan assured Ellen that “we have accepted Dr. Veblen’s resignation.”

Camic writes of “a stigma of shame that Ellen Veblen kept fresh by her relentless efforts to incriminate Veblen in academic circles,” efforts that permanently scotched his prospects for a career at a major research university. The Jorgensens, more colorfully, ascribe to her “a vengeance worthy of Moriarty’s pursuit of Holmes.” But we can regret the damage done to Mr. Veblen without losing sympathy for Mrs. Veblen. She might have had a very different life had medicine been more advanced, since she suffered from something like Graves’ disease (and probably from misguided attempts to treat it). Her life certainly would have been different had gender equality been more advanced, since she suffered, finally, from being in a world less than eager to develop a woman’s intellect and talent.

Veblen, who had so recently insisted on the perquisites of his rank, now knew he’d be lucky to find any academic post at all. He took one—poorly paid, and on an annual contract—at the business school at the University of Missouri, which was then a far cry from the research institutions he had been accustomed to, and put down stakes in what he called “a woodpecker hole of a town in a rotten stump called Missouri.” He would make do. Ellen, perhaps mollified by his reversal of fortunes, finally granted him a divorce; Babe, as his legal wife, eventually joined him in Columbia with her two daughters. By then, however, her health was in decline. Veblen was a bit creaky himself, probably the lingering effects of the calomel he had been given for a case of pneumonia.

Still, he resumed an interrupted career; The Instinct of Workmanship and the State of the Industrial Arts, planned long before, appeared in 1914. In our evolutionary past, he conjectured, a tropism toward workmanship—what he variously called “a proclivity for taking pains” and as “a disposition to do the next thing and do it as well as may be”—enabled our ancestors to survive. Alas, this salubrious instinct was readily overridden or distorted, especially by “the proprieties of the pecuniary culture.”

It’s telling that Veblen, always best known for his theory of the “leisure class,” seldom used that term in his later writing. In part, it’s because he had shifted his focus from consumption to production. He had come to notice, too, that “leisure” was something of a red herring. “No class of men have ever bent more unremittingly to their work than the modern business community,” he wrote in The Instinct of Workmanship. “Within the business community there is properly speaking no leisure class, or at least no idle class”—its besuited members took pride in their strenuous labors, displaying the instinct for workmanship in a perverted form. Being a successful parasite, it appeared, was no job for loafers.

Camic notes that Veblen, ousted from “the research hothouses of Chicago and Stanford,” largely ceased aiming his work at his professional peers. By 1918 he had moved to New York and joined the staff of The Dial, then a biweekly in a political phase. If the irony of his earlier work arose from an artful tension between implicit polemic and professed dispassion, he was now more apt to call a spade a spade, and to revile the schemers who didn’t know how to use one. The wit grew sparser, small gemstones that were set in large cinderblocks but could still catch the light. Writing, at one point, about the “very reputable fortunes” made in the slave trade, Veblen suggests that it was

in this moral penumbra that American business enterprise learned how not to let its right hand know what its left hand is doing; and there is always something to be done that is best done with the left hand.

Among members of the educated public, Veblen remained a name to conjure with. H.L. Mencken, writing in 1919, claimed that he had lately “dominated the American scene”—that “there were Veblenists, Veblen clubs, Veblen remedies for all the sorrows of the world.” Hostile hyperbole was Mencken’s specialty, of course, but when the New School was established that year—as a scantily funded assemblage of illustrious leftists, including Charles Beard and John Dewey—it happily welcomed Veblen to its ranks. The offer was well timed because he was being discarded by The Dial, now under new, more literary-minded management.

While all this was going on, it was weighing on his mind that his wife was losing hers. Babe had spiraled into paranoid fantasies—for example, that Kaiser Wilhelm’s son was planning to assassinate her husband—and ended up in McLean, the renowned psychiatric hospital in Massachusetts. It all went terribly wrong. A hunger strike, a feeding tube, a lung infection: by October 1920 she was dead. In his remaining decade, Veblen took on the responsibility of looking after his stepdaughters, the elder of whom increasingly took on the responsibility of looking after him.

As the 1920s got underway and the financial sector that he warned of in his younger years spread like an algal bloom, he had only the chilly satisfaction of seeing his pessimism vindicated. In truth, that pessimism made him an odd fit for the “Progressive” label sometimes affixed to him. Veblen considered labor unions, for instance, to be just another impediment to his principal concern: maximizing productivity. (“The A.F. of L. is itself one of the Vested Interests, as ready as any other to do battle for its own margin of privilege and profit.”) His research, as the radical economist Douglas Dowd observed, had shown him “a working class that, far from wishing to abolish the economic system under which it worked, sought largely to occupy a more rewarding and honorific role within it.”

Veblen prided himself on being a diagnostician; he was chary about offering remedies, aptly enough for someone debilitated less by the diseases he contracted than by the medications he was given for them. Yet he was drawn to a technocratic vision in which entrepreneurs were replaced by engineers. In his next-to-last book, The Engineers and the Price System (1921), he sketched out a long-odds solution to what ailed us, and proposed having industry run by “a soviet of technicians,” set up as a “self-directing General Staff.” (Those who grew up in the planned economies of the mid-twentieth century may see some misplaced confidence here.) If our productive industries were organized into a whole and then

managed by competent technicians with an eye single to maximum production of goods and services; instead of, as now, being manhandled by ignorant business men with an eye single to maximum profits; the resulting output of goods and services would doubtless exceed the current output by several hundred per cent.

This was his way of dispensing with friction. And yet we are left with a quandary. Veblen scorned Homo economicus as a uselessly unreal model, but if we’re taking human beings as they are, how far will we get by wishing away the profit motive, the pecuniary urges, the appetite for acquisition, even the inclination to compete? His selfless technicians—like his peaceable-savage workmen—are little more plausible than those lightning calculators of utility. One can wonder, too, why Veblen, for all his evolutionary enthusiasms, not to mention his preoccupation with industrial efficiency, took so little interest in innovation. “Just now communism offers the best course that I can see,” he wrote a friend some months before his death.

Perhaps we’d do better to attend less to what he saw than to his ways of seeing. Veblen can be credited with establishing a habit of rational analysis that—in a way now commonplace—tightly enmeshed evolutionary and economic thinking. Over the past half-century, the deliverances of a technical apparatus (most notably, game theory) created an intellectual Schengen Zone between these realms, eased by a shared formal language. Veblen’s notion of “conspicuous consumption” found a powerful heritor in the handicap principle, which emerged in evolutionary theory in the 1970s and applied his explanation for the appeal of “cumbrous” apparel to the biological world. According to this hypothesis, the deer’s uselessly massive antlers or the peacock’s extravagant tail, precisely because they are wasteful and costly, signal that the creature has fitness to burn. “Signaling” theory—concerned with the ways economic actors seek to convey information about themselves—arrived in economics around the same time, and the ultimate result was an interdisciplinary wedding at which Veblen was brought back to officiate.

These days, “costly” and therefore credible signaling is as likely to be discussed in journals of biology as of economics. It is the stotting gazelle, leaping into the air to display its robust health and agility (discouraging predators and encouraging mates); it is the Super Bowl commercial that suggests, simply by its expense, a firm’s confidence in the product being marketed. The Prius in your driveway, the fair-trade stamp on your bag of coffee, the college degree on your resume: signaling theory, in deeply Veblenian ways, has something to say about all these things and more. His gimlet-eyed perspective has, perhaps to a fault, become an intellectual reflex.

If this perspective could seem philistine, not to say inhumane—Theodor Adorno insisted, half in praise, that culture “was never anything for Veblen but advertising, a display of power, loot, and profit”—the philistinism was theoretical, not personal. In his fading years, he busied himself with a translation of an Old Norse saga. His antipathy for pecuniary pursuits was, on the other hand, matched by a certain incompetence at them. He bought oil stocks and invested his nest egg in a Fresno raisin farm—never a good idea—only to see the raisin industry go bust. Despite various baleful remarks about real estate, he acquired the house on Sand Hill Road from his first wife, at a considerable markup. The place lacked the fine craftsmanship of the house where he grew up but had its ramshackle charms. It was amid Ellen’s handiwork that he died, of a heart attack, on August 3, 1929, weeks before a crash that made his holdings worthless and his writings invaluable.

In 2004 a grandson of the second Mrs. Veblen put the house on the market as a teardown. The property, across the street from the Stanford golf course, brought in a seven-figure offer. “Build Your Own Dream Home!” was the realtor’s pitch, and someone did. A former communications exec at Visa lives there now. Veblen would have taken a mordant satisfaction in this. He took a dim view of both credit and corporate communications, but he always relished irony.

This Issue

January 14, 2021

The Poet and the Reader: Nobel Lecture 2020

The Imperial Gardener

-

*

In a lucid and learned overview, Bruce Caldwell shows that Menger himself considered his theory of marginalism to be of, well, marginal importance; the concept was signal-boosted by his Austrian exponents. William Stanley Jevons and Léon Walras, meanwhile, arrived at marginalism through something like convergent evolution. See Caldwell, Hayek’s Challenge (University of Chicago Press, 2005), pp. 17–38, 64–82. ↩