Many recent books and articles by economists and policy analysts ask how the US can recover rapidly from the worst economic crisis since the 1930s. They usually merely assume that the ideal objective is to return to the stable economic growth that preceded the crisis of 2007 and 2008. The underlying assumption is that once adjustments are made, the economy will continue again much along the path it had for a quarter-century.

This optimism isn’t at all warranted. The recession that began in late 2007 was declared over in mid-2009 by the National Bureau of Economic Research, which keeps track of business cycles. But nearly fifteen months later, the unemployment rate remains at 9.6 percent, leaving nearly 15 million Americans out of work. Another 11.5 million, some 7.5 percent of the population who are ready and willing to work, have given up looking for a job or are working part-time because they can’t find a full-time job. The nation’s Gross Domestic Product is growing so slowly that it has not yet reached its prerecession level. By this point in the recovery from all of the nine previous recessions since the end of World War II, GDP had attained its former peak.

What makes this recovery different is clear. Consumers have record levels of debt compared to income and some $12 trillion in losses on their houses and financial investments. They are not going to spend money as they usually do—perhaps not for a long time. A damaged financial system is also not lending significantly, partly because business clients aren’t seeking loans unless they directly generate more sales, and consumer demand is low. Business investment, propelled by piles of cash on the balance sheets, is nevertheless slowing after rising strongly from low levels for the past year.

The economy could slide back into an outright recession again. A fragile financial system could also again be pushed to the brink by a new round of mortgage and other defaults. Fortunately, the number of jobs in October rose by 159,000, breaking a trend of even more modest job creation. More jobs will mean more income and perhaps rising consumer confidence. A “double dip” recession may well have been avoided, but as the Economic Policy Institute points out, the economy will have to produce 300,000 jobs a month, twice a many as this October, for several years to return to the unemployment rate of 5 percent in December 2007. Economists at Goldman Sachs calculate that if historical precedents apply, it would require four years of GDP growth of 4 percent a year, after inflation, to return us to full employment. Many economists believe the nation cannot attain that rate.

The US economy is growing so slowly that the case is strong for another multibillion-dollar investment in government spending to stimulate it. The nonpartisan and usually cautious Congressional Budget Office estimates that the US GDP could easily be 6 percent higher without threatening inflation—that is, it is 6 percentage points below what the CBO estimates as its optimal level. But both the President and Congress are avoiding any substantial stimulus now because of the current surge in the deficit. The Republican leaders of the House in the newly elected Congress say they will demand $100 billion in immediate spending cuts to reduce the budget deficit even as they seek the permanent extension of the tax cuts passed under George W. Bush that are set to expire this year.

Those tax cuts, if extended permanently, will add considerably to the future deficit. But this contradiction does not deter the politicians who are apparently more interested in reducing the size of government than of the deficit itself. In addition, pressure is growing from nations like Germany, China, and Brazil to reduce the US deficit as a way, they say, for the US to cut its reliance on foreign capital and thereby reduce its trade deficit. They fear that current Federal Reserve policies to reduce interest rates will lower the value of the dollar abruptly and make their exports to the US more expensive.

Right now, the best hope is that heavy cuts in government expenditures will be postponed for two to three years. But such a delay will probably not be long enough. Erskine Bowles and Alan Simpson, the cochairmen of the fiscal commission President Obama appointed to propose ways of reducing the deficit, are calling for sharp cuts in spending but say they want to delay the first reductions until 2012, when the economy will have sufficiently emerged from the recession. This would be a severe miscalculation. Barring a surge in growth, the unemployment rate in 2012 will probably be at least 8 percent, roughly the highest level reached since the end of the recession of the early 1990s.

Advertisement

If this poorly considered advice is the best that this commission can give the President, the nation is in trouble. An obsession with taming the deficit, provoked by the rapid rise in the current deficit to $1.5 trillion for 2010, will make a large stimulus impossible. But the sharp surge in the deficit was mostly caused by the recession itself, which reduced tax revenues and raised the level of spending—such as unemployment payments—in response to the recession. President Obama’s stimulus package of $800 billion passed in early 2009 also added to the deficit, but that spending was only temporary and kept the economy from sinking further.1 According to a convincing economic model by the economists Alan Blinder and Mark Zandi, without the stimulus the deficit would have been substantially bigger in coming years.

If we presume that there will be an economic recovery, almost all of the projected deficit through 2020 will be the result of three factors: the recession, the tax cuts of the early 2000s under George W. Bush, and the hundreds of billions of dollars of war spending. In the 2020s and 2030s, however, projected increases in Medicare and Medicaid spending could raise deficits dramatically—and the amount of government debt and the interest paid on it could grow to alarming levels. Social Security spending will increase only modestly by comparison. But dealing with such long-term problems by abrupt cuts in spending now will likely consign the nation to a decade of slow growth, lost jobs, and low wages—and unnecessary, painful reductions in Social Security and other social programs that Americans value most.

What is rarely recognized is that even if the US can emerge from a weak economy within a few years, the economic foundation that existed before the cataclysm of 2007 and 2008 may not be adequate to restore the widely shared prosperity the US needs. For more than three decades, economic growth had been largely dependent on rapidly rising levels of debt and on two major speculative bubbles, first in high technology and dot-com stocks in the late 1990s, then in housing in the 2000s. What will now replace them?

Income inequality widened sharply in these years and average wages stagnated for the many while record high fortunes were made by the few. The financial security and access to adequate health care and education for children that had defined the middle class since World War II have eroded rapidly. Meanwhile, investments in infrastructure such as transportation, as well as clean energy and education, have been badly neglected. All this raises doubts about America’s future economic vitality whether or not it balances its budget, and it does so at a time when international competition from Asia and the Southern Hemisphere will pose serious challenges during this century. How will Americans live a decade from now?

Few writers are trying to address these future concerns with a new and more hopeful economic agenda. One who has attempted to chart a course for what he considers the next “new economy” is the respected British financial journalist Anatole Kaletsky. In Capitalism 4.0, he makes a thoughtful but moderate set of proposals that are, despite his claims otherwise, largely an extension of pre-crisis thinking, in which he relies heavily on his faith in the ingenuity of capitalism as an adaptive mechanism. “Hoping that ‘something will turn up’ may sound like deluded wishful thinking,” he writes, “but it is really just an extension into politics and macroeconomics of Adam Smith’s arguments about the self-organizing dynamics of the capitalist economy.”

Kaletsky sees the history of capitalism as a struggle between government and markets. He writes that the first capitalist stage—Capitalism 1.0—lasted from the early 1800s to the Great Depression, a laissez-faire period in which “politics and economics are two distinct spheres.” This is one of those widely accepted pieces of conventional wisdom that needs serious correction. Kaletsky points out exceptions to the laissez-faire approach, but his brush is still too broad. The US, for example, was never such a truly laissez-faire society and its government always actively intervened in the economy. The American authorities regulated all kinds of products in the colonial years, and imposed severe regulations on the labor markets. After all, many US workers were legally indentured servants.

Thomas Jefferson himself, who persistently warned against the power of central government, was a leading advocate of federal regulations to make land widely affordable to the American masses. Access to land was also a major reason why he bought the Louisiana Territories, doubling the size of the nation, in likely violation of his constitutional powers. State and local government financed and built the canals that were crucial for commerce in the early 1800s, and a remarkable free and mandatory primary school system emerged by the 1850s. Right up until the present day federal and local governments have financed railroads, technical universities, urban sanitation systems, high schools, highways, college tuition subsidies, and much else.

Advertisement

Underemphasizing this reality, Kaletsky writes that laissez-faire economics did not change significantly until the 1930s with America’s New Deal, Capitalism 2.0. It then reverted to its laissez-faire origins in the 1980s—Capitalism 3.0. The earlier “phase of capitalism, from the 1930s until the 1970s, assumed that governments were always right and markets nearly always wrong,” he writes. “The dominant ideology from the 1980s until the 2007–2009 crisis assumed that markets were always right and governments nearly always wrong.”

Kaletsky believes that all three stages were on balance successful, including the last one. The American economy beginning in the 1980s benefited from “the spectacular success of macroeconomic stabilization…at least until the crisis of 2007.” But this was also the period of rapidly rising income inequality in the US, with millions of people with no health insurance, and an ever lower savings rate as people borrowed to keep their heads above water. Kaletsky pays relatively little attention to inequality.

There was also one financial crisis after another, often leading to a recession or slow growth and often requiring federal bailouts. Kaletsky minimizes or neglects the impact on growth of the Mexican crisis of 1982; the stock market crash of 1987; the savings-and-loan and junk bond failures of late 1989 and 1990; another Mexican catastrophe and hedge fund failures in 1994; the Asian financial crisis of 1997; the collapse of Long-Term Capital Management in 1998; and the bursting stock market bubble of 2000–2001. Capitalism 3.0 was hardly an undiluted success.

Still, in his forecast for Capitalism 4.0, Kaletsky writes:

The most distinctive feature of capitalism’s next era will be a recognition that governments and markets can both be wrong and that sometimes their errors can be near-fatal.

His recommendations often make sense. He argues that the Federal Reserve must broaden its objectives beyond such goals as managing inflation, and include support for employment, credit growth, and remedies for trade imbalances. He believes higher capital requirements are now needed for all financial institutions. He would like to see the US adopt an energy tax to reduce its oil dependency.

These reforms, however, will not deal with the rapidly growing levels of income inequality in the US or its stagnating wages. They offer nothing to replace as sources of growth our currently rising debt levels and financial speculation. Kaletsky reiterates the truism that a strong financial sector is essential to growth, adding neither a fresh defense of it nor a serious proposal to limit its size and power, at a time when it can clearly be seen to have done much damage.

Refreshingly, he recognizes that the West’s economies should be allowed to have budget deficits of up to 4 percent of GDP without the strain alarmists warn of. (Some call for no future deficits at all.) But then, along with so many others, he urges the US and other Western nations to cut back on public pensions and health care programs. In the long run, there is little doubt that rapidly rising health care expenditures are America’s most pressing financial problem. But reforming Medicare and Medicaid is not the answer; large-scale changes in the entire health care system will be needed, as Harvard’s Arnold Relman has argued in these pages.2 Rising health care costs are driving Medicare and Medicaid benefits to unsustainable levels. Acknowledging this, Kaletsky offers no serious remedies.

After decades of stagnating wages, lost health care coverage, damaged retirement programs caused by market crashes in the 1990s and 2000s, poor-quality education for lower-income families, and rapidly rising costs of college, most of America’s influential policymakers, including several official and well-financed private deficit commissions, now want to cut back Social Security and health care benefits without proposing any serious new employment programs to help a nation in which one of six who are willing to work cannot find a full-time job.

A prominent strand of thinking in the US holds that cutting social programs and limiting aid to workers are exactly what will revitalize the nation’s economy by demanding that people be responsible for themselves. In sum, markets should be as free of government interference as possible, and must become the efficient distributors of social goods. In Seeds of Destruction, Glenn Hubbard, George W. Bush’s former chief economist, and his coauthor, the economist Peter Navarro, write that such economic policies are the only way back from the edge of the precipice:

The difficult truth that must be told is that America is close to a destructive tipping point. We must change how we conduct our politics and economics and thereby rebuild and rebalance our economy, or we will inevitably go the way of all once-great nations and suffer an irreversible decline.

Like Kaletsky, however, their proposed reforms do not match their stated fears. Hubbard has long been opposed to deficit spending on conventional conservative grounds. It will, he argues, crowd out private investment and prevent markets from allocating productive capital to where it will be spent best. But the authors do not acknowledge that when the US economy is operating well below capacity, there is little private spending that the government could crowd out. It is simply not a concern. Nevertheless, to meet the modest future Social Security deficits, they would cut outlays by raising the retirement age and changing the way benefits are calculated.

Hubbard and Navarro accurately estimate the future deficits of Medicare and Medicaid care as largely a consequence of rising health care costs, not the aging population. In general, health care costs are growing 2 to 3 percent faster a year than GDP per capita in the US, and the costs of Medicare and Medicaid to the federal government are driven up at the same rate.

To reduce the growth of health care costs, Hubbard and Navarro would no longer allow corporations to exclude the cost of health insurance from the taxes they pay. They argue that businesses will then provide less generous and wasteful plans to their executives and workers. If this turns out to be politically impracticable, they would allow individuals to deduct their medical costs from taxes. Presumably, they will then pay more of the bill directly rather than buy expensive insurance. The objective is to force those who use medical services to pay more of the costs. In other words, they want to introduce free-market forces into health care. But few would agree that this would adequately reduce rising health care costs. They would also impose a cap on the growth of Medicare and Medicaid payments, even if health care costs keep rising rapidly, leaving recipients with reduced coverage.

Perhaps their chief goal is to reduce progressive income taxes, which they believe undermine incentives to work and invest. Ideally, they would replace much of the income tax with a value-added tax (VAT)—basically, a national sales tax. Although it is regressive in the sense that it takes more from a poor person’s income than it does from a rich person’s. They argue that it will force America to consume less. They would also do away with taxes on capital gains and interest to encourage more investment and more savings.

Hubbard and Navarro generally avoid discussions of the costs to individuals of their reforms. Basically, they argue single-mindedly that lower taxes are the key to future jobs. In the end, they offer faith but few hard facts. Such a view is disturbingly familiar by now. It is Kaletsky’s Capitalism 3.0—the markets will make everything right. The authors disregard the fact that the philosophy they espouse has more or less been dominant since Ronald Reagan’s presidency. Progressive income tax rates have been flattened. Markets have been largely freed of regulation of product safety and prices. Antitrust and labor laws are hardly enforced any longer. And of course regulation of the financial industry was to a large degree abandoned. Without their improving the economic situation of most Americans, markets are much freer than they were during the rapid growth era of the 1950s and 1960s. In fact, the economy surged after Bill Clinton’s tax increase in 1993.

In a modest tribute to pragmatism over dogmatism, however, Hubbard and Navarro favor new regulations in finance. In particular, they want to increase the amount of the down payment required to obtain a mortgage. They would continue to impose capital requirements on banks, if more flexible ones. They would require that financial derivatives be traded through clearinghouses that would monitor transactions. They do not admit to any contradiction between their support of such regulations and their criticism of government and faith in free markets. In another political compromise, they would propose a “progressive” VAT, with credits for lower-income people. Some more liberal economists also support such a program.

But Hubbard and Navarro say little or nothing about green technologies, poor educational quality, decaying transportation infrastructure, or even stagnant wages. To do so would invite discussion of direct government investment and more incentives. They blame the loss of manufacturing in America, and the good jobs that come with it, essentially on the trade deficit with China, which they would rectify by demanding that all nations abide by international rules of free trade; they also want to prohibit manipulation of currencies. Apparently, America should simply insist that free trade be practiced around the world; but the authors should know by now that this proposal will be resisted by many countries.

We can get some idea of what Hubbard and Navarro’s free-market ideas will cost typical Americans because their central principles are the core of a new program, “Roadmap for America’s Future,” proposed with great fanfare early this year by Paul Ryan, the Republican congressman from Wisconsin who will presumably chair the House Budget Committee in the new Congress. It is a plan to balance the budget and reform the tax system, Social Security, and health care all in one.

The Washington Center on Budget and Policy Priorities summarizes Ryan’s plan quite accurately:

It provides the largest tax cuts in history for the wealthy, raises taxes on the middle class, ends guaranteed Medicare benefits, erodes health care coverage, partially privatizes Social Security, and makes deep cuts in guaranteed Social Security benefits.

Ryan of course claims that he will balance the budget with his spending cuts and new tax reforms. But the Tax Policy Center, a joint effort of the Brookings Institution and the Urban Institute, says that if it is implemented, his plan would raise far less revenue than he claims. The budget would not be balanced.

In a new book about the causes of the financial crisis of 2007 and 2008, Robert Reich, the liberal former labor secretary under President Clinton, also believes that the US is at a critical point. But he recognizes that a return to the pre-2007 economy is tantamount to failure. Reich proposes aggressive policies to change America’s course by using rather than limiting government.

For Reich, the issue is clear—it is the lack of jobs and more particularly the low wages paid to many who have jobs. “What’s broken,” writes Reich, “is the basic bargain linking pay to production. The solution is to remake the bargain.” If Americans don’t earn more, Reich says, there will be persistently insufficient demand for the goods and services the US makes. Reich believes that income inequality and relatively stagnant wages for thirty years accounted for the volume of subprime and other borrowing that directly led to the credit crisis. He wants simply to give money back to lower-income workers by taking it from higher-income workers. The full-time worker earning $40,000 a year would get a supplemental check from the government for $5,000; the worker earning only $22,000 a year would get a $15,000 check. Reich would also cut the income tax rate for those earning up to $160,000 a year.

To pay for what he estimates would be more than $660 billion in such wage supplements, Reich would raise taxes on those earning above $160,000. Those earning more than $410,000 a year, for example, would pay a rate of 55 percent in taxes, an increase of 20 percentage points. He also favors a substantial tax on carbon dioxide to raise revenues, reduce pollution levels, and support America’s energy independence. Together the two taxes, he says, will more than pay for the income transfer to poorer workers. Income inequality, which he believes is the nation’s major economic problem—above all because it acts as a brake on purchasing power—would be sharply reduced.

Reich would also establish what he calls a reemployment rather than unemployment system by providing wage insurance to supplement incomes of those who take jobs that now pay less than their former jobs. He would also create a more extensive job-training program. As for educational reforms, he would give a federally financed voucher to each pupil that would be inversely proportional to the parents’ income. He thus proposes a $14,000 voucher for poorer families but only $2,000 for the better off. He also wants to channel funds into early childhood education.

Regarding health care, Reich would simply expand Medicare to all Americans. The savings in administrative costs would be enormous, he estimates. He believes the nation must invest more in infrastructure, but provides few details about how to do it. And he favors public financing of political campaigns and stricter campaign financing laws.

Reich insists that his plan is “doable,” although he does not say how support for it could be mustered within today’s political parties. He thinks, however, that CEOs will someday see the benefit to business of supporting such aggressive government income redistribution and subsidies. “When they understand where all this is heading, the powerful interests that have so far resisted change are likely to see that the alternative is far worse.”

This sounds fanciful, of course. But retaining blind faith in free markets and reduced government presence as answers to rebuilding the nation are demonstrably more dangerous fantasies. Stunningly, the cochairmen of the Obama fiscal commission, Erskine Bowles and Alan Simpson, made public a set of proposals in November that had far more in common with Hubbard and Navarro than with Reich. They would sharply reduce rather than increase taxes on the rich and maintain government outlays at a punishingly low proportion of GDP. The proposals have not so far had clear support from the other members of the commission. But they won a fair amount of praise from commentators in the press who share the oversimplified obsession with budget deficits. (Few seem to realize that Social Security, for example, now amounts to no more than 5 percent of GDP and will reach a high of only 6 percent in coming decades.)

Government action has historically long been necessary for economic revitalization in America. Kaletsky accepts the value of government but does not propose programs adequate to the size of the problems. Reich is bolder, but his analysis is too often lacking in precise economic details. The stakes are now too high merely to show the injustice of the conventional wisdom. If the economy is to be rebuilt, more carefully worked-out proposals of costs and benefits are needed.

Meanwhile, austerity economics could well leave the nation with a lost decade of slow growth and high unemployment. The case for a substantial new stimulus has rarely been stronger. But we are not likely to get it. The Federal Reserve’s so-called quantitative easing may push interest rates on long-term debt down through the purchase of hundreds of billions of dollars of bonds, but lower rates without strong demand will not be enough; ways must be found to encourage the economic demand that will cause firms to borrow money so that they can produce more goods. That combination of rising demand and borrowing by business to meet it is now lacking, and renewing it should be a central concern of Congress and the administration.

After the Republican election victory it seems far less likely that any bold vision will emerge from the Obama White House. Good jobs and secure benefits are what matter today. Obama has begun to talk more consistently about jobs, but it will take policies that are now much harder to push through in the new political environment. Washington has its eye almost only on deficits. Meantime, the frustrations of workers in the lower and middle classes run high. Political fanaticism raised its head this election and more may be lying in wait.

—November 23, 2010

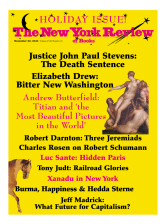

This Issue

December 23, 2010

-

1

See Kathy A. Ruffing and James R. Horney, “Critics Still Wrong on What’s Driving Deficits in Coming Years,” Center on Budget and Policy Priorities, June 28, 2010. ↩

-

2

See “The Health Reform We Need and Are Not Getting” and “Health Care: The Disquieting Truth,” The New York Review, July 2, 2009, and September 30, 2010. ↩