1.

On November 7, 2001, agents from Customs, Immigration, the IRS, and the FBI burst into the Dorchester, Massachusetts, offices of al-Barakaat, a Somali conglomerate with branches in forty countries, and arrested Mo- hamed M. Hussein, treasurer of Barakaat North America, on charges of operating an unlicensed money transfer business, or, as it was known, a hawala. Al-Barakaat stood accused of raising, investing, laundering, and distributing money on behalf of al-Qaeda. Then–Treasury Secretary Paul O’Neill announced that its various companies were “the money movers, the quartermasters of terror.” Meanwhile, federal authorities were also conducting raids on suspected businesses in eight other American cities. It all had the appearance of a clean, efficient police sting.

The raids were the work of Operation Green Quest, a task force established after September 11, 2001, and designed to coordinate the efforts of various federal offices and agencies with experience in tracking suspicious financial transactions.1 While the FBI’s Financial Review Group was to concentrate on the funding of the September 11 hijackings, Green Quest had the more ambitious commission to “disrupt and dismantle” financial networks used by terrorists. Just as Treasury investigators brought down Al Capone for tax evasion, the thinking went, authorities might be able to follow a trail of dirty money from the ruins of the Trade Center all the way to Osama bin Laden’s caves in Afghanistan.

Three years later that initial optimism looks naive: the Bush administration’s efforts to comprehend, much less combat, terrorist financing have been an abysmal failure. Certainly, we know now a great deal about the economics of terrorism that we did not know then, but none of what we have learned is reassuring. We know that acts of terrorism are extremely cost-effective. According to the 9/11 Commission’s final report, the attacks of September 11 cost less than half a million dollars; the 2000 bombing of the USS Cole is estimated to have cost between $5,000 and $10,000. At the same time, the 9/11 Commission learned that prior to September 11, al-Qaeda had an annual budget of $30 million. The organization’s budget is now estimated to break down to roughly 90 percent for infrastructure—maintaining training camps and communications—and only 10 percent for financing actual terrorist attacks. This is alarming news for those seeking to prevent further attacks, because small amounts of money in transit are much harder to trace than large ones.

More alarming is what we have—and haven’t—learned about the sources of terrorist funding. In the summer of 1996, the State Department concluded that Osama bin Laden had a personal fortune of $300 million, and for many months after September 11, the image of a mad millionaire financing his own personal war against the West endured. But the findings of the 9/11 Commission point to a graver reality: al-Qaeda’s annual budget is maintained not out of bin Laden’s deep pockets, but by piecemeal fund-raising, often through charities in the Gulf countries, and particularly in Saudi Arabia, from supporters of violent jihad.2

Yet that is where the trail runs cold. The 9/11 Commission was able to trace money used by the hijackers, because the terrorists were brazen enough to open American bank accounts and receive wire transfers from abroad. But the commission could reconstruct the transactions that culminated in September 11 only as far back as the point at which the funds entered the orthodox financial sector. As for the origins of the money before it entered the legitimate banking system: “To date, the US government has not been able to determine the origin of the money used for the 9/11 attacks.” The commissioners went on to suggest that the origins are “of little practical significance,” because “al-Qaeda had many avenues of funding.” But the practical significance is enormous. Now that various measures have been taken to crack down on legitimate transfers of money for terrorist purposes, the murky networks of terrorist financing, and the hawala remittance system in particular, present a formidable challenge to American authorities.

The United States, which has traditionally been cast as the chief beneficiary of the free flows of capital, goods, people, and ideas that characterized the globalization and Internet revolutions of the 1990s, has now fallen victim to precisely those developments. Osama bin Laden once told the Pakistani newspaper Karachi Ummat that his men were as “aware of the cracks inside the Western financial system as they are aware of the lines in their hands.”3 It seems certain that his followers are more adept at understanding and manipulating the quick migration of assets and finances in this new world than the Western agencies pursuing them. In his recent book, Blood from Stones, Douglas Farah conveys the complexity of terrorist financing and the failure of government agencies to grasp that complexity. He describes a shadowy and widespread world of quick and mutable currency flows—a world which, even as we catch a glimpse of it, seems to vanish before our eyes.

Advertisement

The hawala system provides a window into the mystery of illicit capital flows. Hawala is a way of moving money without actually moving it. It is based on informal but tightly knit networks of hawaladars, or brokers, in various regions around the world. When a Pakistani taxi driver in Washington, D.C., wants to send money home to his family in Peshawar, he approaches a local hawaladar, and hands him cash or a check. The hawaladar contacts another hawaladar in Peshawar—whether by phone or e-mail—who forwards the sum, minus a small commission, to the taxi driver’s family. When the money has been transferred, the American hawaladar owes his Pakistani counterpart the original amount, but because of the number of transactions that are made, the debt tends to pass back and forth numerous times between hawaladars. Outstanding accounts are balanced weekly or monthly, and not always with money: debts are often settled with goods, from Persian carpets to used cars.

In Arabic, the word hawala means “change” or “transform.” But when the Hindi language adopted the word, it acquired an additional meaning: “trust.”4 Trust between hawaladars is the linchpin of the network: one dealer would not credit another unless he was certain the debt would be honored. If a dealer fails to honor a contract he is blacklisted, and this serves as a strong constraint. Trust allows for the signature characteristic of hawala: it is virtually paperless. Hawaladars do not require documentation from those who want to send money or receive it—the system is anonymous. Often the sender of money only needs to inform the receiver of a code word or number which he is to give to the dispensing hawaladar. The dealers do not keep extensive records of their transactions, and are loath to show the authorities the few books they do keep. Most hawala dealers do not announce their business by putting a sign on the door. Hawalas tend to be side ventures, conducted in the back rooms of small businesses in Asian and African communities throughout the world.5

Because of the intimate nature of hawala transactions, the origins of the system remain obscure, and present scholars with a challenge similar to that of researching an oral tradition. Hawala is said to predate the Western banking system. It is believed to have emerged over a thousand years ago in South Asia and the Middle East, and become popular with Arab traders who did not want to carry large sums of money along the Silk Road. Most experts believe that modern hawala networks took shape in the 1960s and 1970s as a way of circumventing bans on gold imports in Southeast Asia and allowing diaspora communities to send money to their families in Africa, the subcontinent, and the Middle East. During the Vietnam War American GIs learned about hawala from Indian merchants in Saigon and used the system to send money home.6

Hawala is an attractive system for a variety of reasons. It is much cheaper and quicker than bank transfers or commercial companies like Western Union. Commissions are minimal, exchange rates are favorable, and most transactions are completed within a business day. Most importantly, perhaps, the system is available to those who live in remote areas without accessible commercial banking systems.

Today hawala is a vast global institution, serving millions of people worldwide. Despite the fact that the system is illegal in India, Interpol estimated that in 1998, the amount of money circulating in India’s hawala system totaled $680 billion, or roughly 40 percent of the country’s GDP.7 In Pakistan, where the system is also technically illegal, hawala transfers far outnumber money transfers through commercial banks. Worldwide, remittances from rich countries to poorer ones amounted to more than $100 billion in 2003, and hawala is one of the chief means of transporting that money. Moreover, it is not only ethnic Africans and Asians who use the system. Since the usual facilities for transferring payments hardly exist in Afghanistan, most international aid organizations operating in the country use hawala, and an estimated $200 million in relief and development funds passed into the country through hawala networks between 2001 and 2003.8

Most hawala transactions are, if not entirely legal, then at least legitimate: the money being transferred is usually “clean,” in the sense that the parties to the transaction are not engaged in criminal activity. But the anonymity of the system has also made it attractive to criminals. A 2000 Interpol report on hawala provides a list of activities associated with the practice, from terrorism and drug smuggling to tax evasion, gambling, and the transport of illegal aliens. Observers differentiate between legitimate “white hawala” and criminal “black hawala,” but the one is often impossible to disentangle from the other. According to the Interpol report, the illicit economy in South Asia is 30 to 50 percent the size of the orthodox economy.9 Because the hawala system is paperless, it would be difficult to separate the dirty transactions. In the words of one Karachi hawaladar:

Advertisement

Maybe one out of every one thousand or two thousand transactions is [terrorist-related]. Trying to find terrorist funds here is not like trying to find a needle in a haystack. It is trying to find a needle in a needle stack.

Indeed, even apparently clean transactions can have an unsavory component. A 2003 World Bank report on hawala dealers in Kabul asks how it is that, in a system where money does not actually move, impoverished Afghan hawaladars can handle their end of the transactions:

How are the regional counterparts [of the hawaladars] able to finance payments on behalf of the international aid institutions? What is the source of the afghani equivalent paid out in the regions? In the last twelve months, for example, international aid institutions have individually transferred amounts in excess of US $10 million. Where is the afghani equivalent coming from?

The report goes on to speculate that transactions for international aid institutions may be completed with “funds from illegal activities such as the smuggling of gold or weapons, drug trafficking, or trafficking in girls and women,” that the aid organizations may be tangentially playing a part in international terrorist financing, and as such, acting as de facto money launderers themselves.10

According to the 9/11 Commission report, “al-Qaeda frequently moved the money it raised by hawala.” Because Afghanistan has no banking system and al-Qaeda fears detection, it has made use of the system, the report tells us, since 1996. When Green Quest launched its sting on the Somali conglomerate al-Barakaat, investigators told the press that company employees had transferred funds from Boston to al-Barakaat’s central money-exchange office in Dubai, from whence those funds were funneled to al-Qaeda.

2.

The terrorists “understood how to take advantage of the rapid deregulation that came with globalization, where international financial transfers are instantaneous and hard to trace,” Douglas Farah observes in the opening pages of Blood from Stones, his short and provocative book on the financial networks of terrorists. Farah was The Washington Post’s West Africa bureau chief, stationed in Abidjan, Ivory Coast, when, a few days after September 11, Cindor Reeves, a member of Liberia’s then-president Charles Taylor’s inner circle, and an important source for Farah, told him an intriguing story. CR, as he is known, explained that in 1999 a group of Arab men struck a deal with Taylor and with Ibrahim Bah, a Senegalese soldier of fortune who had become a commander with Sierra Leone’s Rebel United Front (RUF), to purchase large amounts of diamonds from mines in territory controlled by the RUF. CR explained that these Arab clients lived in a safe house near the diamond fields and occasionally “asked him to join them in watching videos of Hezbollah suicide bombings.” CR claimed that the men were paying much more than the going rate for the diamonds. The next time they met, Farah brought along a recent Newsweek featuring mug shots of the “most wanted” al-Qaeda terrorists. Three of them, CR said, had been among his Arab clients. Before publishing CR’s claims, Farah set out to corroborate the story, and shortly thereafter met with several RUF commanders who confirmed that the transactions had taken place and described the safe house in Monrovia. After reporting in the Post that al-Qaeda had been buying diamonds from the RUF, Farah received word from the US embassy in Abidjan that there was a credible threat against his life, and was forced to flee Africa with his family.

It makes sense that al-Qaeda would have wanted to convert its assets into diamonds before September 11. Since 1998 the Clinton administration had cracked down on terrorist accounts, and in the summer of 1999 froze $240 million of Taliban and al-Qaeda money in Western banks. Converting assets into gold, diamonds, and other precious stones was an ideal solution, because they are easy to hide, transport, and convert back into currency. Thus, Farah tells us, “al Qaeda operatives turned away from Western-style banks toward homegrown money merchants in Saudi Arabia, Dubai, Karachi, and Lahore.” Their chief means of moving money and stones was hawala. The rush to purchase diamonds Farah interprets as “a desperate race against time to convert terrorist cash into a commodity that could survive US retaliation.”

In November 2001, back in Washington, Farah briefed the CIA on his findings and was met with skepticism. “If this had been happening, we would have known about it,” one analyst told him. Farah thinks the reason for their reaction was that “they were terrified of new intelligence failures being exposed.” Even after the BBC produced a documentary showing RUF fighters describing their sales of diamonds to buyers from al-Qaeda, and the London-based watchdog group Global Witness conducted a study that corroborated Farah’s findings, the agency continued to deny, and tried to discredit, his story.11 At a time when damaging accounts of the incompetence of the Central Intelligence Agency have become common, Farah’s book presents an unusually scathing report of irresponsible behavior bordering on malpractice. He recounts a visit by agents to Cindor Reeves ostensibly to validate his story, in which CR was bullied, forced to take a polygraph test, and dismissed as a liar, all in an effort to protect the credibility of the CIA’s witness, Ibrahim Bah—the very man who had arranged the al-Qaeda connection in the first place.

Despite strong evidence, officials in Washington continue to deny the existence of a link between al-Qaeda and diamonds from regions of conflict such as Sierra Leone. A 2003 report from Congress’s General Accounting Office claims that there is “a highly probable link” between African diamonds and international terrorism, but that US law enforcement has been unable to substantiate it. The 9/11 Commission’s final report comments: “We have seen no persuasive evidence that al Qaeda funded itself by trading in African conflict diamonds.” The commission’s skepticism is puzzling in light of Farah’s work, but also in light of a classified dossier provided to commission members by UN war crimes investigators, which reported that numerous witnesses had seen various al-Qaeda members negotiating diamond sales and that “al-Qaeda has been in West Africa since September 1998 and maintained a continuous presence in the area through 2002.”12

The commission’s Monograph on Terrorist Financing says that the commissioners found “no reason to dispute” the claims of the FBI and CIA that there is no link. But it also concedes that

there is some evidence that specific al Qaeda operatives may have either dabbled in trading precious stones at some point, or expressed an interest in doing so, but that evidence cannot be extrapolated to conclude that al Qaeda has funded itself in that manner.

This refusal to connect the dots remains a mystery, as does the commission’s failure to deal directly with Farah’s allegations of such a link. Certainly, Farah’s case relies heavily on the testimony of Cindor Reeves, but he adduces considerable corroborating evidence.

Whether you are persuaded by Farah’s account or not, Blood from Stones provides a convincing portrait of an extensive network of illicit capital flows that is nearly impossible to monitor. Farah describes an extraordinarily wide range of lucrative petty crime that terrorists have resorted to, from stealing and reselling baby formula to illegally redeeming grocery coupons to selling knockoff T-shirts. He recounts a Hezbollah operation in the late 1990s to purchase cigarettes in North Carolina, where the sales tax was 5 cents, and resell them, illegally, in Michigan, where the tax was 75 cents. Over four years, this scheme netted $1.5 million.

The adaptability of terrorist assets is astonishing. Pakistani officials estimate that between $2 million and $3 million in cash is hand-carried from Karachi to Dubai each day. According to Farah, in one three-week period during the American assault on Afghan- istan in 2001, funds leaving Karachi for Dubai amounted to as much as $7 million a day. “Once in Dubai, much of the wealth of the Taliban and al-Qaeda was converted to gold bullion and scattered around the world,” Farah maintains. Indeed, in late 2001, US Customs registered a dramatic increase in gold imports by companies suspected of laundering money for al-Qaeda. Thus dirty money smuggled into Dubai and converted into gold was exported to America, where it could be sold for clean money, and so complete the laundry cycle. In this way, even as the war on terrorism was unfolding, American consumers may have unwittingly assisted bin Laden in laundering his organization’s assets.

In any account of global money laundering and terrorist finances, the city of Dubai emerges as a vital nexus in which clean and dirty money liberally intermingle. The United Arab Emirates (UAE) was one of only three countries, along with Pakistan and Saudi Arabia, to recognize the Taliban government, and during the late 1990s Dubai became the financial hub of the Taliban and of al-Qaeda as well. The sheer flux of people and commodities in the city creates an anonymous transit center for capital. Fewer than 20 percent of the UAE’s population are citizens, the rest are emigrants from all over South Asia and the Middle East. Until very recently the country tolerated unregulated financial dealings. Dubai’s gold souk covers dozens of city blocks and is a major source of the gold that is sent, legally and illegally, to India and Pakistan. According to Farah, the Taliban and al-Qaeda prefer gold to normal currency, and it remains “the official currency” of hawala networks.

Farah’s book leaves the reader with the unsettling impression that everyone from terrorists to rebel groups, from drug smugglers to arms dealers, from the hawker selling fake Nike T-shirts to the convenience store owner offering cigarettes at a discount are all elements in a vast, invisible web, a clandestine economy every bit as intricate and efficient as our own.13

3.

Operation Green Quest did not live up to its initial promise. In July 2002, a federal judge in Massachusetts sentenced Mohamed Hussein, who had been apprehended in the offices of al-Barakaat, to eighteen months in prison. Prosecutors asked for harsher penalties, but were able to substantiate only that Hussein had transferred money without a license, and they could prove no link with terrorism. The 9/11 Commission concluded that while al-Qaeda made extensive use of hawala prior to September 11, the system was not used to fund the World Trade Center attacks. After freezing more than $100 million in assets during the first three months following the attacks, the Green Quest task force seemed to lose its way. Bureaucratic competition and infighting between the agencies created disorganization. Intelligence on terrorist financing did not improve. Many of the various experts assigned to go after al-Qaeda’s finances were veterans of the war on drugs, and were more adept at chasing large sums of money in offshore bank accounts than at learning the nuances of alternative remittance systems. “If it wasn’t Miami Vice money laundering, our bosses didn’t want to know about it,” Patrick Jost, who was part of that effort immediately following September 11, told Farah.

At a major conference on hawala convened by the United Arab Emirates and held in Abu Dhabi in May 2002, the country’s central bank announced that it would start registering and certifying hawaladars. But many of the participants believed that this would merely compound the difficulty by raising the costs of the system. Greg Bretzing of the FBI said at the conference, “The worst thing is to drive operators [further] underground and make it harder to track.” This assessment was endorsed by the 2003 World Bank study, in which hawaladars who were interviewed argued against regulation, saying that money exchange dealers have no incentive to reveal their activities, and that “even if it were possible to identify, register, or license hawaladars, their transactions are so varied and multifarious it would be impossible to develop a consistent set of regulations” for them.

Moreover, when Green Quest announced plans to “disrupt” the financial networks used by terrorists, Somali communities in the United States grew understandably panicked because Somalia has no formal banking system and depends on hawala for all of its international financial transactions. Freezing al-Barakaat’s assets hurt many small depositors in Somalia, and, because of al-Barakaat’s telecommunications interests, shut down the country’s only Internet service provider. Randolph Kent, the UN humanitarian representative in Somalia, said that if the crackdown continued, “we have to start anticipating a crisis that could be unique in the modern state system—the collapse of an entire national economy.”

One of the major functions of the hawala system in the Muslim world is to facilitate Zakat, or charitable giving, one of the five pillars of Islam. In combating the various institutions that supply terrorists with money, the West runs the risk not only of debilitating the economies of countries like Somalia but of appearing to wage a war on Islam itself. A 2002 report to the UN Security Council cites “an institutional confusion between religion and finance” in Saudi Arabia, and points out that the banking system in parts of the Middle East is not regarded as strictly secular.14 Michael Scheuer, a career CIA officer and the author of Imperial Hubris, warns that “though US leaders say truthfully that America neither wants nor is waging a war on Islam, we need to understand how things look from where bin Laden works to align his own forces and incite others.” Scheuer contends that American efforts to limit, control, and track charitable donations in the Muslim world have been perceived by Islamic leaders as a substitution of man’s law for god’s law, and a “siege of welfare work.”15

In the three years since the Barakaat raid, the question of the financing of terrorism has faded from public consciousness and political agendas. A bipartisan task force sponsored by the Council on Foreign Relations recommended $40 million to go to the Treasury Department to train foreign governments in disrupting terrorist fi-nancing, but in the fiscal year 2003, the Bush administration allotted a mere $4 million for that task. And on June 30, 2003, with rather less fanfare than had attended its formation, Operation Green Quest was quietly disbanded. In Farah’s view this failure was not particularly lamentable, because by the time Green Quest was organized, “most of al-Qaeda’s resources were already beyond reach.” And currently, in the assessment of former National Security Council official Rand Beers, the Bush administration’s efforts on tracking and combating terrorist finances are effectively “a rhetorical policy.”

In a presentation to the Senate on September 29, Lee Hamilton and Slade Gordon of the 9/11 Commission conceded that “stopping the flow of funds to al-Qaeda and affiliated terrorist groups has proved essentially impossible.” It seems clear, however, that any effort to thwart the quartermasters of terror must begin with an effort to understand their tactics, and to that end, Douglas Farah’s important contribution should not be overlooked.

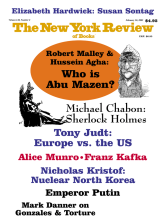

This Issue

February 10, 2005

-

1

Green Quest was technically a Treasury task force, but included staff from the IRS, the Financial Crimes Enforcement Network (FinCEN), the Secret Service, Customs, and the Office of Foreign Assets Control, and had frequent consultation with the Department of Justice.

↩ -

2

In fact, according to the final report, bin Laden received only $1 million a year from his family, and in 1994 the Saudi government forced the bin Ladens to sell Osama’s portion of the family business, then froze the proceeds of the sale, thereby effectively divesting him of his fortune.

↩ -

3

The interview was conducted at an undisclosed location by an unnamed correspondent of the paper, and published on September 28, 2001.

↩ -

4

While hawala is the term commonly used in the Middle East to describe this system, similar systems with different names are present in other regions: hui kuan in Hong Kong, padala in the Philippines, phei kwan in Thailand, and so forth. In India, the system is often known as hundi. See Mohammed El Qorchi, Samuel Munzele Maimbo, and John F. Wilson, “Informal Funds Transfer Systems: An Analysis of the Informal Hawala System,” International Monetary Fund Occasional Paper, No. 222 (2003).

↩ -

5

Press accounts of hawala have been stymied by the refusal of hawaladars to go on record. See for example Michelle Cottle, “Eastern Union,” The New Republic, October 15, 2001. One revealing glimpse of the system was provided when a Virginia hawaladar, Rahim Bariek, testified about his work before the Senate Subcommittee on International Trade and Finance on November 14, 2001.

↩ -

6

There is remarkably little academic literature available on the origins of hawala. Remittance systems of this sort date back to Tang Dynasty China (618–907), and the ancient Chinese system known as fei qian, or “flying money.” Some hold that that system was exported to other countries in the eighteenth and nineteenth centuries by Chinese living abroad, spurred in part by the growth of the tea trade, and that a broad remittance network was established, which covered most of China and extended to major cities in Japan, Russia, and Southeast Asia. As for the system’s presence in the Middle East, suggestions that hawala dates back a millennium, though common, remain unsubstantiated. There seems to be scholarly agreement that it was present in some form during the Ottoman Empire, when letters of credit facilitated long-distance trade. Hawala was favored for transactions involving the state, such as payment of tax revenues within the Empire, from the provinces to the capital city. See Sevket Pamuk, A Monetary History of the Ottoman Empire (Cambridge University Press, 2000), pp. 84, 169.

↩ -

7

See Scott Baldauf, “The War on Terror’s Money,” The Christian Science Monitor, July 22, 2002.

↩ -

8

See Samuel Munzele Maimbo, “The Money Exchange Dealers of Kabul: A Study of the Hawala System in Afghanistan,” World Bank Working Paper No. 13 (2003).

↩ -

9

Patrick M. Jost and Harjit Singh Sandhu, “The Hawala Alternative Remittance System and Its Role in Money Laundering,” Interpol General Secretariat, January 2000.

↩ -

10

Maimbo, “The Money Exchange Dealers of Kabul.”

↩ -

11

The BBC documentary was called “Blood Diamonds.” The report was “For a Few Dollars More: How al-Qaeda Moved into the Diamond Trade,” Global Witness Report, April 2003.

↩ -

12

See “Al-Qaeda Bought Diamonds Before 9/11,” Associated Press, August 7, 2004, and National Commission on Terrorist Attacks Upon the United States, Monograph on Terrorist Financing, p. 23.

↩ -

13

The Italian economist Loretta Napoleoni gives a name to this phenomenon: “the New Economy of Terror.” In Modern Jihad: Tracing the Dollars Behind the Terror Networks (Pluto, 2003), Napoleoni describes a “fast-growing international economic system” through which various terror groups generate and launder funds from criminal activity. She suggests that the annual turnover of this parallel economy could be as high as $1.5 trillion—roughly twice the gross domestic product of the United Kingdom.

↩ -

14

Jean-Charles Brisard, “Terrorism Financing,” report prepared for the president of the Security Council, United Nations, December 19, 2002. See also Timur Kuran, Islam and Mammon: The Economic Predicaments of Islamism (Princeton University Press, 2004).

↩ -

15

Anonymous, Imperial Hubris: Why the West Is Losing the War on Terror (Brassey’s, 2004), pp. 10, 11.

↩