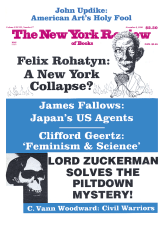

Pat Choate writes that his book is not really about Japan—despite its subtitle, despite the big red hinomaru circle of the Japanese flag that dominates its cover, despite the debate that Choate has provoked in Washington about whether Japanese interests have too much influence over American politics. (The two books under review here have almost identical big-red-dot covers, suggesting that maybe it’s time to retire the hinomaru as a design motif for writings about Japan.) Choate says that, instead, he is concerned with the structural corruption that arises when American politicians and bureaucrats leave office and immediately go to work as lobbyists for special interests. The most important of these interests have traditionally included defense contractors, assorted American corporations and economic interest groups (such as sugar or milk producers), and some foreign governments.

If a book like Choate’s had been published ten years ago, it would have concentrated on the lobbies in favor of a bigger defense budget and firmer US support for Israel. But through the 1980s, Choate says, Japanese corporations and the Japanese government have put more money into lobbying than any other single group, foreign or domestic. Therefore, it is hard to discuss the general problem of corruption without coming back again and again to Japan. He writes in his introduction,

In a sense, this book is not about Japan or any other foreign interest. It is about a fundamental problem with American governance—one that allows foreign interests to assume a dangerously large role in America’s politics and policymaking through political manipulation.

Choate’s book is most impressive if he is taken at his word—if the book is judged as an anatomy of Washington, rather than of Tokyo or of US–Japanese economic relations. Its strength lies in its extensive anecdotes and case studies of how lobbyists actually work in Washington, and its demonstration that foreign, and especially Japanese, money is playing a larger and larger part in electoral politics throughout the country. Two years ago, the noted Japanese business consultant Kenichi Ohmae publicly recommended that Japanese companies should “simply halt” investment in the districts of congressmen who have criticized Japan, to pressure them to change their views. Choate indicates that such a strategy is underway. The book’s major weakness is that it assumes, rather than argues or demonstrates, that US and Japanese interests necessarily conflict, and that working for any “foreign” interest (including, say, the government of Canada) is suspect activity.1 The book should be considered a polemic about self-inflicted American problems, and as such it is useful and important.

Since late last year, Choate—who is a veteran of Washington politics rather than of specifically Japanese concerns—has done an amazing job of building anticipation for this book, above all for Appendix A, the list of former government officials who have gone to work as agents of foreign interest groups. In newspaper interviews, on talk shows, even in congressional testimony, he has said that his book would take the lid off foreign influence buying in Washington, and that the appendix would contain a list of names, sums paid, and jobs done. The publisher fed the too-hot-to-handle impression by refusing to send out any prepublication copies of the list, even as part of reviewers’ galley proofs that were themselves held until just before publication. Appendix A was unveiled as part of the completed book only a month ago.

The famous list does touch on Japan, as we will see, but it also outlines a more general sociological pattern. The list has some limitations, even beyond the ones that Choate discloses. Choate and his assistants spent several months going through records filed with the Justice Department, under the Foreign Agents Registration Act, looking for retired politicians or government officials who had become foreign lobbyists. Of the several thousand filings that met their test, only a few hundred names made it into Appendix A. Choate says he was trying to put together a sample that was representative—by political party, by branch of government, by type of lobbying—but since he is using real people’s real names, the ones who do show up in print might feel that they have been arbitrarily selected. (Some of the lobbyists Choate concentrates on in his text do not appear in the list at all.)

The lobbying fees shown on the list can be misleading, since they are lumped together in two ways. First, as Choate clearly explains, the sum that a firm received from foreign clients is listed next to the name of each member of that firm. Thus the millions of dollars that the public relations firm of Hill and Knowlton somehow earned from the Republic of Turkey are listed half a dozen times, alongside the names of the numerous former US government officials who now work for Hill and Knowlton. The person-by-person sums vary for Hill and Knowlton and the other large firms, since the Foreign Agents Act requires a firm to disclose how much money it received during the period each agent was registered. For instance, Hill and Knowlton took in $3.2 million from Turkey while Donald Massey, a former deputy sergeant-at-arms of the Senate, was a registered agent of Turkey, but only $1.8 million during the period when Lawrence Brady, a former assistant secretary of commerce, was a registered agent. Some but not necessarily all of this is the same money.

Advertisement

Second, the names on the list are grouped by function, and some types of “foreign lobbying” that most people would consider harmless are included in the total. For instance, the law firm Paul, Weiss, Rifkind, Wharton and Garrison is listed as receiving $9 million from a British firm called Consolidated Gold Fields (which operates mines in South Africa), during the time Consolidated was represented by Terence Fortune, a former State Department legal adviser. But Mr. Fortune says that virtually all of the money was for normal legal fees, and that less than 2 percent of the total, about $156,000, was for “political activity”—lobbying in the ordinary sense of the term. Similarly, of the $1.6 million Paul, Weiss received from the Japanese electronics giant NEC, Fortune says that $150,000 went for lobbying and the rest was for legal fees. Lufthansa paid $8 million to the Washington law firm of Wilmer, Cutler, Pickering while Lufthansa was represented by Lloyd Cutler, who makes the list because he was briefly Jimmy Carter’s White House counsel. Nearly all of this money went for legal proceedings and regulatory hearings over airport landing rights. Lawyers’ fees like these may be considered scandalous, but they are part of an older and more familiar scandal than the one Choate is describing. The list shows that a Japanese firm named Outokumpo Oy paid nearly one million dollars to the law firm Arent, Fox while two ex-politicians, former Senator John Culver of Iowa and former Representative Michael Barnes of Maryland, were working there. This is its own case of mislabeling: Outokumpo is based in Finland, “Oy” being the Finnish counterpart to “Inc.”

These crudities of aggregation reflect the law’s shortcomings rather than Choate’s: he was merely working from the disclosure forms. They suggest how difficult it can be to figure out just how much foreign influence there is in Washington, and how much of it is bad. But what the list does reveal, beyond any blurring or “aggregation” problems, is the sad comedy of many Washington careers.

Careers in Washington are unusual because the opportunities are simultaneously so large and so small. The financial and psychic rewards of official Washington certainly look large when compared to those in most American small towns, or those of nonprofessional workers anywhere in the country, or those of nonofficial Washington, including the very large black middle class that dominates District politics and the mainly white surrounding suburbs. The congressmen, congressional staff members, foreign service officials, senior military officers, upper-level civil servants, and of course journalists who make up “official Washington” generally earn upper-middle-class incomes. Their work is, by most standards, stimulating and pleasant. But there is not much truly big money in Washington, not by the standards of Tokyo or Los Angeles or New York. Big fortunes, at least those that are not inherited, usually depend on one of three accomplishments: selling to a vast market, as with the movie or record or soft-drink businesses; creating something that will bring in revenues or royalties forever, as with the oil-drill bit that built Howard Hughes’s fortune; or retaining a little of the huge sums of money that pass through your hands, as with bond traders and investment bankers.

Doing any of these is difficult in Washington. For David Stockman and Henry Kissinger to make big money after their government service, they had to go to New York. The sums that flow through federal accounts are obviously immense, but IRS or Pentagon officials can’t put a commission on them, as investment bankers could. The Washington culture is not entrepreneurial, in the sense that people naturally try to come up with the product or gimmick that will let them retire and live on royalties. Almost everyone’s product, and not in a squalid sense, is himself—his connections, knowledge, reputation, advice. By definition, this is a product with a specific and limited market. For those who have left office, the market consists of the corporations and interest groups whose welfare is affected by the federal government.

The saddest thing about the Washington product is that, much more than a movie or a drill bit, it is a waning asset. Most people in official Washington would prefer to sell their services for the combination of money, recognition, and excitement that is available when they are still engaged in government, rather than for money alone. Congressmen would like to be reelected forever, staff assistants would like to be in the action forever, diplomats would like to be managing foreign crises forever, journalists would always like to be analyzing the latest news on the talk shows—while, of course, continuing to make today’s considerable incomes in all these fields. But one way or another, the engagement comes to an end. Congressmen are defeated, military officers are retired at fifty, a generation of “young” Democrats grows old waiting for another chance at the White House. Everyone starts to feel “bracket creep”: the children are in college, the lawyers and doctors are making twice as much as you are, the sub-$100,000 ceiling of the federal pay structure begins to seem cramped. Then comes the stage, which most people in Washington describe sheepishly rather than gleefully, when it is “time to make some money.”

Advertisement

This brings us back to Pat Choate’s list: a thousand such dramas, or at least several hundred, are outlined here. Four years ago, Paul Laxalt was interviewed daily about world affairs. He was a “best friend” of President Reagan, and a temporary hero for having talked Ferdinand Marcos into leaving office. Today he is out of the Senate and at the head of “Laxalt, Washington,” which Choate lists as receiving some $868,366 for unspecified services to the government of Antigua/Barbuda. Five years ago, George Bush was vice-president and Daniel Murphy, a Navy admiral, was his chief of staff. Since then, according to Choate’s list, Murphy has represented more than thirty foreign interests, from the government of Haiti and Japan’s Liberal Democratic party to Airbus Industries of France, Daewoo of Korea, and the Icelandic Ministry of Foreign Affairs. Three years ago, Charles W. Dyke was the commanding general of the US Army in Japan, an institutional descendant of Douglas MacArthur. Since then he has been a consultant for, among others, Mitsubishi International. (His wife has been on George Bush’s staff since his years as vice-president.) Three years ago, two officials of the US Department of Commerce were writing regulations designed to enforce the “antidumping” agreement against Japanese semiconductor makers. A month after they resigned, they went to work for those same semiconductor companies, alerting them to exactly what the US auditors would be looking for.

The stories go on and on: the former local TV newscaster who gets into the White House press office—and quickly gets out to give PR advice to foreign governments; the congressional staff assistant who specializes in foreign affairs, and then sets up his own company with half the third world as clients; a group of well-connected Republican members whose company represents almost every major Japanese manufacturer. In interviews discussing his book, Choate has made it clear that his fifty pages listing real people could easily have been expanded to hundreds of pages.

In such activity undignified? Of course. The most harmful effect is not the work the lobbyists actually do but the effect of their example on those still in the government. One former trade negotiator told Choate,

When people in government get ready to leave, they know where the money is. It’s with the Japanese. Nobody who’s looking at an opportunity to make $200,000 or more a year representing a Japanese company is going to go out of their way to hurt them while in office.

Amazingly enough, the branch of government that has tried hardest to wrestle with this problem is the military. For a generation it has worried about the career path that leads straight from the Pentagon to General Dynamics or Lockheed, and over the last decade it has tried to build in a few protections. The part of the government Choate concentrates on—the Commerce department, trade negotiators, and economic policy-makers in general—has barely begun to consider the problem. The final chapter of Choate’s book lists a number of suggestions for closing this “revolving door.”

But in addition to being unseemly, the pattern is also funny—and sad. Sad because many of these people feel, as Michael Milken or Ross Johnson presumably do not, that they have sold out. Most would prefer to go back to being a senator or ambassador or colonel or campaign manager for half the pay, if they had the chance or if they felt they could afford it, which they don’t. And it is funny because of the illusory and sometimes shabby side of the business. Choate’s list seems designed to raise moral questions about the agents: Why did they take the money? What were they willing to do? Much of the time, however, I found myself wondering about the clients: How did the poor suckers get talked into these million-dollar deals? Why on earth did they pay?

Although Choate shows that the lobbyists stimulate a tremendous amount of activity, he generally cannot provide conclusive proof that the foreign money produced results that would not have happened anyway. For instance, Choate says that Toshiba paid more than $20 million to American lawyers and lobbyists, after a Toshiba subsidiary, in violation of agreements with the US, was found to have sold propeller-making machinery to the Soviet Union. (William Holstein says that, in all, Toshiba spent at least $30 million to sway American opinion in this case.) The lawyers and lobbyists did their work, and Congress decided not to impose trade sanctions against Toshiba. But even if Toshiba had saved all these millions it is conceivable that the Congress would have balked in any case, because of pressure from the many American corporations that depend on components from Toshiba. In its own way, this latter possibility would have been a more dramatic illustration of how US policy can be shaped by America’s reliance on Japanese technology and money.

In many cases, the surge in Japanese lobbying reflects a fleecing of Japanese companies by Americans who have become expert at telling Japanese how much they have to fear from other Americans who are critical of Japan. Choate cites my own writings about the Japanese economy as among those used to incite such fears. The more that American politicians, academics, and journalists worry about Japan’s economic impact on America, the easier it is for American lobbyists to extort protection money from confused but cash-rich interests in Japan. Once, in Tokyo, I hid behind a pillar in a ballroom, so that the visiting speaker from a think tank in Washington would not see that there was another non-Japanese in the room. I listened as he quoted several articles critical of Japan, including one I had written, and then told his Japanese audience that storm clouds were gathering in the United States. The only way to deal with the menace, of course, was to support a friendlier view. At the end of the meeting the man handed out his business cards, saying he’d be glad to help combat such evil threats. Early this year, a Japanese executive of a major Japanese corporation told me he thought it looked bad for American politicians to lobby for foreign interests. “It looks worse to me than it does to the ordinary American,” he said, “because I actually see these people. At least once a week a former Congressman or bureaucrat is knocking on my door to tell me that I need his help.”

How much does the Washington career pattern that Choate describes really matter? It certainly is different from the practices of most major nations. The closest counterpart, the Japanese system of amakudari, shows how unusual the American situation actually is.

Accounts of amakudari, which means “descent from heaven,” turn up in almost every admiring Western description of the Japanese economic miracle, usually to represent the close government–business relationship in Japan. The heaven in this case is the Japanese bureaucracy, which attracts some of the country’s most talented graduates and, as in France, still heavily shapes the country’s political and economic policies. (Prime Minister Kaifu had been scheduled to visit the Middle East just after Iraq invaded Kuwait. The bureaucrats in the Foreign Ministry called the trip off, without bothering to pretend that this had been Kaifu’s idea, or even that he was sick.) Japanese bureaucrats are forced to retire early, no later than their mid-fifties. Up to this point in their lives, they have been highly esteemed but not so well paid. But after retirement they “descend” into lucrative board-of-directors jobs with the industries they guided and regulated in their previous careers. This practice is often described by outsiders as if it were a natural reflection of Japan’s team spirit and instinct for consensus. In Japan it is generally seen more realistically as an unavoidable deferred payoff for the bureaucrats, and an investment in “human relations” with their successors still on the job.

What makes amakudari different from the Washington pattern is that the Japanese market for political favors works only within clearly understood bounds. The bureaucrats won’t go to work just for the first company that shows up with cash, especially not for the first foreign company. Makoto Kuroda, a blustery former MITI official, worked as an adviser to Salomon Brothers in Tokyo after he left office; his decision is often cited to show that the situations in Washington and Nagata-cho or Kasumigaseki (the bureaucratic centers of Tokyo) have become the same. In fact, Kuroda’s career demonstrates just the opposite. He worked for Salomon Brothers during a year-long cooling-off period after leaving MITI; during that time, as he himself has said, his duties consisted largely of a weekly lunch with other Salomon officials. Last June, when the year was over, he “descended” to his more natural place on the Mitsubishi board of directors. Ronald Reagan’s $3 million trip to Japan, which was seen there essentially as a commercial for the Fuji-Sankei television and publishing group, is the starkest illustration that, for American officials, whatever the market will support is OK. “It is difficult to imagine Kakuei Tanaka, Helmut Kohl, François Mitterrand, or Margaret Thatcher providing a similar paid endorsement of an American firm,” Choate says. In his book, William Holstein touches on the same point:

“There’s no other major country in the world where foreigners can come in and manipulate the system like this, I promise you,” says Tomasz Mrocyzykowski, a professor at American University in Washington and a specialist in U.S.-Japanese relations. “The Europeans simply don’t allow it. It’s amazing that [in Washington] I can leave government, open up my own company, and make fifteen times as much working against the interests of my country.”

In this market for services, Japanese purchasers are clearly in a strong position, since they have so much cash. Choate contends, on the basis of Foreign Agents Registration Act forms, that Japanese companies probably pay as much for Washington lobbying as the next half dozen nations combined. Much of this money has undoubtedly been wasted, just as many Japanese investors have undoubtedly overpaid for “trophy” properties like Rockefeller Center and have generally bought into the US commercial real estate market at its peak. But they’ve got the buildings, and within a few years the prices should recover. Similarly, Japanese interests may have paid too much for political influence, but they haven’t come away completely empty-handed.

Choate’s book is full of cases that ended in “Japanese victory,” such as the fight over the definition of a “truck.” Cars imported to the US from Japan are subject to a relatively low tariff (2.5 percent), but are limited by “voluntary export restraints.” The reverse is true of trucks, whose numbers are uncontrolled but which are subject to a 25 percent tariff. As Japanese “transplant” factories in the United States have started turning out more Nissans, Hondas, and Toyotas, Japanese manufacturers have used more of their export quota for high-value cars, like the Lexus and Infiniti, and they still have had unused room within the quotas. Therefore, they have tried to get their light pickup trucks reclassified as “cars,” which would mean a much lower tariff and would not displace any car exports.

The US customs commissioner under Ronald Reagan, William von Raab, was not sympathetic to this plan. Choate quotes the delightfully wry ruling von Raab issued when he turned down the Japanese request to have light trucks be considered as “cars.” (“These vehicles are built on truck bodies. They have truck characteristics. Most are built in truck divisions. Most are built in truck factories. They are advertised as trucks…. Even my grandmother can go into a parking lot and tell the difference between a passenger car and a truck. These are trucks.”) But after extensive lobbying, von Raab’s ruling was overturned by the Treasury Department—which, Choate makes clear, has been preoccupied since 1985 with the need to keep Japanese investors buying US bonds, and therefore is eager at all costs to avoid offending Japanese lenders. The trucks came into the United States as “cars,” qualifying for a low tariff, but before they went on sale, they became “trucks” again, for which pollution and mileage standards are much lower than for cars.

This decision, Choate says, cost the US government some $500 million in lost tariffs. Another way of putting the same point, of course, is that the ruling saved American consumers those $500 million in extra costs. Here as elsewhere in the book Choate skips past the argument that the interests of American producers (in this case, companies that make light trucks) should outweigh the interests of American consumers. The argument can be made, I believe, but it rests on evidence and reasoning not found in this book.

A less well-known but more portentous case is that of a small company called Fusion Systems. Through the last two decades, Fusion has done exactly what management experts say American business should do to save the nation’s economy. Its technologists came up with a genuine breakthrough: a new kind of ultraviolet lamp; which can produce unusually intense, direct light. The Fusion light was enormously attractive to the printing industry, which could use it to dry ink on plastic labels instantly, and to semiconductor manufacturers. Fusion sold successfully around the world, including in Japan, where Mitsubishi Electric bought one of its lamps in 1977.

Soon thereafter, Mitsubishi began filing patents for an ultraviolet lamp of its own that bore a marked similarity to the Fusion model. By the mid-1980s it had more than 250 related patents registered with the Japanese patent office. Patent law in Japan works from entirely different premises from America’s, rewarding those who file a claim first (rather than those who can show they came up with the innovation first), and allowing numerous separate patents for minor variations. The American patent system might grant a patent for a bicycle gear shift; the Japanese system could allow patents for a red bicycle with that gear shift, a bicycle with lights and that gear shift, and so on. Mitsubishi did not challenge or copy Fusion’s central patent, but it filed the equivalent of “bicycle-with-lights” patents—patents for the Fusion system with a new casing, the Fusion system with some new attachments, etc. “These applications may cover what are, taken individually, relatively insignificant aspects of the new invention,” Maureen Smith, a Commerce Department official, said about the Japanese patent approach. “However, if enough of these ‘nuisance’ patents are filed, the inventor of the original product may discover that he is unable to produce his [own] product if these [nuisance] patents are granted.”

This was exactly the prospect Fusion faced. Mitsubishi raised the threat of a patent-infringement fight, but then said that it would be so much nicer, so much more in keeping with the Japanese tradition of sharing, to avoid such unpleasantness through a “cross-licensing” agreement. Each side could use the other’s technology, with no petty feuding over proprietary rights. At that point what had been a competition over patents would become a straight contest in manufacturing efficiency between Mitsubishi and Fusion, and Mitsubishi would undoubtedly win.

Fusion wanted its case to be seen as a policy question—as a symbol of what happened when two very different patent systems prevailed in the world’s two most advanced economies. Mitsubishi was just as eager that this remain a strictly commercial dispute, which the two belligerents (one of whom was roughly one thousand times larger than the other) could work out. To promote this message, it hired James Lake, who was press adviser to Ronald Reagan’s presidential campaign in 1984 and George Bush’s in 1988. Through a complicated process that Choate describes, Mitsubishi won the policy battle—the US government stayed out of the Fusion dispute. (Fusion still refuses to grant a cross license to Mitsubishi.) Choate concludes this episode with a quote from Donald Spero, Fusion’s president: “Mitsubishi and its lobbyists are just sitting there laughing at us. If they can continue to pick off the little guys like me, you can just wave goodbye to America’s creative power.”

Choate’s account of the Fusion case, and of several other episodes of which I have first-hand knowledge, rings true. But even the most vivid lobbying tales he tells strangely suggest the limited importance of Japan’s lobbying efforts. Yes, lobbyists turned the trucks into “cars.” But it was the nature of Japan’s industrial strategy that made its companies so formidable when producing vehicles of any kind. Yes, lobbyists apparently scared the US government away from Fusion’s side, but deeper trends, which had nothing to do with lobbying, concentrated such wealth and engineering adaptability in Mitsubishi’s hands. If Japanese companies fired every lobbyist—as they would if they were smart, either to avoid recriminations like those that Choate’s book may provoke or as a good-will gesture to improve ethics in American government—the economic relations between the two countries would barely change at all. Those relations depend on the deeper differences between the American and Japanese economic systems.

In the last third of his book, Choate describes what is probably the most consequential form of Japanese influence: the effort to shape not US government policy but the general American view of the differences between the two nations’ systems, and of the meaning of Japan’s economic strength. In particular, Choate says, money is given to academics, journalists, politicians, and think-tank members who promote the idea that Japan’s economy isn’t really much different from America’s, and who allege that to say it is different is to be racist, intolerant, and destructive.

This argument may sound peculiar to those who have not been engrossed in it. On one side is a group saying, in effect, that economic imbalances between Japan and America are temporary, and if they are not they are mainly the result of America’s internal failures. In any case the imbalances don’t really matter, since they merely reflect the deepening interdependence between the two countries. The other side says that the imbalances are chronic, not temporary, because the two systems have different goals, and that instead of “interdependence” what we’re starting to see is a one-way shift in dependence, parallel to the process in which Britain became deeply dependent on the United States in the course of the last seventy years.

Reasonable people can disagree on these questions. Choate’s point is that huge sums of Japanese money go to support those in the first camp, since the practical result of their view is to keep American trade policy toward Japan more or less unchanged.

William Holstein provides a number of similar illustrations in his book, The Japanese Power Game. For instance, he notes that the economist C. Fred Bergsten, an intelligent and honorable man, argued strenuously in the mid-1980s that the overvalued US dollar was killing American exports, and that as soon as the yen rose and the dollar fell, the trade problems between the US and Japan would melt away. The years have not been kind to most of Bergsten’s projections, but Holstein says that German and, increasingly, Japanese organizations have shown greater interest in funding the economic research organization he directs. “There is no hint” that Bergsten and others have “changed their public policy pronouncements simply because they either profit from or obtain funding from Japanese-related sources,” Holstein says.

The point, rather, is that Japan has advanced their weight and their prestige in the marketplace of ideas at least in part because they sing the right tune, and this has advanced Japan’s agenda as well. Bergsten, in particular, has been valuable for the Japanese…. It was his argument that the dollar-yen relationship was the key problem in redressing the trade imbalance that helped prepare the intellectual groundwork for the dramatic strengthening of the yen. His assumption was that Japan would respond to this kind of market force. But it did not, and does not. Without identifying his Japanese funding, he also publishes studies that support the view that foreign investment in general and Japanese investment specifically do not require any new policy responses.

In these American discussions of Japan, something is possible that would be very unlikely in arguments about policies toward Germany, or Mexico, or even about education or medical care within the United States. Because the barriers of language, distance, cost, and experience are so great, most American participants in this debate simply posit what Japan must be like, in order to conform to Western theories and expectations. Americans and Germans stopped working long hours when they became rich; therefore, the same change must be about to occur in Japan. American and European women have demanded greater equality in business and politics; therefore, so must women in Japan. The American economy is geared toward defending the consumer’s interest, and Americans know that protectionism is bad because it inflates the prices that consumers must pay. Therefore Japanese consumers must also rise in protest against protectionism in Japan. Meanwhile, a relatively small group of economists, policy makers, and journalists observes what is actually happening in Japan.

The Economist and The Wall Street Journal show the results of this tension in almost every issue. Their reporters, who are based in Japan, turn up information about how its system works, while the editorial and “leader” writers, in Manhattan and London, assure their readers that the Japanese system cannot deviate for long from Anglo-American theories of market rationalism. In the September 29 issue of The Economist, for instance, the business section carried a story on the impending “amorphous metals” war. An American company, Allied-Signal, had devised a way to form certain new alloys that had very attractive technical properties. When used in electric transformers, for instance, they cut transmission waste by as much as two thirds. The Japanese government has in various ways discouraged the importation of amorphous materials (which the Japanese electric industry would love to get)—while MITI has encouraged thirty-four Japanese companies to cooperate in developing amorphous materials of their own. The story’s concluding words were: “Japan agreed last week to acquire 32,000 amorphous-metal transformers between now and 1993—less than 0.5 percent of the Japanese market. The rest will be supplied in due course, by Japanese companies.”

In the same issue of the same magazine, a book reviewer asserted with Oxford-Union-style confidence that government efforts to guide technology or control trade were bound to fail. The proof was, after all, to be found in the example of “the East Asian dragons, whose stunning growth was built on efficient investment and innovation, which, in turn, owed everything to openness to trade.” The success of the East Asian “dragons” is indeed due to investment and innovation—and to open markets somewhere else. The reporter who wrote the amorphous metals story clearly understood this; but somehow not even evidence contained in its own pages can shake the magazine’s prevailing (and influential) editorial faith.

The amorphous metals and fusion stories obviously do not prove that The Economist’s approach to Japan is wrong. But Choate and Holstein both emphasize that America’s Japan debate is distorted because so much foreign money props up one side.

To what end? Choate tends to speak sweepingly about “Japan” doing this and “the Japanese” doing that, when specific and often competing firms are involved. But I think he is right in saying that the overall goal of the lobbying and politicking is to shift the balance of dependencies, so that the United States needs Japan so much—to cover its deficit, to make high-tech products, to provide markets for grain, beef, and timber, to dangle investment offers in front of Ohioans and Tennesseeans—that it dare not criticize the aspects of Japanese policy it dislikes. The plot of a forthcoming novel, Something To Die For, by James Webb, the former Navy secretary and Vietnam War hero, turns on just such a possibility.2 American and Japanese officials disagree deeply on a policy question, but the Americans are afraid that, if they push their point, Japanese investors will pull out and the US stock market will collapse.

The continuing shift in dependencies is the central theme of William Holstein’s book. He says, “The Americans are rapidly accumulating dependencies on a single nation, Japan, which is working diligently to build its own room to maneuver and to strengthen its identity, rather than submerging its interests in the international scheme of things.” Perhaps because it has slipped into the bookstores so much more quietly than Choate’s book, Holstein’s is if anything more startling.

Holstein is an experienced Business Week reporter, who has worked in Japan and China, and his book is breezily written as if it were one very long news-magazine article. The first half contains a long, illuminating discussion about the past two years’ worth of political upheaval in Japan, centering on the “Recruit Cosmos” scandal.

The rise and fall of the Recruit company fits American patterns of entrepreneurial capitalism more closely than it does the Japanese zaibatsu (industrial combine) stereotype. The company was more or less the personal creation of Hiromasu Ezoe, a young, shrewd, good-looking businessman who, Holstein argues convincingly, almost certainly came from Japan’s burakumin, or untouchable, caste and therefore was forced to work outside normal corporate channels.

The Recruit company started as a kind of national help-wanted service, offering job placement information through magazines and computer data banks. Eventually it expanded into vast real estate and financial operations. By the mid-1980s, Ezoe and Recruit were bribing virtually every significant figure in Japanese politics and in parts of the bureaucracy. In some cases the company was paying for specific favors, such as advance word on Ministry of Labor employment data; in other cases, Ezoe seemed simply to be making wholesale purchases of future goodwill. In 1989 Prime Minister Noburu Takeshita had to resign because he and so many of his associates had taken Ezoe’s money. His successor, Sosuke Uno, had not been on the Recruit paylist—and was mocked for that very reason, since he had apparently been so unimportant that Ezoe had overlooked him. A few months later, Uno himself had to resign after his former geisha mistress sold her story to mass circulation magazines.

Outside Japan, especially in America, the Recruit and Uno stories were presented as watershed changes in Japan. Takeshita’s resignation showed that the Japanese public was finally sick of “money politics”; Uno’s josei mondai (“woman problem”) was a symbol that the women’s movement was coming to maturity in Japan. But Holstein, who does a marvelous job of making Japanese politics comprehensible to Western readers, says that quite the reverse was true. The Recruit case amounted to the old “money politics” establishment slapping down Ezoe the arriviste, and Uno was doomed largely because he had been so stingy and unchivalrous to his mistress, rather than because he had a mistress at all.

In discussing Japan’s economic role, Holstein argues that, while Britain is still listed as the leading investor in the US, an unknown but large amount of “British” investment is just passing through London on its way from the Middle East, Hong Kong, and other sites. “It is likely,” he says, “that Japan is already the single largest investor in the United States if one considers that a significant share of what is described as British investment isn’t really British.”

The sharpest note in Holstein’s book, however, is one that is likely to run through all the news from Japan for many years to come. It has to do with markets, and in particular whether American society is capable of saying that anything the market supports (except commercial sex and drugs) could possibly be wrong.

Like Choate, Holstein asks whether a system driven by short-term market considerations—one in which former presidents will make commercials and companies will be broken up as soon as their asset value exceeds share price—can defend its collective interests against a society that places some political and moral issues beyond market bids. Holstein makes clear that Americans created the market, and foreigners, notably Japanese, are simply agreeing to buy what we have put on sale.

One of his closing scenes is of a Fire-stone shareholders’ meeting in Chicago, where the sale of the company to the Japanese tire company Bridgestone was being completed.

I looked for some sense of drama. Here was a once-great American company being sold off. Did anyone care? After the meeting, there was a group of elderly ladies clustered around Firestone chairman John J. Nevin. Perhaps they were misty-eyed, remembering the old days. No, it turned out; they just wanted to know when they could cash in their shares.

The excitement of today’s Japan is that it tests not simply our systems for making tires or running companies but the most fundamental ideas on which our society is based. The upheaval in Eastern Europe has seemed to confirm what many in the United States have said all along: that democratic capitalism works better than socialist tyranny. The growth of Japan and some of its neighbors in East Asia, if we see them for what they are rather than squeezing them into our familiar categories, challenges what most American leaders have said and thought. A limited market system has in some ways proven more effective. A controlled version of democracy has often shown itself more capable of meeting national needs. As Ronald Dore, the British sociologist and author of Taking Japan Seriously, recently said, “The Japanese have never caught up with Adam Smith. They don’t believe in the invisible hand. They believe…that you cannot get a decent, moral society, not even an efficient society, out of the mechanisms of the market powered by the motivational fuel of self-interests.” Perhaps they are wrong, or right only about their own quasi-Confucian system. In any case we should be able to respond to a direct trial of our own beliefs.

Instead of becoming intellectually engaged by the contest, many people in both countries seem to dread having it occur. Japan and America now resemble two huge vessels, steaming not toward each other but passing each other in the night. Japanese officials have “understood” America too quickly, assuming that we are touchy these days but can be handled as long as they avoid talking about blacks and Hispanics, and give us money when we complain. For their part, Americans run out of imaginative energy when it comes to Japan. Rather than summoning the effort it would require to conceive of such a different society, we assure ourselves (and listen to spokesmen who reassure us) that it can’t be that different after all. The world is still bigger and more surprising than we, in our weariness, expect. That is what Japan can show us, if we are willing to look.

This Issue

November 8, 1990

-

1

Since so much of Choate’s argument concerns bona fides and hidden interests, I must in prudence volunteer a few disclosures. I know Choate, and I am predisposed to sympathize with his view of Japan. I make a brief appearance in the book, as I discuss later in this article. Also, I first went to Japan on a fellowship from the Japan Society of New York, which got money for the fellowship program from the “US-Japan Foundation.” This foundation, in its turn, was established by the enormously rich and controversial Japanese figure Ryoichi Sasakawa. Sasakawa spent time in prison after World War II as a war criminal, because of his pro-fascist activities before the war. His fortune is based on gambling, speculation, and similar activities, and he is generally an unsavory character. In the tradition of Cecil Rhodes and Alfred Nobel, he is trying, late in life, to cleanse his name by applying his money to good works.

↩ -

2

James Webb, Something to Die For (Morrow, to be published early next year).

↩