Since presidents tend to choose economic advisers who can be depended on to advise that presidents want to hear, the direction of intellectual influence runs more from president to adviser than from adviser to president. As is usually the case, the president, Mr. Reagan, and the chairman of his Council of Economic Advisers, Martin Feldstein, had similar views long before the two met. But the adviser’s views are still important since they provide the principal filter through which new economic information reaches the president, and they reveal much about what the president wants to hear.

Although technical, this volume of previously published essays written between 1975 and 1981 is a good reflection of Martin Feldstein’s ideas and the resulting filter. The view is simply put in the first paragraph, with the “proof” of it occupying the rest of the book.

The interaction of inflation and existing tax rules has powerful effects on the American economy. Inflation distorts the measurement of profits, of interest payments, and of capital gains. The resulting mismeasurement of capital income has caused a substantial increase in the effective tax rate on the real income from the capital employed in the nonfinancial corporate sector. [I.e., as inflation causes the dollar income of corporations to rise, they pay higher corporate taxes on their real income.] At the same time, the deductibility of nominal interest expenses [from taxes] has encouraged the expansion of consumer debt and stimulated the demand for owner-occupied housing. The net result has been a substantial reduction in the accumulation of capital in nonfinancial corporations.

As a result, Feldstein argues, the American economy is performing poorly and economic policies need to be recast. While admitting that the best solution would be tight fiscal policies (a budget surplus) and easy monetary policies (low interest rates), Feldstein sees this as politically impossible. Congress won’t cut civilian spending. As a result the only feasible “second best” solution “for achieving the dual goals of balanced demand and increased business investment would combine a tightmoney policy and fiscal incentives for investment and saving.”

According to Feldstein tight money will prevent inflation and raise the real rate of interest after taxes. Inflation will be held down by using tight monetary policies to prevent unemployment from falling below what is now a very high “natural” rate of full employment (i.e., the rate of unemployment necessary to prevent inflation from accelerating). Higher real interest rates will deter spending on housing and consumer durables as well as on plant and equipment, but the latter effect is to be more than offset with specific tax incentives for productive investment.

This view is not completely wrong. In relation to the growth in our own labor force, or to our foreign competition, Americans don’t save or invest enough. The problem is that Feldstein makes the error that he attributes to others at the end of his book:

The basic reference on this type of “expert inference”…is the children’s fable about the five blind men who examined an elephant. The important lesson in that story is not the fact that each blind man came away with a partial and “incorrect” piece of evidence. The lesson is rather that an intelligent maharajah who studied the findings of these five men could probably piece together a good judgmental picture of an elephant, especially if he had previously seen some other four-footed animal.

Feldstein is a blind man feeling part of the elephant but thinking he is the maharajah.

In the formal models with which Feldstein tries to prove his conclusions workers do not appear as real human beings. The labor force is taken to be a constant fraction of a growing population and always absorbed into an economy that is as fully employed as it can be. There is no personal distress or social pain to unemployment. Working skills (human capital) do not appear. Nor do the “soft productivity” problems of motivation, cooperation, or teamwork. Workers’ decisions to spend or invest aren’t sensitive to their tax rates. This is a privilege allowed only to the capitalists. There are no problems of equity except the need to tax the capitalist more gently. Technical progress is represented as simply a slightly faster rate of growth in population or it is ignored. Technical progress does not require expenditures on research and development or on the training of scientists and engineers. There are no dynamic economies of scale by which expansion of productive capacity causes the average costs of production to fall.

If the only variable that is allowed in a formal model is the amount of physical capital (as is the case in the Feldstein models), it is not surprising that physical capital “proves” to be the key variable in creating economic progress in that model. The model is capable of showing nothing else.

Advertisement

For example, think about Feldstein’s conclusion about “historic cost depreciation”—the practice of deducting from a corporation’s income each year part of the original cost of its capital equipment and plant. This practice, he argues, raises the effective corporate income tax in a period of inflation. Because allowable historic depreciation deductions are smaller than current replacement costs, business depreciation deductions are too small, taxable profits are as a result too high, and businesses pay more taxes than they should. This is of course true. But what about the worker who has invested in his working skills, human capital, and is not allowed any depreciation deduction whatever under our tax laws? A partial deduction is better than no deduction. As a result, whatever inflation’s impact on raising the effective real rate of corporate taxation, it has a larger impact on the effective real rate on human capital investments in working skills—a part of the elephant unexamined by Feldstein.

While the effective tax rate on corporate income is certainly higher than it would be without inflation or with a perfect tax system that taxed only real income gains (after correcting for inflation), another part of the elephant reveals that the share of total federal taxes paid by corporations has steadily declined from 23 percent of total federal tax collections in 1958 to 9 percent in 1983. Corporations pay far less than they used to pay.

Both facts are true and both are part of reality. And it is also part of reality that if we give more special incentives to saving and investment, someone else will have to pay more taxes to make up the missing revenue.

Or take Feldstein’s factual claims that real net investment and real net rates of return on investment are down. Yet another part of the elephant reveals that American investment in plant and equipment has risen from 9.5 percent of the GNP during the period between 1948 and 1965 to 11.7 percent of the GNP in the period between 1977 and 1982. The fraction of our resources devoted to gross investment in plant and equipment is up substantially.

If the after-tax cash flow (after-tax profits plus tax-free depreciation allowances) for 1958 is contrasted with a recent year that showed similar levels of unemployment and use of industrial capacity (1980), we find that the after-tax cash flow of nonfinancial corporations has risen from 17.9 to 18.9 percent of the gross domestic product of nonfinancial corporations. The after-tax cash flow available to be used by corporations is up, not down.

Gross investments and earnings can rise while net investments and earnings are falling if real economic depreciation grows. Your firm may be producing more income while you write off machines that will soon have to be replaced. This is implicitly assumed by Feldstein but is never explicitly acknowledged, and he gives no reference to any argument supporting it. But if rising depreciation charges rather than taxes and inflation lie at the heart of the problem, the conclusions are very different from the inferences Feldstein draws. Net investment and net earnings would be down even if there were no inflation and a perfect tax system.

Real economic depreciation rises when the time grows shorter during which equipment can be used before it wears out or becomes economically obsolete. If this happens Americans have to invest more (and therefore consume less) to get the old rate of growth—not because of inflation or tax laws, however, but because of an adverse shift in technology to shorter-lived equipment. The problem is not getting back to a neutral tax system or preventing inflation, but deciding whether we want to restructure the patterns of our society so that we consume less (sacrifice more) and have the old rate of growth.

The amount of capital invested per worker (the capital-labor ratio) is certainly growing more slowly than it used to grow, but forget tax and inflation problems for a moment and think of the problem from yet a different part of the elephant. The average American worker uses about $58,000 worth of plant and equipment (in 1982 dollars). To have the average American productivity a worker must have that $58,000 in equipment. But this means that if America had a baby boom twenty years ago, parents were implicitly promising not just to bathe, feed, and educate their babies but that approximately twenty years later they would stop and save $58,000. This would provide the capital to equip each one of their babies (and their wives) to enter the labor force as average American workers. And it is precisely this implicit promise we Americans aren’t keeping.

What was once a rising ratio of capital to labor is now a falling or stagnant ratio—not because we are investing less (we are actually investing more) but because the labor force is growing much faster. The solution is more investment, but the cause is found in a baby boom two decades ago—not in taxes and inflation.

Advertisement

What do the simple textbook models tell us about what would happen in the aftermath of a baby boom? A rising supply of labor leads to a falling wage rate. If the supply of capital does not expand as quickly as the labor force, the wages of labor will fall relative to the price of capital. With this shift in relative prices, firms find it profitable to use more cheap workers and less expensive equipment. But as businesses make this profitable substitution, productivity falls as each worker is operating with less and less capital.

Unfortunately our economy has been behaving precisely as it is supposed to behave. If one looks at the relative cost of capital and labor before taxes, the cost of capital (purchase price, energy cost of operating, and interest cost of financing) was becoming cheaper relative to the cost of labor (wages plus fringe benefits) at the rate of 1 percent per year from 1945 to 1965. Business therefore had an incentive to invest in labor-saving equipment. But from 1977 to 1982 the before-tax cost of capital rose at a rate of 9 percent per year relative to the cost of labor. Instead of having an incentive to invest in labor-saving equipment businesses had an incentive to substitute cheap labor for expensive capital. An imperfect tax system plus inflation may have made such incentives slightly larger but it did not create them. The capital-labor ratio would have grown much more slowly with or without inflation and an imperfect tax system.

The problem is not a market bias leading to too little saving and investment (the Reagan-Feldstein view) but the social problem of absorbing the baby-boom generation into the economy; and it is this problem that requires a re-rigging of the economic system to encourage savings and investment. For if the system is not changed, part of the population, the baby-boom generation, will have a standard of living lower than that of both their parents and their own children.

But if one admits that the tax system needs to be re-rigged to solve the social problems springing from the baby boom, the gates have been opened: the government has a responsibility to solve social problems. And this is something that neither the president nor the chairman of his Council of Economic Advisers wants to admit. As a result they fix their attention on a very narrow set of market imperfections.

If one looks at falling achievement-test scores and comparative educational-test results or working skills in other countries, it is clear that today’s workers have deficiencies in education and skills that are far more important than the amount of physical capital with which they work. Curing America’s education and training deficiencies is much more important than curing its capital problem; yet the problem never appears in the Feldstein models of the world.

To move to what at first glance seems a completely different part of the elephant: In 1977 there were 490,000 security guards on American payrolls. By 1982 that number had risen to 685,000. Yet every security guard represents negative productivity. Their hours of work count in the denominator of our productivity statistics but their work adds nothing to the numerator since they guard old output rather than producing new output.

A more honest society would not need so many guards and would be more efficient—many of the 685,000 guards could be put to work producing new things. The same is true for every lock, every burglar alarm, every barred window. Each represents a diversion of capital investment away from investment in plant and equipment that would increase productivity. Someone could write articles showing how dishonesty and social unrest were lowering the productive capital stock—but Feldstein doesn’t.

Still, even if you do not believe the Feldstein story is the entire truth about the genesis of the problem, and even if you think that the Reagan-Feldstein problem is only a small part of the full story, a lack of savings and investment is still part of the elephant. How close has the current administration come to curing that part of the problem which they themselves have emphasized?

During the Carter administration personal savings amounted to 4.1 percent of the GNP. But since government deficits represent funds borrowed from private savings to finance public consumption, the Carter administration’s deficits (1.7 percent of the GNP) must be subtracted from personal savings to get the net amount of savings available for private investment. When this subtraction is made only 2.4 percent of the GNP was left for investment under President Carter. This was, and would still be, inadequate.

What has happened since then?

In 1981 President Reagan proposed and enacted personal and corporate income tax cuts biased toward high-income capitalist savers and investors on the grounds that such a shift was necessary to increase savings and investment. The experiment has been performed. The evidence is now in. The strategy did not work. With the Reagan tax cuts fully in place the personal savings rate has fallen to 3.3 percent of the GNP in the first nine months of 1983. Lower taxes led to a lower savings rate—not a higher savings rate. In addition the federal government deficit has risen from 1.7 percent to 5.7 percent of the GNP. When the appropriate subtraction is done, the net savings available for private investment has become negative—minus 2.4 percent of the GNP. The federal government is now absorbing all of personal savings and much of business savings.

When it comes to their announced objectives the Reagan tax cuts have been a failure. Total savings is down, not up. While Martin Feldstein recognizes the negative savings implications of the large deficits, he seems completely unable to convince the president of the validity of his views—once again confirming the principle that presidents hear what they want to hear.

If you look at the much higher personal savings rates abroad (they are two to three times as high in Germany or Japan), there is a simple explanation why they are higher, but it is also not an explanation that the Reagan administration wants to hear. The explanation is not lower taxes for the capitalists, but less consumer credit. When I borrow $30,000 to buy the recreational vehicle that I want, not only do I not save, I also subtract $30,000 from the pool of savings available for industrial investment. For someone else’s $30,000 savings must be used to finance my consumption.

What is officially measured as personal savings is not the gross amount individuals save, but net savings—personal savings minus personal borrowings to buy consumption goods. And the difference between low American savings rates and high German or Japanese savings rates is not so much in differences in our gross saving rates as in the amounts that we are permitted to borrow back for consumption purposes. In 1982 personal borrowing absorbed 66 percent of gross personal savings.

The rest of the industrial world is simply much more restrictive than the US when it comes to consumer credit—demanded down payments are larger; repayment must be faster; interest charges are not tax deductible. The other advanced countries do not allow consumer credit to eat up 66 percent of their personal savings.

If the Reagan administration were really serious about trickle-down incentives for saving and investment, it would start with a proposal to abolish the tax deductibility of mortgage interest payments and state and local taxes on second or third homes. For whatever you think about government subsidies for housing there is presumably no case for a subsidy on multiple homes. Yet we all know that such a proposal will not be made. For the real Reagan program is not to increase savings and investment. He is unconcerned when the level of savings actually falls. The real aim is designed to shift the tax burden from high-income groups to middle-income groups. And in carrying out this hidden agenda, the president has been a success.

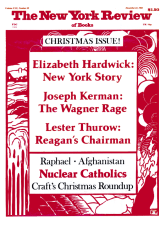

This Issue

December 22, 1983