Is energy our friend or our enemy? In their personal lives, most people regard energy as an essential friend. It powers our computers, warms our homes in the winter, fuels our cars and planes, and provides a necessary input to produce virtually everything we use. Modern life would be inconceivable without the friendly side of energy.

But in recent decades, energy has also become an enemy. Presidents have lamented our “addiction to oil,” we have gone to war to protect oil fields from hostile powers, and air pollution from fossil fuels kills tens of thousands of people every year. Perhaps most worrisome, the accumulation of greenhouse gases such as carbon dioxide threatens to change the earth’s climate in ways that are unpredictable and potentially dangerous.

The two faces of energy are the primary reason why energy policy is so controversial and tangled. We need national policies that address the enemies of pollution and global warming. But because energy is such a large part of consumer budgets and so central to our advanced economies, people are reluctant to allow energy prices to reflect the true social costs of energy consumption. We see this tradeoff play out in energy and environmental policy year in and year out.

1.

The tangled history of energy policy is admirably described in the new book by legal scholar Michael Graetz, The End of Energy. Graetz is a professor of tax law at Columbia University and a major thinker about the design of our current tax system. He was at the Yale Law School for almost twenty-five years before that. He also was deputy assistant secretary of the Treasury for tax policy in 1990–1991. His earlier works include proposals to simplify the tax system and an influential book on the inheritance tax.1

Graetz’s new book is primarily a description of the development of energy policy in the United States from Nixon through Obama. His summary judgment gives his basic theme:

This book is about the problems, policies, and politics of energy in America…. It is about all the major forms of energy…and how our government’s attempts to control and decontrol, subsidize and command, legislate and repeal over the past four decades have produced a system and economy of energy production and consumption that fails to well serve our needs or those of our environment. The book is, then, in one sense a story of failure….

As will be clear, I largely agree with Graetz’s analysis and conclusions.

The first major book on energy economics was an elegy to energy our friend. This was The Coal Question, written by William Stanley Jevons in 1865. Jevons was one of the most brilliant economists of the nineteenth century. He saw coal as central to the revolution that moved the British economy from human to mechanical power and he understood how important energy was to an industrial economy:

Day by day it becomes more evident that the Coal we happily possess in excellent quality and abundance is the Mainspring of Modern Material Civilization…. Accordingly it is the chief agent in almost every improvement or discovery in the arts which the present age brings forth…. Coal alone…commands this age—the Age of Coal.2

Coal and its derivatives were dominant in the middle of the nineteenth century. It peaked at two thirds of world energy use in around 1900, and declined to about one fifth today as it was displaced by petroleum and natural gas. The composition of energy consumption in the US today is: petroleum (38 percent), natural gas (25 percent), coal (21 percent), nuclear (9 percent), hydro and other renewables (7 percent). New sources such as wind power have grown rapidly but are still a small fraction of total energy use.

In the early 1970s, coal was seen as America’s life raft because the US was, according to President Carter, the “Saudi Arabia of coal.” Chapter 5 in Graetz’s book, “The Changing Face of Coal,” describes the transition from the Jevons view to today’s view. In the United States, 95 percent of coal is used to generate electricity. In many developing countries, such as China and India, Jevons’s view probably represents the unspoken approach to coal. In most countries, it is cheap and abundant (either domestically or through international trade). But its side effects are very damaging.

The US energy system can be thought of as coming in three stages of production.3

• The first stage is undeveloped resources. These consist of coal or oil in the ground, wind, natural uranium, and the like. Raw resources have relatively little value, perhaps 1 percent of national wealth.

• The second stage consists of transforming raw resources into useful energy products. This phase is both complex and economically important. Total expenditures on energy products in 2010 amounted to $1.165 trillion, or about 8 percent of GDP.

Advertisement

• The third stage represents energy goods and services. The major energy goods and services are ones that contain a large share of energy in their economic content. The standard package includes motor vehicle fuels, electricity, and gas for residential uses. The most recent numbers indicate that households on average spend about $5,000 each year on these products.

From this capsule description, it is clear that energy is a vast part of the US economy. It is also a huge physical volume. If we convert energy into metric tons of coal equivalent, the American economy consumes almost 40 tons of coal-equivalent energy per household each year. If this were delivered by a UPS carrier in ten-pound packages, it would require a delivery once an hour through the entire year. Luckily, it is generally transported through efficient pipelines and transmission wires, and the electricity doesn’t weigh anything.

2.

Such analytical description of the energy system would hardly seem to inspire heated debates about energy policy and, by itself, would lead us to the conclusion that energy is a very important friend. What has converted energy into a foe is its unintended side effects, or what are known in the environmental literature as “externalities.”

An externality is an activity that imposes uncompensated costs on other people. Externalities from energy use include the deadly air pollution emitted by cars and power plants, oil spills, radioactive emissions from nuclear power plants, sludge from coal mines, and congestion from overloaded streets and highways. More recently, scientists have focused on greenhouse gas emissions, such as the carbon dioxide that comes from burning fossil fuels, as a particularly dangerous externality.

Graetz argues that the central problem in energy policy has been the failure to deal with external effects:

Although our government has enacted thousands of pages of energy legislation since the 1970s, it has never demanded that Americans pay a price that reflects the full costs of the energy they consume. Nothing that we did or might have done has had as much potential to be as efficacious as paying the true price.

What are the major external costs of energy? How do they compare with the market costs? And which fuels are the ones that have the largest external costs? Although Graetz does not treat this issue systematically, this question has been studied in depth for many years by energy and environmental economists.

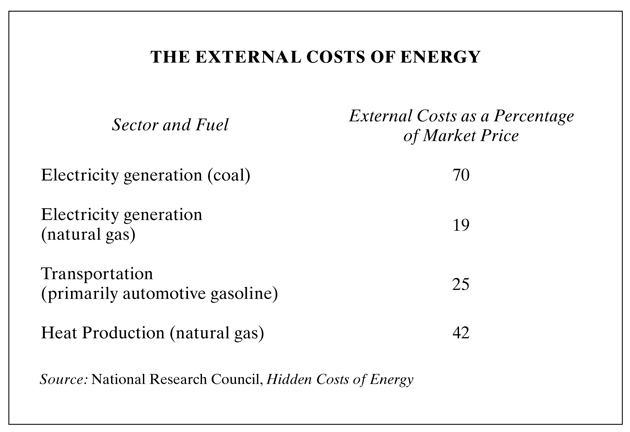

The most recent thorough review, Hidden Costs of Energy, was undertaken by a committee of the National Research Council. This study examined a comprehensive list of external costs but concluded that the major social costs, aside from climate change, were air pollution, such as sulfur dioxide from coal-fired electricity and emissions from cars and trucks. The panel estimated the damages from each of these sources, and then estimated the economic damages from pollution in each of these sectors. Additionally, the panel focused on climate change damages.4

The table on this page summarizes the results from the National Research Council study. It shows the ratio of the estimated external or uncompensated costs of energy to the market price. For example, electricity generated from coal has an estimated external cost of 70 percent of its market price. Petroleum is used primarily for automotive fuels, and its social costs are one quarter of the price of gasoline. Electricity production from natural gas has among the lowest ratios of social cost to market price. It is important to note that the product itself is not harmful (electricity to power our computers is still our friend); rather it is the dirty production process that emits the pollution that ultimately causes the damages and is our foe.

Why does burning coal lead to such disproportionate damages? Per unit of energy, coal is very cheap relative to other fuels. In supplying energy, coal costs only one tenth as much as oil, so there are powerful economic incentives at home and abroad to use coal.

A second feature is that burning coal is very dirty, releasing both conventional pollutants and greenhouse gases. Per unit of energy, coal emits 27 percent more CO2 than oil and 78 percent more CO2 than natural gas. So if we include a charge for climate change, this would lead to a relatively large penalty for coal. In the aggregate, the emissions of CO2 from coal-fired electricity- generating facilities are the largest single industrial source of greenhouse gas emissions in the United States. They make up one third of all emissions in an industry that constitutes only about one half of one percent of the US economy! Moreover, studies indicate that reducing coal-fired generation is the least expensive way for the US to reduce its carbon emissions in the near term.

Advertisement

Coal has a wide variety of costs, some hidden and some quite visible. Coal mine accidents grab the major headlines, and ravages of the land are visible and dramatic. However, the major external cost is the effect on human health from air pollution associated with coal burning. Coal burning emits sulfur dioxide, which is transformed into dangerous fine particles. Background studies used by the National Research Council panel estimated that coal-fired electrical generation is responsible for 21,000 premature deaths a year, and some estimates are even larger. This is a staggeringly large toll—twice the annual number of murders in the country.

This is the scientific basis of Graetz’s assertion about the too-low level of energy prices. It should be emphasized that the external costs vary widely by region, fuel, and product, so an “energy tax” would be a poor instrument for incorporating social costs. We do not have an energy tax, or a carbon tax, or a sulfur tax. The reasons why the US has avoided taxing energy and pollution are the central message of The End of Energy.

Graetz is a tax specialist, and his chapter on energy taxation is especially interesting. Environmental economists have emphasized the use of externality taxes (sometimes called Pigovian taxes after their first important advocate, English economist Alfred Pigou). The idea is to levy a tax on “bads” that have negative externalities, where the tax is equal to the size of the external costs. In the case of coal, the “bad” is largely sulfur dioxide. If the pollution from coal were currently taxed proportionally to its damages, the price of coal-fired electricity would increase from 9.0 cents to 15.2 cents per kilowatt-hour (kwh).

If we were to calculate the externality taxes implied by the costs shown in the table (on sulfur, carbon dioxide, and other harmful pollutants), these would raise over $300 billion per year in revenues. Somewhat more than half of this would be taxes on the global warming externality, while somewhat less would be charges on the conventional pollutants. (This calculation is incomplete for the conventional pollutants because it omits other energy uses than those shown in the table, but includes all CO2 emissions from the US).5

In reality, US energy policy has largely shunned environmental taxes in favor of environmental regulation. Virtually every proposal for an energy tax from Nixon to Obama was defeated in Congress. By way of explanation Graetz writes, “We have eschewed taxes and instead employed virtually every other policy tool imaginable. Handing out tens of billions of dollars in subsidies annually is far more seductive to politicians.” And many of these subsidies mainly serve as tax shelters. Graetz quotes Congressman Pete Stark: “They’re not wind farms; they are tax farms.”

Two central points emerge from this calculation. If we look at actual taxes in the energy sector, they are far below the calculated external costs. In 2007, for which we have complete data, after discounting the net of energy subsidies, the money paid in total federal energy taxes was $21 billion, or less than one tenth of the level necessary to price energy at its social costs. Virtually all of these taxes were gasoline taxes—devoted to building roads so that cars could drive faster and farther! So Graetz is correct in his assertion quoted above that the US has failed to charge the full cost of its energy consumption; it is not even close.

A second point is that environmental taxes can play a central role in reducing the fiscal gap in the years to come. These are efficient taxes because they tax “bads” rather than “goods.” Environmental taxes have the unique feature of raising revenues, increasing economic efficiency, and improving the public health.

3.

The most contentious policies over the last half-century concern oil. Oil policies are a tangle of different objectives and problems that include the rising levels of oil imports, local and regional pollution, the interaction with national security, effects on the balance of payments, inflation, the high profits of US oil companies, trade-offs between drilling and environmental preservation, and oil’s contribution to global warming.

Graetz is right to emphasize the contradictory and confusing signals that policymakers have sent out about oil. President Nixon froze oil prices in 1971, thereby reducing them relative to the market and encouraging consumption. Three years later, after the 1973–1974 oil embargo, he launched Project Independence, stating, “Let this be our national goal: At the end of this decade, in the year 1980, the United States will not be dependent on any other country for the energy we need.” This goal has been a staple of American politics, with similar statements by Presidents Ford, Carter, Reagan, Bush I, Clinton, Bush II, and Obama.6 Graetz concurs, lamenting that “our failure to break free of our bondage to OPEC oil is both surprising and disheartening.”

If we look at both the rhetoric and substance of oil policy, particularly oil dependency, much thinking is misguided because of misconceptions about the nature of oil dependency. We can usefully think of the oil market as a single integrated world market—like a giant bathtub of oil. In the bathtub view, there are spigots from Saudi Arabia, Russia, and other producers that introduce oil into the inventory. And there are drains from which the United States, China, and other consumers draw oil. Nevertheless, the dynamics of the price and quantity are determined by the sum of these demands and supplies, and are independent of whether the faucets and drains are labeled “US,” “Russia,” or “China.” In other words, prices are determined by global supply and demand, and the composition of supply and demand is irrelevant.7

Why is crude oil an integrated world market? The reasons are that the costs of transporting oil are low, different crude oils are largely interchangeable, and the different crudes can be blended. This means that crude oil is fungible, like dollar bills. A shortfall in one region can be made up by shipping a similar oil there from elsewhere in the world. US oil policies make no more sense than trying to lower the water level in one end of the bathtub by taking a few cups of water from that end.

We know that the world oil market is unified because there is a single price of crude oil that holds no matter what the source. For example, we can look at whether prices (with corrections for gravity and sulfur) in fact move together. A good test of this view would be to ask whether a benchmark crude price predicts the movement of other prices. Looking at crude oil from twenty-eight different regions around the world from 1977 to 2009, I found that a 10.00 percent change in the price of the “Brent” crude oil—a blend of crude often used as a benchmark for price—led to a 9.99 percent change in the price of other crude oils. These correlations among crude oil prices are markedly higher than are observed for virtually any other traded good or service.

The implication of the bathtub view is profound. It means that virtually no important oil issue involves US dependency on foreign oil. Whether we consider pollution, macroeconomic impacts, price volatility, supply interruptions, or Middle East politics, our vulnerability depends upon the global market. It does not depend upon the fraction of our consumption that is imported.

I will use two examples to illustrate this point. A first hardy perennial is the idea that we should limit our consumption to oil from “secure sources.” This might mean concentrating on Canada and Mexico, or perhaps relying only on our own output, or we might even exclude Alaska lest it someday decide to secede.

These policies make no sense in an integrated world oil market. Suppose that the United States limited its imports to completely reliable sources—ones that would never, ever cut off supplies—and specifically prohibited imports from unreliable country A. This would lead country A to send its oil to other countries. In an integrated world market, the result would be simply to reallocate production from non-A countries to the United States to make up the shortfall here and eliminate the excess there. Unless a country actually changes its flow into the world bathtub, there will be no impact on the United States of sourcing imports from secure regions only.

Another useful example is sanctions and embargoes. These are often launched as ways of putting economic pressures on countries. The US imposed oil sanctions on Libya from 1986 to 2004 and then again this year; and on Iran from 1979 to the present. The rationale of these policies was to reduce demand for oil from offending countries and decrease their export prices and revenues. But these were only partial in that they did not cover the entire world, including smugglers. The bathtub theory of the world oil market would predict that there would be no effect for the same reason that reducing dependency has no effect: production would simply be reallocated among other countries.

What actually happened during the embargoes? The data indicate that prices in Iran and Libya were virtually unchanged. This is exactly what the bathtub model predicts because, to a first approximation, such embargoes should be expected to have no effect on world prices or production, no impact on the target countries, and no impact on the United States or other consuming countries. They are purely symbolic measures.

The conclusion is that oil policy should focus on world production and consumption and not on the portion we import, and should focus as well on the externalities from our consumption in the form of pollution and global warming. This means primarily that oil consumption should face its full social cost. The major external cost that remains to be addressed is climate change. Until countries put an appropriate price on carbon emissions for oil and other fossil fuels, energy policy will be incoherent, and energy and environmental policies will be working at cross-purposes. The National Research Council estimates cited above used a damage cost of $30 per ton of CO2 emissions. This is somewhat higher than estimates from my own work but is a reasonable target for a US carbon price over the next decade or so. If phased in gradually through a cap-and-trade or carbon tax, such a price would help promote both fiscal and environmental goals.

Energy policy is a good case study for politics in modern America, and Graetz’s book is a sobering reminder of the shortcomings of our political system. He shows that the ability of the federal government to respond to long-term challenges is very limited when a good policy will impose short-term costs. The need for taxes on energy externalities such as carbon emissions is central to our ability to reduce the harmful side effects of economic growth. It is striking how the political dialogue in the US has ignored a policy that has so many desirable features. Perhaps, in the near future, faced with the deadline of a dire economic situation, negotiators will formulate such a policy. It would generate substantial revenues while bringing so many long-run economic and environmental benefits. Simply put, externality taxes are the best fiscal instrument to employ at this time, in this country, and given the fiscal constraints faced by the US.

This Issue

October 27, 2011

How Doctors Can Rescue the Health Care System

A Jewish Writer in America

-

1

100 Million Unnecessary Returns: A Simple, Fair, and Competitive Tax Plan for the United States (Yale University Press, 2007); Death by a Thousand Cuts: The Fight Over Taxing Inherited Wealth, with Ian Shapiro (Princeton University Press, 2005); and The US Income Tax: What It Is, How It Got That Way, and Where We Go from Here (Norton, 1999). ↩

-

2

William Stanley Jevons, The Coal Question: An Inquiry Concerning the Progress of the Nation, and the Probable Exhaustion of our Coal-Mines (London: Macmillan, 1865), pp. vii–viii. ↩

-

3

I will rely on the energy data from the Energy Information Administration, which is an independent statistical agency lodged in the Department of Energy. The most recent Annual Energy Outlook 2011 contains useful statistical data and analysis and is available at www.eia.gov/forecasts/aeo. ↩

-

4

This table takes the mid-range of estimates for the social cost of carbon from the National Research Council study ($30 per ton of carbon dioxide). Additionally, it uses the market prices of the energy products as provided by the Energy Information Administration; see footnote 3. ↩

-

5

I have discussed the role of carbon taxes in these pages, “The Question of Global Warming: An Exchange,” September 25, 2008. It is striking that externality taxes could make a substantial contribution to reducing the long-term federal deficit. Indeed, if all pollution were taxed at its full social costs, this would raise more revenue than the amount of deficit reduction targeted by the recent congressional negotiations. This inconvenient fiscal fact has been overlooked by the teams of experts examining our fiscal future. ↩

-

6

A nice roundup of presidential quotes is contained at www.businessinsider.com/american-foreign-oil-dependence-2011-3#-6. ↩

-

7

A more extensive treatment of the integrated world oil market, including the statistical analysis discussed below, is contained in my study, “The Economics of an Integrated World Oil Market,” Keynote Address, International Energy Workshop, Venice, Italy, June 17–19, 2009, available at www.econ.yale.edu/~nordhaus/homepage/documents/iew_052909.pdf. ↩