In the mid-1990s, when Amazon emerged as an online bookseller, publishers welcomed the company as a “savior” that could provide an alternative to the stifling market power of that era’s dominant chain stores, Barnes & Noble and Borders. Book publishers with exceptional foresight may have understood that they “had to view Amazon as both an empowering retail partner and a dangerous competitor,” as Brad Stone puts it in The Everything Store, his deeply reported, fiercely independent-minded account of Amazon’s rise.

Yet at first, Amazon seemed innovative and supportive. The company’s founder, Jeff Bezos, a Princeton- educated computer scientist and former Wall Street hedge fund strategist, had married a novelist; he often expressed a passionate devotion to books, particularly science fiction and management guides. In its early days of creative chaos, Amazon seemed to want to use the Internet to expand the potential of readers and publishers alike. Bezos hired writers and editors who supplied critical advice about books and tried to emulate on Amazon’s website “the trustworthy atmosphere of a quirky independent bookstore with refined literary tastes,” as Stone puts it.

Among the management books Bezos read devotedly were ones by and about Walmart executives. He became inspired by Walmart’s example of delivering low prices to customers and profits to shareholders by wringing every dime possible out of suppliers. By 2004, Amazon had acquired significant market power. It then began to squeeze publishers for more favorable financial terms. If a book publisher did not capitulate to Amazon, it would modify its algorithms to reduce the visibility of the offending publisher’s books; within a month, “the publisher’s sales usually fell by as much as 40 percent,” Stone reports, and the chastened victim typically returned to the negotiating table.

“Bezos kept pushing for more” and suggested that Amazon should negotiate with small publishers “the way a cheetah would pursue a sickly gazelle.” This remark—a joke, one of Bezos’s lieutenants insisted—yielded a negotiating program that Amazon executives referred to as “the Gazelle Project,” under which the company pressured the most vulnerable publishers for concessions. Amazon’s lawyers, presumably nervous that such a direct name might attract an antitrust complaint, insisted that it be recast as the Small Publisher Negotiation Program.

Around this time, Amazon also jettisoned its in-house writers and editors and replaced them with an algorithm, Amabot, that relied on customer data rather than editorial judgment to recommend books. The spread of aggression and automation within Amazon as the company grew larger and larger echoed classics of the science fiction genre to which Bezos was devoted. An anonymous employee bought an ad in a Seattle newspaper to protest the change. “DEAREST AMABOT,” the ad began. “If you only had a heart to absorb our hatred… Thanks for nothing, you jury-rigged rust bucket. The gorgeous messiness of flesh and blood will prevail!”

Will it, though? Over the last decade, Amazon’s growing market share and persistent bullying, particularly in the realm of digital books, where it now controls about two thirds of the market, raise the question of how well competition and antitrust law can protect diverse authors and publishers. Amazon has become a powerful distribution bottleneck for books at the same time that it is also moving to create its own books, in competition with the very publishers it is squeezing.

The evidence to date is that Amazon and the attorneys that advise it do not fear antitrust enforcement. You might suppose, for example, that the publication of Stone’s book, which contains extensive on-the-record interviews with former Amazon executives describing the company’s most dubious practices, would have chastened it and caused it to pull back from strong-arming publishers—to avoid bad publicity, if for no other reason. Yet that has not proved to be the case.

This spring, Amazon has again launched a negotiating campaign to force publishers to accept concessions on the percentage of revenue it takes from e-book sales. And Amazon has again punished those who resist. Its most prominent target has been Hachette, the French publishing group, which will bring out The Everything Store in paperback in October. As of early June, as part of its pressure tactics, Amazon had removed the link on its website that would allow customers to preorder the paperback edition of Stone’s book, as well as links that would facilitate other preorders of Hachette books.

Jeff Bezos’s conceit is that Amazon is merely an instrument of an inevitable digital disruption in the book industry, that the company is clearing away the rust and cobwebs created by inefficient analog-era “gatekeepers”—i.e., editors, diverse small publishers, independent bookstores, and the writers this system has long supported. In Bezos’s implied argument, Amazon’s catalytic “creative destruction,” in the economist Joseph Schumpeter’s phrase, will clarify who will prosper in an unstoppably faster, more interconnected economy.

Advertisement

“Amazon is not happening to book selling,” Bezos once told Charlie Rose. “The future is happening to book selling.” Yet the more Amazon uses its vertically integrated corporate power to squeeze publishers who are also competitors, the more Bezos’s claim looks like a smokescreen. And the more Amazon uses coercion and retaliation as means of negotiation, the more it looks to be restraining competition.

Toward the end of his account, Stone asks the essential question: “Will antitrust authorities eventually come to scrutinize Amazon and its market power?” His answer: “Yes, I believe that is likely.” It is “clear that Amazon has helped damage or destroy competitors small and large,” in Stone’s judgment.

In view of Amazon’s recent treatment of The Everything Store, Stone may now end up as a courtroom witness. Yet there are reasons to be wary about who will prevail in such a contest, if it ever takes place. As Stone notes, “Amazon is a masterly navigator of the law.” And crucially, as in so many other fields of economic policy, antitrust law has been reshaped in recent decades by the spread of free-market fundamentalism. Judges and legislators have reinterpreted antitrust law to emphasize above all the promotion of low prices for consumers, which Amazon delivers, rather than the interests of producers—whether these are authors, book publishers, or mom-and-pop grocery stores—that are threatened by giants.

In 1951, the largest retailer in the world was the Great Atlantic & Pacific Tea Company, or A&P. Founded in 1869, the food chain seized upon the faster communications and more efficient transportation links of its era—a new transcontinental railroad and, later, automobiles and trucks—to build supermarkets with wondrous-seeming selection and lower prices. Throughout the company’s rise, as Marc Levinson describes in a fascinating history,1 it was a target of anger and lobbying by small-town grocers and producers, who protested that A&P was destroying not only their livelihoods, but also the quintessential place of small enterprise in American life. A&P perfected a “relentless squeeze on suppliers” and it “pioneered the practice of carefully dissecting manufacturers’ costs to determine what prices they should receive for their products,” much as Amazon is doing to book publishers today. Also like Amazon, the supermarket deliberately sold some items below cost to attract customers who, once in the store, would also buy profitable items.

A difference between A&P’s position then and Amazon’s now involves politics. At the cusp of the Great Depression, corner grocers and independent food wholesalers still had considerable political power in both of the major parties. In President Franklin Roosevelt, they also had a powerful defender. Roosevelt understood how A&P’s efficiencies and low prices made food accessible to impoverished Americans. Yet he was also concerned that A&P’s ravenous growth might cause hundreds or thousands of small merchants to fail, exacerbating the nation’s jobs crisis. Roosevelt therefore oversaw a divided approach that used regulation to assure small grocers of some price stability while also enabling A&P to sell low-cost food, although not as freely as it would have without regulation.

Then, in the early 1940s, the Roosevelt administration’s antitrust chief launched a wide-ranging investigation into A&P’s business practices. In 1946, a federal judge found the chain’s executives guilty of criminal violations of the Sherman Antitrust Act, even though the judge conceded that A&P had lowered food prices to the benefit of consumers.

Since then, politics and antitrust jurisprudence have shifted to favor consumers and large corporations at the expense of small producers. On the political left, a consumer rights movement emerged in the late 1960s as a response to dangerous automobiles and corporate pollution. That movement gave consumers priority over small businesses in challenging powerful corporations. On the right, free-market ideologists built think tanks and long-term legal strategies to defeat business regulation of all kinds and to reduce the scope of antitrust enforcement from its expansive Progressive-era origins.

From the Reagan presidency onward, the right succeeded remarkably. Large corporations perfected their lobbying power in Washington while small businesses like bookstores and corner grocers watched their political influence and their hold on the American imagination fade. The United States today presents a more bifurcated economic landscape of empowered, atomized, fickle, screen-tapping consumers and the globalized, often highly profitable corporations that aspire to serve them.

In Europe’s democracies, small producers and retailers have proven to be more resilient politically. The Czech Republic, Marc Levinson notes, passed a law in 2010 requiring minimum price markups by retailers to prevent “chains from undercutting mom-and-pop stores.” The patisseries and florists of Paris benefit from regulation with similar intent. The conviction within Europe that a thriving culture depends on small, diverse enterprises that may warrant special economic protection is exemplified as well by France’s ardent defense of its film industry. Crucially, these patterns of resistance to the digital age’s speed-of-light patterns of creative destruction have a political foundation—they are popular at election time. This is not the case in the United States, which lacks a politics favoring small- and medium-sized cultural producers, whether these are authors, journalists, small publishers, booksellers, or independent filmmakers.

Advertisement

In the digital book market today, the influence of even the very largest groups such as Hachette offers no match for Amazon’s grip on distribution and technology. In any event, the real problem of “the Age of Amazon,” in Stone’s apt phrase, does not concern antitrust economics or consumer prices. It concerns the future of reading and writing. There is no evidence that high retail book prices today discourage reading. The problem is the opposite: because of the digital revolution, the price of information has collapsed in a very short time. Free news, stories, YouTube videos, games, and other content generated by users but enabled by online aggregators and pirates have undermined the leverage of authors and publishers who depend on copyright protection to make a living.

This is the setting in which Amazon is now moving to upend for its own benefit the traditional pricing system in book publishing. At issue is the character of our public life. As the literary agent Andrew Wylie, a fierce critic of Amazon’s predation, wrote recently, “The book industry is overwhelmingly the repository of our nation’s culture. To destroy it is to destroy the culture.”2

Whatever his intentions, Jeff Bezos has more influence than any person in the world today over the future of reading. Last year, he extended his power into journalism, by paying $250 million in cash to purchase The Washington Post. How does Bezos see himself and what does he want?

He is not an easy man to caricature. In Stone’s portrait, he is nerdy, dreamy, prescient, and ruthlessly competitive. He aspires to kindness as a personal ideal but sometimes rages cruelly at his subordinates. He demands hard data and has an unusually keen mind, one that allows him to follow complex numbers to whatever business insights they may yield, and to think ahead of his peers. He claims to value books, authorship, and journalism as public goods, and he seems to wish to be remembered as a patron—even a savior—of American letters in the digital age. Yet it is not clear that Bezos’s ideas about the future of reading are driven by any principle other than the maximization of Amazon’s position. Bezos became a multibillionaire because of his insights about books and reading, and yet books and reading have also seemed at times incidental to his personal and financial ambitions.

How did Bezos rise to power? In 1963, in Albuquerque, New Mexico, an eighteen-year-old unicyclist and circus performer named Ted Jorgensen impregnated a sixteen-year-old high school sophomore named Jacklyn Gise. Their son Jeffrey was born on January 12, 1964. The new parents married but soon divorced. A few years later, as Stone recounts, Jackie met a Cuban-born oil engineer who went by Mike Bezos, and who was about to take up a stable if peripatetic career at Exxon. They married and moved to Houston; Mike adopted Jeff as his own. When he was ten, Jeff’s parents told him that Mike was not his biological father. Years later, he told Wired magazine that he learned the news about his father at the same time that he discovered that he needed glasses. “That made me cry,” he said.

Bezos came of age in comfortable suburban homes, and was enrolled by his parents in a school for gifted children. At age twelve, he told a visiting researcher, whose unpublished manuscript Stone tracked down: “The way the world is, you know, someone could tell you to press the button. You have to be able to think what you’re doing for yourself.”

Bezos developed an ambition to travel into space and help mankind migrate from Earth. He was the valedictorian of his high school class and in his speech he quoted from Star Trek and described a plan to build permanent human colonies in orbit so that Earth could be turned into a nature preserve. Years later, his high school girlfriend told reporters that Bezos had always wanted to become rich so that he could “get to outer space.”

He studied computer science and electrical engineering at Princeton, graduated in 1986, and struck out for Wall Street. He landed eventually at D.E. Shaw & Co., which had been founded by David Shaw, a former Columbia University computer science professor. “Shaw pioneered the use of computers and sophisticated mathematical formulas to exploit anomalous patterns in global financial markets,” as Stone recounts.

Bezos entered the book business by cold deduction, not by any high-minded or sentimental desire to have publishers as partners. Shaw was prescient about the commercial potential of integrated computer networks. He and Bezos discussed an idea they called “the everything store,” which would seize upon the Internet as an “intermediary between customers and manufacturers” to sell “nearly every type of product, all over the world,” Stone writes.

Bezos decided to break away from Shaw to start a prototype, but he “concluded that a true everything store would be impractical—at least at the beginning.” He therefore analyzed twenty possible product categories for his new company, including clothes, software, music, and office supplies. According to the principles of mathematics, physics, and finance Bezos applied, books were the best choice. They were “pure commodities” in the sense that a book in one store was exactly the same as a book in another. They were easy to pack and hard to damage. And “there were three million books in print worldwide, far more than a Barnes & Noble or a Borders superstore could ever stock.” Thus an online bookstore would allow Bezos to promote “unlimited selection,” the most important insight that had attracted him and Shaw to the vision of Internet-empowered retailing.

At least two qualities distinguished Bezos from other pioneers of e-commerce and help to explain his subsequent success. The first was his gargantuan vision. He did not see himself merely chipping away at Barnes & Noble’s share of retail book sales; he saw himself developing one of the greatest retailers in history, on the scale of Sears Roebuck or Walmart. Secondly, Bezos focused relentlessly on customer service—low prices, ease of use on his website, boundless inventory, and reliable shipping. To this day, Amazon is remarkably successful at pleasing customers.

To achieve such excellence amid the buggy software, experimental warehouse schemes, and overall novelty of Amazon’s business plan was, inevitably, hard going. By Stone’s account, Bezos did not always handle his frustrations gracefully. He was “prone to melodramatic temper tantrums that some Amazon employees called, privately, nutters.”

“Why are you ruining my life?” he would ask one of his executives.

The Gazelle Project and other programs of aggressive negotiation with book publishers after 2003 look inseparable from the corporate ethos fostered by Bezos as Amazon grew. Of course, retailing is an industry with notoriously low profit margins and its successful new entrants tend to be acidly tough-minded negotiators. Perhaps it was inevitable that Amazon would turn nasty toward its former partners in book publishing as it grew. In any event, as the years passed, books mattered less and less to Amazon’s diversifying business. A company founded on an insight about the magical, boggling variety of books—three million titles, all under one virtual roof!—increasingly merchandised books the same way it sold cameras and socks.

Bezos expressed confidence that physical books would yield to digital book reading eventually. By Stone’s account, Steve Jobs’s innovations at Apple in digital music—the creation of the iPod and the iTunes store, which rapidly upended and damaged the music industry—persuaded Bezos that Amazon had to move fast to capture the digital reading market before Apple did.

Bezos created a secret workshop called Lab126 to develop what became the Kindle reader. At the same time, he embarked on high-pressure and in some respects deceptive negotiations with book publishers to create enough digital book inventory to make the Kindle valuable. In November 2007, Bezos took the stage at the W Hotel in lower Manhattan to introduce the Kindle in the splashy modern manner of Silicon Valley gadget debuts.

“Why are books the last bastion of analog?” Bezos asked. “The question is, can you improve upon something as highly evolved and well suited to its task as the book, and if so, how?” Seventeen minutes into his presentation, Bezos announced an answer to his question: very cheap prices would do the job.

He said that for the Kindle, Amazon would sell digital versions of new and popular books for the flat rate of $9.99. “There was no research behind that number,” Brad Stone recounts. “It was Bezos’s gut call.” Moreover, “Amazon knew quite well that publishers would absolutely hate the $9.99 price,” which was far below traditional retail list prices.

In fact, the publishers had been snookered. Amazon had pressured them to convert their inventory to digital forms without telling them what pricing they would have to swallow. As Bezos promoted $9.99 in one television interview after another, like a man selling steak knives, “the grim reality sank in, and publishing executives kicked themselves for their own gullibility.” Bezos’s pricing gambit

changed everything. It tilted the playing field in the direction of digital, putting additional pressure on physical retailers, threatening independent bookstores, and giving Amazon even more market power. The publishers had seen over many years what Amazon did with this kind of additional leverage…. [They] believed their necks were being fitted for the noose.

It was amid this anxiety that a number of large publishers entered into discussions among themselves and with Apple about how they might escape Amazon’s control. According to evidence later presented at an antitrust trial, the publishers feared that Bezos’s carnival barking about a $9.99 digital price would ultimately reduce the plausible price of a physical book, further undermining large retailers like Barnes & Noble, as well as the many hundreds of surviving independent bookstores on which publishers depended.

Starting late in 2009, six major book publishers worked out a deal with Apple that would effectively raise typical digital prices to between $12.99 and $14.99. Under the terms, the publishers would receive less money per book than they would from Amazon at $9.99. Yet they were willing to accept short-term losses to defend “consumer perception of the value of a book,” as a federal judge later wrote.3

The Obama administration’s Justice Department, encouraged by a white paper submitted by Amazon, investigated that deal and filed civil antitrust complaints against five publishers and Apple in 2012. The publishers all settled. Apple went to trial last year and lost; its appeal is pending. In fact, the evidence at trial showed that the publishers and Apple had acted in blatant disregard of the Sherman Antitrust Act. Yet testimony and documents also made clear that the book publishers conspired because they were afraid of Amazon’s market power and of its record of retaliation against suppliers that dared to defy its wishes.

The question now is whether the Justice Department will apply the same degree of scrutiny to Amazon’s activities in the digital book market that it applied to Apple five years ago. Sandeep Vaheesan, a special counsel to the American Antitrust Institute, has pointed out that “the courts must recognize that defending consumers [also] requires protecting small firms from the anticompetitive behavior of dominant companies.”4

The evidence is in plain sight—namely, that Amazon controls more than half of the digital book market and is using that control to punish uncooperative publishers. This warrants a substantial Justice Department investigation. Only Justice has the resources and independence to apply the law—book publishers are more dependent on Amazon than ever. To advance the public interest, the department should consider, among other subjects, how antitrust law applied to Amazon might assure greater diversity of economically workable authorship and publishing—cultural and democratic competition, that is, not just price competition. To argue that antitrust should focus merely on price and market numbers is to ignore the law’s deeply political and public-minded history.

Amazon’s business continues to pose challenges to Bezos: its revenue growth has been much stronger than its profit growth, and the company’s stock price has therefore been highly volatile. This has put additional pressure on Amazon to cut supplier costs. Yet these days, at fifty, with a fortune estimated to be about $30 billion, Bezos has entered into a more diversified phase of his entrepreneurial life. According to Stone, he spends some of his time at the headquarters of Blue Origin, a rocket and space exploration company that he founded. (Bezos has bought up almost 300,000 acres of land in rural Texas to build a rocket launch facility.) Blue Origin’s offices are

studded with Bezos’s space collectibles, like props from Star Trek, rocket parts from various spaceships throughout history, and a real cosmonaut suit from the Soviet Union [as well as] a full-scale steampunk model of a Victorian-era spaceship.

So far, the company’s record has been mixed; one of its test vehicles burned up at 45,000 feet in 2011. Yet according to his friend Nick Hanauer, as quoted by Stone, Bezos exercises every morning because “he absolutely thinks he’s going to space.”

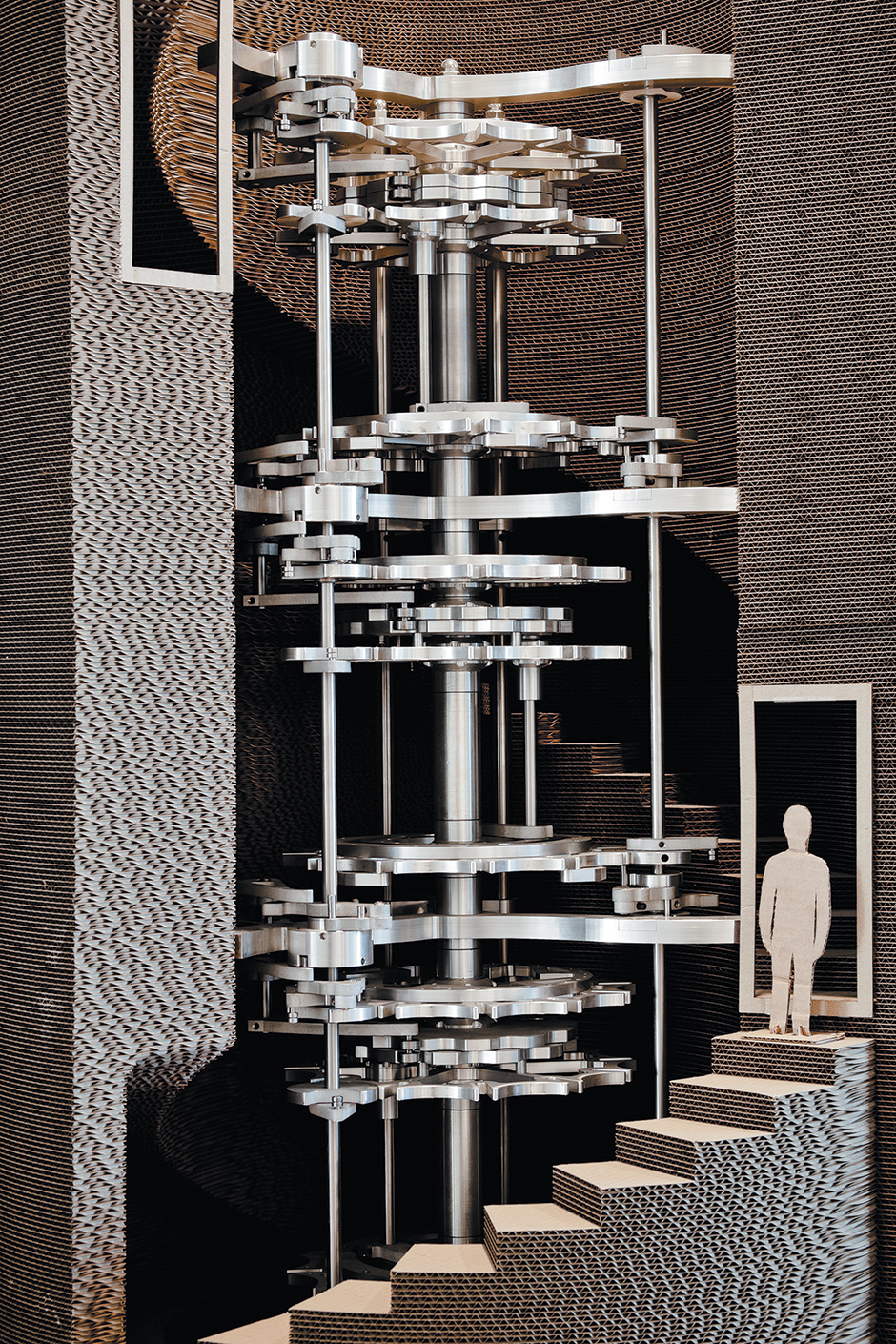

With Stewart Brand, the founder of the Whole Earth Catalog, Bezos has also involved himself with “The Clock of the Long Now,” a large mechanical timekeeper that Stone describes as “an aspirational project aimed at building a massive mechanical clock designed to measure time for ten thousand years, a way to promote long-term thinking.” Bezos is installing such a clock on his Texas property.

It is not easy to discern where Bezos’s purchase of The Washington Post last year fits in this eclectic portfolio. He hopes, according to reporters and editors at the paper with whom I have spoken, to develop a worldwide digital newspaper suitable for e-readers like the Kindle—a digital newspaper that might ultimately thrive on subscription revenue. Bezos has spent little time in the Post’s newsroom. But he has left in place an able editor, Marty Baron, and has invested modestly but significantly in the newsroom budget, as well as in research and development. The paper this year won two Pulitzer Prizes, including a share of the prize for public service for the work by Barton Gellman and other reporters that arose from the revelations of Edward Snowden.

The detachment evident in Bezos’s involvement at the Post so far reflects what remains his ambiguous position in American letters. Bezos seems to believe that he can disrupt book publishers while still advancing the cultural medium he claims to love. Yet if that is his belief, there is little evidence to support it. Amazon has introduced a kind of self-publishing enterprise, the Kindle Single, which offers to writers publisher-displacing royalty rates of up to 70 percent. The trouble is that 70 percent of nothing is nothing and most Kindle Singles don’t sell enough for an author to feed a cat.

Amazon’s success has arisen from excellence in data science, distribution, and business execution, not creativity with content. The company’s attempts to publish its own trade books and to develop original television have so far failed. It is not clear how well Bezos understands the human agency involved in writing and publishing, or the ecosystems in which editors and writers have worked for centuries. Like other Silicon Valley disruptors, Bezos’s impatience with publishers can sound like contempt. Yet he seems content with The Washington Post’s allegiance to high journalistic norms. On the evidence available, Bezos is at once a visionary, an innovator, and a destroyer. Perhaps he will yet rescue the Post, revive the newspaper business, and also recast Amazon’s role in digital books from predator to something more creative. Unfortunately, the record of deep reporting that Brad Stone has given us—in a book we cannot at the moment preorder in paperback on Amazon—offers little basis for such optimism.

-

1

The Great A&P and the Struggle for Small Business in America (Hill and Wang, 2011). ↩

-

2

Correspondence from Wylie, quoted by permission. ↩

-

3

Judge Denise Cote, United States v. Apple Inc. et al., 12 Civ. 2862 (DLC), July 10, 2013. ↩

-

4

Sandeep Vaheesan, “The Great A&P and the Struggle for the Soul of Antitrust,” Iowa Law Review Bulletin, Vol. 98, No. 55 (2013). ↩