1.

Dapperly dressed, living in the best hotels, and often mentioned in the headlines of the world press, Joseph Duveen (1869–1939), the subject of Meryle Secrest’s new biography, was the great showman of the art market. Chief partner of the powerful art firm of Duveen Brothers, Joseph made some of the most spectacular art sales of the twentieth century, particularly of old masters, and was feared and admired by fellow dealers and clients. Known as a bon viveur, never without a cigar in hand, he had a reputation as a hard-nosed negotiator who would nickel-and-dime an old friend, but then impulsively shower him with lavish presents. Rumors abounded of his powers of persuasion, many encouraged by Duveen himself, but it has always been hard to see much beyond the jovial but steely salesman who was much talked about, widely acquainted, but little known.

Duveen was an uncomplicated man whose unabashed enthusiasm for artworks not only helped sales but infected all those who dealt with him. The mordant Andrew Mellon, one of Duveen’s best clients in the 1930s, parried an outburst of praise for one of his pictures with the sardonic remark, “Lord Duveen, my pictures never look so marvelous as when you are here!” Kenneth Clark, the art historian and director of London’s National Gallery, remarked that “when he was present everyone behaved as if they had had a couple of drinks.” Mary Berenson, wife of the famous connoisseur Bernard Berenson, compared his presence to drinking champagne. Berenson himself, less kindly, said it was more like slopping down gin. Duveen seems to have been fully endowed with the qualities of a salesman, but was there anything more to this engaging but rather transparent character? This is the question that haunts Secrest’s biography.

Duveen’s fame (perhaps notoriety is a better term) derives from the way in which he helped foster and exploit one of the most extraordinary migrations of cultural treasures that ever took place. Between the 1880s and the Wall Street Crash of 1929, old masters, contemporary paintings, modern art, furniture, silver, Chinese porcelains, rare books and manuscripts, altarpieces and church decoration, medieval architecture, clocks, reliquaries, carpets, armor, tiles, coins, and every conceivable bibelot were shipped in unprecedented numbers out of Europe and into the United States. Such flows of art had happened before, but, like the Roman plundering of Sicily or the mass accumulations of the French Revolutionary and Napoleonic regimes, they were usually the booty of war. In this case cultural treasures were moved by Adam Smith’s invisible hand, not the force of arms.

The causes and consequences of this migration are well known. As Secrest reminds us, in the late nineteenth century European agricultural revenues collapsed as cheap grain imported from the United States produced a precipitate fall in food prices. The leading members of the British and European aristocracy, the holders of most of the Continent’s cultural treasures, faced mounting debts and possible insolvency. In North America a number of fabulously wealthy American industrialists and entrepreneurs made rich by America’s remarkable economic growth developed a competitive interest in the Old World’s finest works of art. The Europeans disgorged their cultural riches; the American millionaires, helped by Duveen, bought them.

A list of these rich American collectors—among them Cornelius Vanderbilt, J.P. Morgan, Isabella Stewart Gardner, Ben Altman, Peter and Joseph Widener, Henry Walters, Henry O. Havemeyer, William Randolph Hearst, Henry Clay Frick, Henry Huntington, Samuel H. Kress, and Andrew Mellon—is an inventory of the triumphs of American capitalism in coal, iron, and steel, retailing and banking, communications and transport. The scale of this collecting was unparalleled. When J.P. Morgan died in 1913 his collections were valued at some $60 million; they would be worth billions today. Benjamin Altman, who also died that year, left a picture collection worth $20 million. William Randolph Hearst was spending about $5 million a year at the peak of his collecting. Samuel H. Kress amassed a collection of 3,210 works of art. But these famous, often obsessive collectors, the men and women Duveen liked to work with, were only the most visible manifestation of a much broader phenomenon in which America’s well-to-do citizens appropriated the cultural treasures of Europe, decorating their houses in what is best described as plutocratic pastiche.

The full extent of this cultural migration is almost impossible to measure, but we get some sense of its impact from the price lists that Secrest uses and that were assembled by Gerald Reitlinger in his classic study The Economics of Taste.1 Almost every sort of artwork and antique rose sharply in price after the 1880s. This was true not just of old master paintings, but of Limoges enamels, Italian faience, Ch’ing dynasty porcelain, and late Gothic, Renaissance, English, and above all French furniture. In 1902 a gold-ground tapestry panel—the Mazarin tapestry—sold for between £65,000 and £72,000, at a time when the pound was worth nearly five dollars. Any item of furniture associated with the French royal family—a commode or escritoire—fetched a huge price.

Advertisement

The works of individual artists also leaped in value. Between 1870 and 1912 the cost of works by Fragonard increased between ten- and twenty-fold. Titian’s Man in a Red Cap, sold in 1876 for £94 and 10 shillings, reached a price of £50,000 in 1915. Rembrandt’s Nicholas Ruts cost £375 in 1850 but £30,000 in 1904. At first other rich collectors, notably the European and English branches of the Rothschild family, took part in this spending spree, but in the decade before the First World War all the top prices were paid by Americans. The one exception was the world-record £310,000 paid by the tsar of Russia for the Benois Madonna of Leonardo in order to prevent its acquisition at the same price by Duveen for Henry Clay Frick.

In much of Europe these developments were met with consternation. “Has America at last got it all?” asked The Year’s Art in 1910.2 France, Italy, and Greece all enacted legislation to protect their cultural patrimony. In Britain, where free trade was a shibboleth, prominent members of the establishment set up the National Art Collections Fund, a private charitable body to raise funds to compete with foreign buyers in the art marketplace. Such measures could staunch but not stop the flow of cultural goods that continued unabated until the American markets collapsed in 1929.

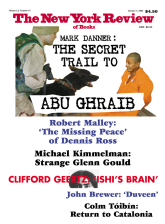

Duveen Brothers played a major part in this bull market for the decorative and fine arts, and Joseph Duveen was a key intermediary in developing some of the most important fine art collections in America, including those that still survive in the Frick and Metropolitan Museums in New York, the Huntington Art Gallery in Los Angeles, and the National Gallery in Washington. But there have always been two obstacles to a fair assessment of the Duveen enterprise. The first is Duveen himself. He was, as his first biographer, the dramatist S.M. Behrman, remarked, “the most spectacular art dealer of all time,” a man who relished publicity and worked every bit as hard to inflate his public reputation as he did the prices of old master art. Most art dealers in the early twentieth century were shy of the press. Duveen was a news hound. He spoke to journalists constantly; he had a special relationship with The New York Times, a big promoter of the great American collectors like Morgan and Frick; and he monitored news coverage of his firm’s activities, assembling a vast archive of reports from the European and American press, which he frequently attempted to manipulate. He would doubtless be delighted to know that in 2004 he is not only the subject of Meryle Secrest’s monumental biography but also one of the main characters in Simon Gray’s London West End play The Old Masters.

What Duveen told the world was what he thought it should hear. He set out to project himself as the most visible and important art dealer in the world, a monopolist in great art serving monopoly capitalists, who only bought the best and only paid the highest prices. As his friends all remarked, he was a brilliant storyteller and, like practically every other great raconteur and salesman, Duveen was habitually prone to be economical with the truth. He saw hyperbole as a form of understatement. As a result it is difficult to get beyond the many stories, some apocryphal, most unsubstantiated, that Duveen told about his triumphs in manipulating prices and buyers and engrossing the richest collectors. The problem is obvious in S.N. Behrman’s witty and beautifully written biography of 1952, originally composed as a series of articles for The New Yorker and recently reprinted.3 Behrman never had access to any of Duveen Brothers’ records. Instead he talked to friends and clients of Duveen, former employees in the firm, the widows of collectors, and collaborators like Kenneth Clark and Bernard Berenson, and quizzed them about Duveen and his dealings. He portrays a genial giant manipulator—no other dealer matters, no other member of the firm is important, collectors and the public are as putty in his hands. This is Duveen as he would have liked to be remembered, the man who single-handedly masterminded the old master world.

But other dealers were equally important. The first great old master collection in the United States, that of Isabella Stewart Gardner, was the work of another dealership, Colnaghi’s. Joseph Widener’s most important pictures were almost all purchased through the London dealer Agnew’s. Henry Clay Frick only became Duveen’s client toward the end of the plutocrat’s life. Equally, Joseph Duveen, as Secrest points out, was no more than the firm’s salesman. He would never have succeeded without the teams of scouts and researchers who tracked down pictures for the firm. Nor did Duveen always get his way with collectors, some of whom, like Carl Hamilton, were well capable of bamboozling him. There were great successes but, as Secrest shows, there were also some spectacular failures.

Advertisement

Getting at the truth about Duveen, past the flummery, extravagance, and exaggeration, has been so difficult because Duveen and the firm always combined secrecy with publicity. They went to great lengths to conceal their activities, not least because some of their actions—spying on customers (Andrew Mellon was followed around for years), reading the contents of their wastebaskets, and bribing their servants for information—were at best morally dubious and possibly illegal. Correspondence and cables were written in code (albeit a rather crude one) and given special names. Bernard Berenson, famously, was called “Doris.” No one outside the firm had access to its archives, which were a jealously guarded resource. This situation continued after Duveen’s death, when Duveen Brothers had become the newly incorporated and immodestly named Imperial Art Corporation, run by three former Duveen employees, including Edward Fowles, who eventually became sole proprietor. In 1964 Fowles sold the firm to the Californian collector Norton Simon, who was chiefly interested in acquiring its substantial stock. (If you want to know what the Duveen firm then had in its basement you can visit the Norton Simon Museum in Pasadena.)

A year later the Duveen library, over 12,000 volumes of sales catalogs and works on art history, many annotated by members of the firm, was purchased by the Sterling and Francine Clark Art Institute to form the basis of its research library. Then in 1968 Edward Fowles deposited most of the firm’s archive with the European paintings department of New York’s Metropolitan Museum of Art. But the old habit of secrecy died hard. Access was restricted to the staff of the Met and the Frick; other scholars were excluded. Fowles labored in the archives on a memoir, allowing his ghostwriter, the British journalist Colin Simpson, to use the materials to write a fascinating study, The Partnership, about the discreetly concealed business relationship between Duveen and Bernard Berenson; but no one could check his sources.4 Only when the archive passed into the hands of the Getty Trust in Los Angeles in 1998 did it become more generally available, especially when the cataloging and microfilming of its vast holdings—contained in 100 yards of shelving, and 584 boxes, and requiring 422 reels of microfilm—was completed in 2002. Aptly enough, the Duveen archive has found its final resting place in the last of the great old master museums named for a donor, a type of American institution that the firm did so much to create.

2.

The appearance of Meryle Secrest’s Duveen: A Life in Art could therefore hardly be more timely. The author of lively (sometimes controversial) biographies of two of Duveen’s old sparring partners, Bernard Berenson and Kenneth Clark, Secrest knows skulduggery in the fine art world better than most, and has the honorable distinction of being one of those excluded from the Duveen archive when it was deposited at the Metropolitan Museum. But in writing about Duveen and Duveen Brothers, Secrest faces a dilemma. Both Berenson and Clark (like Frank Lloyd Wright the subject of her other “art” biographies) were complicated characters with dramatic private lives whose messy affairs would nowadays make headlines in the New York Post. Some of Secrest’s best writing in Being Bernard Berenson and in Kenneth Clark unravels the intricate connections between the public and private lives of these two men. But with “Jo” Duveen there is no private life of interest. He married his teenage bride, Elsie Salamon, when he was thirty. She was beautiful and used to the sort of comfortable life he gave her. She said little, produced a daughter, was a good hostess, and remained Duveen’s constant companion. According to Mary Berenson, Duveen had a mistress but there were no hidden longings, none of the melancholy and withering self-criticism of Berenson, none of the tortured complexity of Clark’s relations with his wife and other women.

Duveen’s private life is utterly uninteresting and, one senses, was not that important to him. His public life in art was his all. Secrest quotes a telling anecdote of Mary Berenson’s about a visit to the Duveens in 1913:

We talked politely on various topics for the first half hour—and then I broached the selling of pictures, and a loud sigh of satisfaction went up to the ceiling, and we settled in to a thoroughly congenial topic.

Though Duveen was occasionally troubled by setbacks and, according to Secrest, the occasional bout of depression, he loved the life he lived and apparently suffered no internal conflicts. Even as he knew he was dying he could say in all sincerity, “I have had a wonderful life.”

Deprived of the inner conflicts and bad behavior that makes for a difficult life but excellent material for the biographer, Secrest nevertheless has the advantage of the Duveen papers and of greater public knowledge than ever before about Duveen’s wheeling and dealing. But the sheer volume of the Duveen archive not only threatens to cut him down to size but to swamp him entirely. Its materials are more the subject matter for a business school case study than for a biographer. His deal-clinching and the publicity that surrounded it are dwarfed by the records of a vast enterprise, a machine for producing art information and aesthetic value. The reports of his scouts on private picture collections and the financial status of their owners, the cables and wireless messages, all faithfully copied and filed by secretaries, opinions (notably those of Berenson) on the authenticity and attribution of pictures and objets d’art, receipts and invoices for purchases, restorations and expenses: they all testify to the controlling obsessions of the firm and to the ruthless organization that was every bit as important to its success as the personal flair of its principal. Much of this obsessive attention to detail was, as Secrest points out, attributable to Duveen’s meticulousness and was enforced with a ruthlessness worthy of a petty tyrant, but it was a general feature of an astonishingly well-run firm. Here Secrest gets the balance right, using the vast archive to puncture some of Duveen’s tallest stories and to uncover Behrman’s preference for a good yarn of dubious truth; yet she never lets the business overwhelm her subject.

As Secrest’s opening chapters show, Joseph Duveen did not so much create a great enterprise as transform one he inherited. When he began working for the firm in 1886, his father, Joel, and his uncle Henry already had a thriving transatlantic business in the decorative arts, specializing in Oriental porcelain and tapestries. By the 1890s, Secrest points out, “every autumn the London branch sent the New York branch almost three hundred cases a week, for something like six weeks.” Profits from the New York enterprise had reached over £500,000 by 1895, and the firm had already snared its first American multimillionaire in the shape of Benjamin Altman, the department store owner, who began buying from Duveen’s in 1882. But the Duveen brothers were dealers in decorative arts and interior designers—when Edward VII finally got on the throne, they designed the décor for his coronation. They avoided the fine arts and painting as a risky business that needed expertise they did not have.

Joseph, who was made a partner in the firm in 1890 and took over more and more of the business after his father’s illness in the following year, had no such scruples, and boundless confidence in his own judgment. He was determined to move into pictures. But his first foray was little short of a disaster. In 1901 he decided to buy at auction a pedestrian portrait by John Hoppner of Lady Louisa Manners which he had earmarked for Altman’s collection. Rival dealers, determined to keep Duveen Brothers out of the market, helped bid up the picture and left the firm stuck with it. The Duveens paid a ridiculous record price of £14,752 for a picture that Altman disliked and sent back. After this setback, Duveen changed tactics. In the first decade of the new century he turned from buying individual pictures at auction to buying collections by private agreement. As Secrest points out, there were commercial advantages to this:

When a painting is put up for auction and a dealer buys, since the sales price is known the dealer’s profit will be circumscribed by whatever the client considers reasonable. But when a dealer buys a collection the value of the piece of sculpture or painting is whatever he says it is, and how much he calculates he has paid for each item remains a trade secret.

In 1905 Duveen paid a staggering $4.2 million for the collection of Rodolphe Kann, a banker who had made a fortune in South African gold and diamonds. Two years later he bought the collection of Oscar Hainauer, the Berlin representative of the Paris Rothschilds bank, for $1 million. He sold the best works in both collections to J.P. Morgan, Altman (who purchased four Rembrandts), Arabella Huntington, and P.A.B. Widener. Within a couple of years he had made a profit of $4 million on the Hainauer collection alone.

The purchase of these collections pushed Duveen into the big league of dealers in old master art, and enabled him to use the rivalry between Frick, Altman, and the Huntingtons (Henry E. and his wife Arabella) to push up prices. He set out to monopolize the rich collectors, to play them off against one another, foment rivalries, and to resell the works they bought. Thus the Fragonard panels called Romans d’amour et de la jeunesse, bought by J.P. Morgan from Agnews in 1898 for $350,000, were purchased by Duveen from the Morgan estate and sold in 1913 to Frick for $1.25 million. Duveen sold Rembrandt’s Aristotle Contemplating the Bust of Homer no fewer than three times: first to Arabella Huntington in 1907, then to Alfred W. Erickson (the cofounder of the McCann-Erickson advertising agency), who paid $750,000 but had to return it (for $500,000) in the aftermath of the 1929 crash, and finally back to Erickson again in 1936, when the buyer had regained his fortune. As Secrest shows, Duveen was determined to ensure a bull market and keep prices rising.

The period before World War I was a golden age for art dealers, when prices reached a level that was not to return until the 1980s. During these years Joseph Duveen perfected the manner that was to be his trademark for the rest of his career: an ostensible contempt for money, which drove his partners to despair; a willingness to take risks—the more vertiginous the better; a relish for conspiracy and undercover activities; and a determination to live on a par with the richest men in Europe and America, matching their extravagance but exceeding them in taste. Duveen was a showman, clowning it in England, according to Kenneth Clark, but lording it over clients in the United States.

Yet underpinning this success, as Secrest hints but might have investigated more fully, lay Duveen’s financial power. No other dealer had an arrangement with a bank guaranteeing overdrafts up to $6 million; no one had better access to the House of Morgan and its funds. The firm, thanks to a timely loan from a consortium of bankers, was even able to absorb a fine of $1.2 million levied by United States Customs for evading import duties in 1910. In effect, Duveen acted as a financial intermediary between the banks and his clients, offering them long-term credit in order to meet the firm’s high prices. As Duveen wrote, “We have no other course but to make dates of payment for periods with our clients, and then keep milking them, otherwise the game cannot be carried out.” The methods and terms of payment (installment plans, bonds, shares, land), and the loans that made them possible, were every bit as complex as those described by Christopher Mason in his remarkable analysis of the Sotheby’s-Christie’s art scandal of the 1990s.5

It was also in these pre-war years that Duveen acquired the habit of not only talking up his own pictures but disparaging those of his rivals, a practice that often landed him in the courts. As Secrest memorably puts it, “his fondness for hyperbole” often led to trouble: “A work of art was not only the most divine object he had ever seen (like babies) or the most execrable, ridiculous, shameful, hateful, and obviously false piece of work he had ever seen in his life.” “One wonders,” she adds, “which gave him most pleasure: flaunting a provocative opinion or rescuing himself from a hair-raising situation with dramatic last-minute reprieves.” But though Duveen’s attributions were never disinterested, they were rarely without merit. The picture sold by a rival dealer to Henry Huntington in 1913 as a Romney portrait of the Kemble sisters, and that Duveen refused to accept as by the artist, turned out to be neither a Romney nor of the Kemble sisters. The Hahn version of Leonardo’s Belle Ferronnière, which Duveen dismissed as a copy in 1920, thereby provoking a legal battle that lasted nearly a decade, is widely considered to be a later version of the Belle Ferronnière in the Louvre, not by Leonardo. Even Duveen’s determination to attribute the so-called Allendale Nativity to Giorgione and his bullying attempt to persuade Bernard Berenson (who saw it as an early Titian) to agree with him—an act that provoked a final breach between the two men in 1937—has much modern scholarly support.

Duveen was sued not just because he was indiscreet but because he was very rich—on three occasions he was sued for half a million dollars or more—and because the power of his opinion was deeply resented. This became abundantly clear in the New York trial over the Hahn Belle Ferronnière (to which Secrest devotes an excellent chapter), where the question of Duveen’s power in the marketplace overshadowed the issue of attribution.

3.

Art markets are fueled by money, gossip, and expertise. As Secrest shows in graphic detail, the last was often in short supply. Duveen’s legal battles and the disputes over attribution were symptomatic of the weak state of expertise and of the corresponding opportunities for fakery, forgery, and old-fashioned swindling. Duveen tried to protect himself—concentrating on famous works of art with known provenances and pedigrees and buying, in a secret agreement of 1912, the services of Berenson, the most famous connoisseur of the age. At the same time neither he nor Berenson was immune from taking advantage of the ignorance or gullibility of their clients. The entire trade in old masters took place in a shifty market populated by figures far more devious and dishonest than either of them, and, as Secrest shows, even they were sometimes defrauded by a con artist or outfoxed by a clever faker.

In the 1920s and 1930s Duveen’s life changed little. He continued to cultivate a succession of extremely rich clients, replacing those who died with new millionaires like Andrew Mellon, Julius Bache, and Samuel H. Kress. He bought major collections en bloc, like the Dreyfus collection of Renaissance sculpture for which he paid $5 million. And he also brought off some spectacular sales, none greater than the batch of twenty-six paintings and eighteen sculptures he sold to Andrew Mellon in 1936 for $21 million, which now reside in the National Gallery in Washington. He persisted in seeking the limelight, and never succeeded better than in the publicity surrounding the sale of Gainsborough’s The Blue Boy, owned by the Duke of Westminster. Henry Huntington, who had long coveted the picture, paid Duveen $728,800 for it in 1921. The portrait was cleaned and exhibited in London’s National Gallery in 1922 and caused a sensation. Ninety thousand visitors came to see it in the month of January and there was an outcry at its departure from Britain. Once across the Atlantic, The Blue Boy was exhibited in the Duveen galleries in New York, before finally being freighted in a special box to Huntington’s mansion in San Marino, California. The Blue Boy was only the most famous example of rich American collectors’ fascination with portraits of what Secrest calls “pretty people,” a craze that pushed the prices for a good Gainsborough close to those of a Raphael or a Giorgione.

As Secrest shows, Duveen’s final years had their fair share of disappointments. During the late 1920s and the 1930s he did much to consolidate himself as a public figure. He donated money for an extension to the Tate Gallery, for improvements in the National Portrait Gallery, and, at the end of his life, for special galleries to house the Elgin Marbles in the British Museum. He donated pictures to the Tate and sponsored exhibitions of contemporary British artists. He had been knighted in 1919, became a trustee of London’s National Gallery in 1929, and a peer of the realm, Lord Duveen of Millbank (the site of the Tate Gallery), in 1933. But as Duveen grew weaker from the cancer that had dogged him since the late 1920s, he had to face the breakup with Berenson, a costly and unsuccessful law suit with the shady collector Carl Hamilton, his ignominious removal from the Trustees of the National Gallery—Kenneth Clark distrusted him—and a huge public row over the cleaning of the Elgin Marbles. Nevertheless he remained doggedly optimistic to the end.

Secrest has no doubt about the importance of her subject. Duveen has a place in history as the creative spirit behind the great American collections that became the great American art museums:

Duveen’s far-sightedness in the selection of these objects cannot be overstated. He instructed and cajoled, and as a result American museums are filled with Old Masters rather than tenth-rate salon paintings of the dernier siècle they might otherwise have contained.

Her final verdict, then, though offered with a great deal more evidence, is not far removed from that of Behrman’s scintillating series of essays published half a century ago. Her account is more accurate, more comprehensive, more balanced, but lacks the elegance of Behrman’s prose. Nevertheless, she has given us by far the best account of Joseph Duveen’s life in a biography that is rich in detail, scrupulously researched, and sympathetically written. Her inquiries into early-twentieth-century collecting whet our appetite for a more general history of the art market in the first half of the twentieth century. They also remind us that the firm of Duveen Brothers, whose dealings were even larger than those of its leading partner, still awaits its historian.

This Issue

October 7, 2004

-

1

Gerald Reitlinger, The Economics of Taste, Volume 1: The Rise and Fall of the Picture Market, 1760–1960; Volume 2: The Rise and Fall of the Objets d’Art Market Since 1750 (Holt, Rinehart and Winston, 1964–1965).

↩ -

2

Quoted in Reitlinger, The Economics of Taste, Vol. 2, p. 236.

↩ -

3

S.N. Behrman, Duveen: The Story of the Most Spectacular Art Dealer of All Time, with an introduction by Glen Lowry (The Little Book Room, 2003).

↩ -

4

Colin Simpson, The Partnership: The Secret Association of Bernard Berenson and Joseph Duveen (London: Bodley Head, 1987).

↩ -

5

Christopher Mason, The Art of the Steal: Inside the Sotheby’s-Christie’s Auction House Scandal (Putnam, 2004).

↩