Why can’t we deal with class? Terms like “upper middle” and “lower middle” refer to style and sophistication, not the deeper divisions of social life. On the whole we prefer to circumvent the question of class. We think of cities as being composed of “ghettos” and “white ethnics” and “the aged.” Discussing families on welfare or crime in the streets, we speak of blacks and Puerto Ricans. Sociologists neutralize the subject by referring to “stratification.” Or they tell us it is “ambiguous” and “complex.” The Census once reported that 70 percent of all Americans show some “inconsistency” between their earnings, education, and occupations. We all know Yale graduates who are driving taxis.

Yet we know America has classes, and that they are more than temporary way stations. No matter how we divide up Americans according to culture, careers, even income, power is at the heart of the question. Some people have more freedom, more independence, than others. Some are buffeted about from birth to death, never in a position to bend events or answer back to authority. Class may confer power over others; but in personal life it affects how you can make the world work on your behalf. Traditionally class has depended on property. In the classical couplings—patrician and plebeian, lord and serf, guild master and journeyman—one class had holdings of substance. When Marx spoke of the bourgeoisie, he meant people owning a mill with at least 100 workers and living in a town house with servants.

Nowadays one can go a long way in America without property. Indeed, a person can achieve influence and independence without ever accumulating an estate of six figures. Hence all the emphasis, in writing about influence, on officials and administrators whose power derives from office rather than ownership. Hence too the stress on seniority, tenure, and professional certification: securities upheld by law even if not entirely transmissible to one’s heirs. However, the current state of the economy has shown how flimsy some of these underpinnings can be. Seniority isn’t worth much if one’s company goes out of business. Having an architect’s license this year is hardly a guarantee of comfort. After floating through the Sixties on whimsical balance sheets, we are again learning that there is no substitute for wealth. Moreover the desire to accumulate holdings is still strong: witness Spiro Agnew, William Ronan, and Otto Kerner. Doctors, lawyers, and businessmen, as they reach their forties, see the prospect of a cool million they can call their own, notwithstanding neglected wives, disaffected children, and involvements in dubious projects.

Which Americans should we call rich? Peter Singer, in these pages some weeks ago (NYR, March 6), commented that the richest 5 percent of our population holds 40 percent of the nation’s wealth. However, 5 percent of the population is three million families, or anyone earning at least $30,000 a year. G. William Domhoff—of whom more later—concentrates on the top 1 percent, which still means 600,000 households and a bottom line of about $60,000. The trouble with both estimates is that they include too many people who, while well off, are still what we think of as upper-middle-class.

A surprising amount of information on income is available, so long as we realize that agencies collect figures in different ways and for different purposes. Moreover, by the time the tables get published the statistics can be out-of-date. The 1970 census, for example, has some interesting figures; but they are based on incomes for 1969, which is a long way back. At that time, 390,708 of the country’s seventy million households had incomes in excess of $50,000, the top category in the census summaries.1 (A “household” for the census consists either of a family or a single person living alone or with an unrelated roommate. Two unmarried people who share the same bed are counted as two households.) Almost half of these $50,000 households had at least two and often three wage-earning members. So along with affluent executives, the bracket includes families in which on Friday night everyone empties his pockets onto the kitchen table. The census also found that in 1969 the country contained 13,457 households with incomes of over $50,000, even though none of the members worked. This is apparently what we have in the way of retired, widowed, and otherwise idle rich.

Still, as was intimated earlier, within a top bracket beginning as low as $50,000 will be many salaried and professional people who are well off but still not what we mean by rich. For more detailed information on the higher reaches, our best information comes from the Internal Revenue Service, which does a lot of unpublicized things with our tax returns. (Even when the rich pay little or no taxes, they still submit returns.) As a result, IRS statistics are not precisely comparable with those of the census. Thus while the census uncovered 390,708 households with over $50,000 in 1969, the Internal Revenue Service received 410,521 such returns that year. One reason for the discrepancy is that in some cases wives and husbands file separately; another is that IRS does a better job than the census at finding certain kinds of people. (The evidence indicates that citizens are about equally truthful in answering the two arms of government.) IRS uses its “adjusted gross income” figure rather than the full total. However for most households the difference between the two is not great. The latest IRS breakdowns cover 1972 incomes, as listed on 78 million returns.2 These include 43 million joint husband-wife declarations, with most of the remaining 35 million coming from single persons, of whom 3.6 million were heads of families. (See table on next page.)

Advertisement

HIGH INCOME TAX RETURNS: WHO MADE HOW MUCH

While $50,000 clearly puts one at the top of the pyramid—only three-quarters of 1 percent of the country’s households reach that level—most people in that bracket still get most of their income from salaries and other payments for services. It is only when one passes the $200,000 mark that property becomes the major source of income. Most of the households in the $50,000 to $200,000 range represent the executive and professional explosion we have experienced since World War II. These people tend to be experts and administrators rather than owners; and because they earn their money, a disproportionate part of it goes straight to the government in taxes. Moreover when they do invest they are not terribly good at it. Their ratio of capital losses to capital gains is over twice that for households above $200,000.

All things considered, the country’s propertied class can be defined as the individuals or families or households who file the top 22,887 returns. Representing three one-hundredths of 1 percent of all filings, their average income ($407,000) amounted to forty-two times the national average ($9,600) for 1972, and their unearned income ($290,000) came to 337 times that for the average household ($860). But all this simply lets us know what people took in during a given year. Indeed, in the case of the rich, it tells only what they decided to take in. It does not apply to the extent and distribution of personal holdings.

On wealth itself we have no reliable information. Neither the census nor Internal Revenue has ever asked people to declare their holdings. What you own is nobody’s business while you still have breath in your body, the only exception being if you happen to run for or hold office in a jurisdiction where disclosures are mandatory. Among our rights to privacy, this one seems paramount. And were we to require accountings, there would still be problems. The cash value of real estate, mineral rights, or art objects often depends on which appraiser you retain. Moreover a labyrinth of brokers, dealers, street names, holding companies, and family foundations can keep the curious from knowing a particular person’s holdings. It takes the researchers at Fortune and Business Week the better part of a year to run down estimates on well-known families, and even there the chief source is gossip.

Hence we should be grateful to Professor James D. Smith of Pennsylvania State University for his efforts in this matter. He analyzes estate records—the sums people declare when they die—to obtain an idea of how much is still held by the living. The method has plenty of pitfalls, of which Smith is painstakingly aware. Still it is the best technique we have. Unfortunately it takes time to collect and compute the figures. (His new book works with 1969 data.) Even so, Smith and his colleagues have given us some information where previously we had none whatever.

In one of the papers, Vito Natrella calculates that in 1969 some 120,000 people had a net worth of at least $1 million. However this valuation includes everything from yachts and villas to gas leases and sculptures, in addition to equities in self-owned businesses and practices. To get more accurate figures it is probably best to shelve the hardware and count only negotiable securities. By and large this means corporate stocks. (Despite tax breaks, the rich put only about $15 into bonds for every $100 they hold in stocks.) According to Smith, approximately 55,000 living Americans had stocks worth $1 million in 1969, and of these 5,000 held more than $5 million.3 Together these 55,000 people owned about 18 percent of the country’s personally held corporate stock. If we want evidence of concentrated wealth, this is probably the best statistic to use. Happily, it approximates the Internal Revenue total on $200,000 filings. Rather than Ferdinand Lundberg’s legendary sixty families, America’s rich consist of 50,000 to 60,000 people, representing perhaps 20,000 households.

Who are these people? Many of course are retired, and one can see them entering and leaving their East Seventies town houses and Palm Springs condominiums. The largest single group, however, are local proprietors. They own the largest department store in Duluth, the second biggest bank in Memphis, and lettuce fields in the Salinas Valley. In the larger cities their holdings extend into newspapers, real estate, and brokerage houses. This is our best counterpart of a classical bourgeoisie, and its members have a major say in controlling civic affairs. Generally their influence stops at the state line, however. Owning half of downtown Wichita doesn’t usually gain you a dinner invitation from the White House.

Advertisement

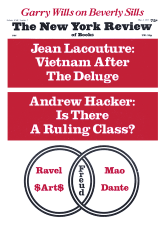

But are they a ruling class, and a national one at that? Perhaps the most prolific exponent of this view has been G. William Domhoff, a young psychologist at the University of California’s Santa Cruz campus. He began his inquiries in 1967 with Who Rules America? Three years later he published his answer: The Higher Circles.4 His most recent book, The Bohemian Grove, carries the subtitle “A Study in Ruling Class Cohesiveness” and examines clubs, associations, and similar gathering places. When Domhoff says, “There is a ruling social class in the United States,” he means to be taken literally. He is not simply saying that people in top positions bump into one another at the Council on Foreign Relations or clubs like the Links and Pacific Union. Rather, he contends, they form a distinctive stratum whose members frequent the same resorts and send their children to connected prep schools. These linkages lead to friendships and marriages, ensuring hegemony for the future. Interlocking directorates are not enough for Domhoff: he cites bloodlines and debutante parties to thicken the fusion.

Domhoff has a following, especially among younger teachers of political science who agree with his analysis and want something more recent than C. Wright Mills. Unlike Mills, however, Domhoff can be rather casual about his facts, leading to the suspicion that he may be in over his head. Take the basic question of who belongs to his ruling class. At one point he claims that its members own “25 to 30 percent of all privately held wealth in America.” However James Smith’s calculations indicate that to account for 29 percent of the country’s holdings one must extend the list of owners to include almost four million persons. At another time, Domhoff’s upper class embraces “one percent of the population,” which gives us two million people, including everyone who earns $35,000 a year. At the back of The Bohemian Grove he lists 2,000 names (an “Appendix of Heavies”) ranging from Kingman Brewster and David Rockefeller to Jacques Barzun and Edgar Bergen.

It is not easy to conceive of Domhoff’s “rulers” as a class. Still, his questions are important; power in America can be understood through the people who participate in its exercise. But indiscriminately throwing statistics into a stewpot only confuses the issues.

Domhoff makes corporate executives the central members of his ruling class. I have been following his and other arguments to this effect for some time, and I still cannot see the point of giving them that label. Mills called them an “elite,” a term referring to people whose power accompanies their occupancy of certain offices—bishops, generals, judges, salaried managers of public and private enterprises. Most have little in the way of property and their influence lasts only so long as they sit at a particular desk. Members of this elite are easily replaceable; in many cases it is impossible to distinguish an officeholder from his predecessor or successor. Ruling classes, in contrast, have traditionally consisted of persons who can be named and remembered. Since both individual and family property play a much smaller part in our own leading institutions, it is misleading to keep on speaking of a ruling class. For one thing, it prompts us to look for power in the wrong places. For another, it is historically inapposite. We will not understand the institutions of our times if we cling to an old conception of class rule. We do indeed have classes; but their arrangement reflects the corporate structure.

Most executives come from modest middle-class backgrounds, having majored in accounting at, say, Ohio State or in engineering at Purdue. They spend most of their adult lives climbing the company ladder, with periodic promotions but no spectacular leaps. Only those who rise to a top vice presidency begin to accumulate assets of any substance. Robert Murphy, the recently chosen chairman of General Motors, owned less than $300,000 in stock at the time of his elevation, which came after thirty-seven years with the firm. Clifton Garvin, Exxon’s president after twenty-eight years’ service, had $380,000 at the time of the last proxy statement.5 Neither makes the millionaire list even though they each hold one of the most powerful jobs in America.

Administrative officers like these do not overlap to any great extent with the world of inherited wealth. Their children grow up in the suburbs of mid-America and are more apt to attend Bloomfield Hills high school than Foxcroft or St. Paul’s. Only about a third of their sons end up at institutions like Yale or Williams; most send their children to freshwater colleges like Lehigh and Ohio Wesleyan and Iowa State. A far cry, certainly, from the debutante circuit. Those who carry on the dynasty do so in the special cases of a founding family: Sarnoff at RCA, Bronfman at Seagram, Ford of Ford, and the Watsons in IBM. But even in companies like these an outsider now has an open chance for the most powerful job. Irving Shapiro, no less, currently occupies the corner office at Du Pont. On the whole the men who get to the highest corporate positions have nothing distinctive about them. Simply listing their names diverts attention from the real structure of power.

The description of America as fifty states may best be left to high-school civics courses. Our real centers of sovereignty are corporate bodies with inelegant names like Esmark, Tenneco, and Transamerica. We still leave to these institutions the major decisions on investment, innovation, and employment. In that sense, Union Carbide and Amerada Hess are more “necessary” to our prosperity than West Virginia or Arizona. (When a recession comes, we ask what we can do to help companies create more jobs.) The shape of regions, professions, public authority, indeed such class configurations as we have—all these reflect directions charted in corporate board rooms.

It would be incorrect to say that these institutions run the entire country; they control only those parts of it that bear on their operations. That they get their way in Congress, the parties, and the bureaucracy derives mainly from the fact that we have no alternative ways to organize the economy. Of course the big corporations also move things along with a little underwriting. Where once Commodore Vanderbilt helped out Mark Hanna, business school graduates at American Airlines, Minnesota Mining, and Goodyear Rubber did some laundering for Charles Colson and Maurice Stans.

This is not to deny that rich families invest most of their fortunes in corporate securities. The question is whether by so doing they gain control of the economy. Domhoff, along with several other analysts, wants us to believe that they do. Last December, for example, he told the House hearings on the then vice president designate that “15 employees of the Rockefellers have been identified on the boards of nearly 100 corporations…with combined assets of some $70 billion.” 6 Gerard Zilg has a similar finding in his new book, Du Pont: Behind the Nylon Curtain, where he lists “over 100 multimillion dollar companies in which the Du Ponts have a controlling interest.” The list includes Boeing Aircraft, the Chemical Bank, Coca-Cola International, Continental Can, and Uniroyal.7

Sad to say, there is less here than meets the eye. That Rockefeller people are on the boards of companies worth $70 billion may sound impressive on first hearing. But a single person could reach that figure with four directorships—say, of General Motors, Exxon, General Electric, and IBM. Indeed, he could come close to it simply by sitting on the board of AT & T, which alone has assets of $67 billion. If Rockefeller agents need a total of 100 directorships to reach $70 billion, they aren’t even near the major leagues. Zilg’s book contains a lot of home truths about the Du Ponts, who emerge as a mean-fisted and nasty-minded lot, a heavy influence on the state of Delaware. However his claim that they have “a controlling interest” in 100 companies turns out to refer to the number of firms having a clan-member on their board. One board seat doesn’t give you “control” unless you have quite a few shares in your pocket; and there is no evidence that the Du Pont directors on Zilg’s list are in a position to have their way at Chemical Bank or Coca-Cola.

There are of course people who have built up their own enterprises into billion-dollar corporations: Norton Simon, Edwin Land, Howard Hughes. However I can think of only one case where a single family largely owns and controls a series of great companies. These are the Mellons, who keep away from publicity by sticking close to Pittsburgh. Gulf Oil and Alcoa are essentially Mellon properties, as are the somewhat smaller Koppers and Carborundum companies, the First Boston Corporation and the Mellon National Bank. For example, the Mellons own 20 percent of Gulf, well over the amount needed for control, and have four of the ten seats on its board. (Alcoa won’t reveal the share the Mellons control, but the family has three of the twelve board seats.)

But who are the “Mellons”? Since the death of Richard King Mellon five years ago, the family has had neither strong leaders nor any discernible common purpose. Functionaries handle the directorships as well as the trusts and foundations which form a perpetual pool of Mellon capital. In a real sense all the Mellon nieces and nephews and second cousins have themselves become a kind of corporate body, not very different from pension funds and other investing institutions that want a steady return on their money. There is no evidence of a peculiar “Mellon” stamp on the policies of First Boston or Gulf or Alcoa. In the way their money is deployed, Mellon family members seem indistinguishable from a consortium of banks or insurance companies.

Why, then, the desire to see control as a matter of kinship? Maurice Zeitlin, a University of Wisconsin sociologist, makes a more convincing case for a ruling class than Domhoff does by extending his ambit beyond family to “groups of associates…and other cohesive ownership interests.”8 This makes sense to the extent that he includes banks and brokerage houses and corporate checksigners, without all the gossip about who belongs to which clubs and whose sons “date” whose daughters. Yet even Zeitlin ends up by trying to find a ruling class of “freely intermarrying families.” “If we are to locate the actual centers of corporate control,” he writes, “we must discuss the most effective kinship unit.”

But who says we must? There seems little point in using a term like “kinship” to link anonymous administrators like Garvin of Exxon and Murphy of General Motors. C. Wright Mills’s conception of an elite was convincing because the kind of people who now ascend to presiding positions are in fact different from their propertied predecessors. Nelson Rockefeller, who buys people when he needs them, is more a throwback to J. P. Morgan or William Randolph Hearst than he is akin to the modern corporate types who tend toward civil service routines. Even though their paths undoubtedly cross in the course of business, our top managers are not linked together in ways that make them a cohesive culture. Nor have they the kind of self-confidence that characterizes a bourgeoisie. Balzac would find nothing to write about here.

It is entirely possible to engage in rule without being part of a ruling class. If we assume that corporate capitalism deserves all the criticism it can get, must there be particular malefactors to receive that indictment? All this listing of names, bloodlines, and marriages implies an inability on our part to understand and deal with power in its institutional form. Apparently we cannot visualize power as exercised administratively. Instead of the edifice of Chase Manhattan, our eyes seek out Rockefellers in the flesh. Indeed we often ignore an even more powerful bank, First National City, because the name of its chairman escapes us.

Of course corporate power appears in several constellations. Some companies present themselves as being solidly established and yet “modern” in outlook, especially those that join the Committee for Economic Development and other pronouncement-making bodies. But just as the railroads got an early start through federal land grants, so entire new industries have been created by war, space, and covert contracts. This has been especially true of the more freebooting firms in the South and far West. Once public money gets transfused into Global Marine and McDonnell Douglas, tax-payers find themselves the powerless junior partners of operating executives. When Elizabeth Tudor commissioned Drake and Frobisher to do her dirty work, she at least kept the upper hand.

By concentrating on families, clubs, personalities, the criticism of contemporary capitalism is in deeper confusion than its target. Blaming “the rich” or a “ruling class” no longer makes much sense. People have sometimes shown themselves ready to direct their resentments at institutions: suspicious attitudes toward oil companies and utilities show that. Even so, it has yet to be demonstrated how deeply one can hate American Cyanamid or Rockwell International. The class struggle is easier with an enemy of flesh and blood, as we know from countries like China and Cuba, where local landlords were an everyday sight. Our own capitalism’s demise seems slated for yet another postponement until its attackers find ways of rousing mass anger against an edifice whose power depends neither on the personal qualities of those who hold it nor on their membership in a ruling class.

This Issue

May 1, 1975

-

1

Census of Population, 1970: Detailed Characteristics, Final Report PC(1)-D1 (US Government Printing Office, 1973), Table 252.

↩ -

2

Statistics of Income, 1972: Individual Income Tax Returns, Internal Revenue Service (US Government Printing Office, 1974), Table 4.

↩ -

3

James Smith, Stephen Franklin, and Douglas Wion, The Concentration of Financial Assets in the United States (Urban Institute, 1973), Table 6.

↩ -

4

Who Rules America? (Prentice-Hall, 1967), The Higher Circles (Random House, 1970).

↩ -

5

Proxy statements list only executives’ shares in their own companies. But given in-house loyalty, these probably represent the bulk of their stock holdings.

↩ -

6

The New York Times, December 5, 1974.

↩ -

7

Gerard Zilg, Du Pont: Behind the Nylon Curtain (Prentice-Hall, 1974), pp. 549ff.

↩ -

8

Maurice Zeitlin, “Corporate Ownership and Control: The Large Corporation and the Capitalist Class,” American Journal of Sociology, March 1974, p. 1098.

↩