After more than twenty years of relative neglect, the history of capitalism is once again of high interest to scholars and their students. The new interest has many sources, but the chief impetus is surely the recognition that the world we know is rapidly changing under the pressure of a global capitalist system that is moving away from the forms it has taken since its early modern beginnings in Europe. Theorists such as Adam Smith are again on students’ reading lists, along with writers as different as Karl Marx, David Ricardo, Joseph Schumpeter, and Friedrich Hayek.

New studies of the United States’ emergence as a capitalist power, of Europeans’ move into Asian markets, African lands, and South American mines during the Renaissance, or of South Asia’s or China’s entry into the global economy appear daily. The history of finance and financial institutions is also receiving new attention from historians treating monetary policy, banking, and credit as central elements of the capitalist system that defines the West, not simply the subjects of technical studies. Some historians are approaching the history of capitalism in ways that are different from the work of most economists, whose focus has traditionally been on what they call “the market” or “the economy,” on how it “grew” or “performed,” and on the policies or institutions that best assured—or failed to assure—its proper functioning. The Nobel Prize–winning economist Douglass North’s books Growth and Welfare in the American Past (1974) and Institutions, Institutional Change and Economic Performance (1990) exemplify this approach. The French economist Thomas Piketty’s much-discussed Capital in the Twenty-First Century (2013), a critical study of how modern capitalism has inexorably functioned to create rigid hierarchies in which the rich stay rich, is one important exception to standard economic histories; its wide readership is a sign that the new interest in capitalism’s history is no longer confined to the academy and to historians alone. It now seems more urgent than it has for years to reveal how the system we call capitalist came into being, to expose its logic, and to reveal its powers for both good and bad.

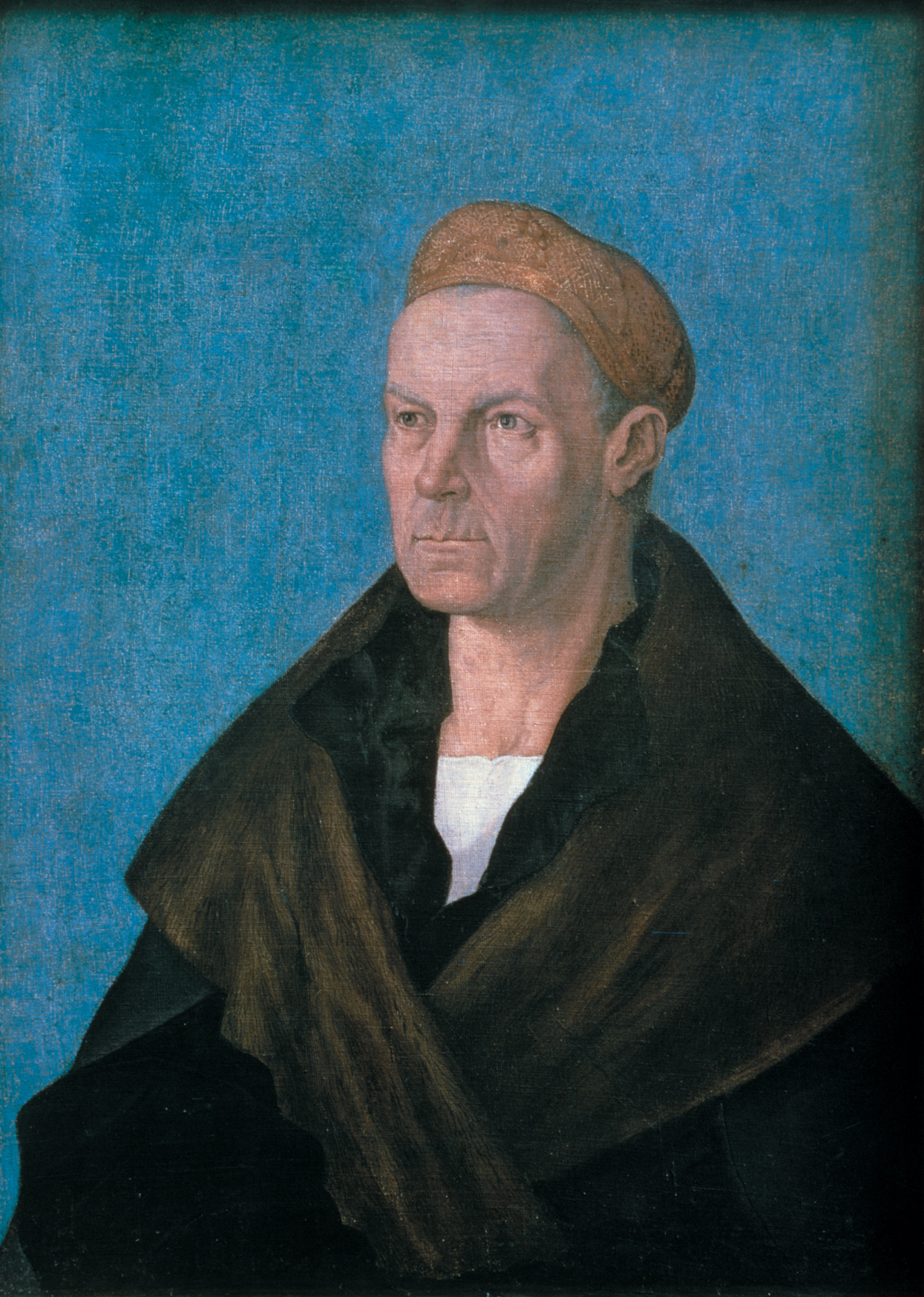

Greg Steinmetz’s The Richest Man Who Ever Lived: The Life and Times of Jacob Fugger is an effort to contribute to such a history. Written by a journalist to introduce the most important merchant banker of the sixteenth century to North American readers, few of whom would recognize his name, the book is a careful synopsis of a rich body of scholarly and not-so-scholarly literature in German, little of it translated. It is a lively portrait of the late Renaissance and tells the story of how Fugger, born in 1459 into an already prosperous merchant family in the then-booming town of Augsburg in Bavaria, assembled a private fortune that was unmatched in his day. The Medicis were not nearly as rich; by any fair measure, Fugger’s wealth was probably unmatched even by the Rothschilds or the Rockefellers in their heydays. Although his subject is Fugger, Steinmetz also mentions some of his contemporary or near-contemporary competitors, including the French banker Jacques Coeur and leading German banking families such as the Welsers and Hochstetters, who, he explains, were less creative (and less successful) if not different in kind.

Steinmetz is correct to insist that Fugger was exceptional. The Fugger family money may have originally come from trading textiles, many of them made in their hometown of Augsburg, but Jacob Fugger’s business quickly became lending, investing, and trading a great variety of goods, surpassing men like Coeur and the famous Italian banking family the Bardis. Like them, he became a creditor to some of the most powerful if cash-poor princes of the day. He was also, however, brilliant at extracting concessions, sometimes entire properties, as collateral, which gave him precious rights to the silver mines of Tyrol, in what is now western Austria, as well as Hungarian copper, Spanish mercury, and gold and silver from the New World. Hard to extract and hard to process, these minerals were essential to rule in an age when battles were fought with firearms and cannons made from bronze (a copper alloy), and when mercury was central to alchemic science and the metallurgical arts, and even thought to cure syphilis. Fugger’s mineral holdings had another use as well. Any prince worth his title had to assure that enough silver or gold circulated to sustain commerce, fill his coffers, and sometimes allow him to make coins bearing his portrait.

Later Fugger entered the pepper market, financing shipments from India. According to Steinmetz, he was better known as a pepper merchant than as an investor in mines. Thus, on a grander scale and with more skill than most others, Fugger expanded his business from trade and used his ability to provide ready credit in order to secure rights to productive assets, such as mines, that reliably yielded returns over considerable periods of time. He made princes, in his case the Habsburgs, dependent on his money. He financed their elections to the emperorship, extended loans to pay their armies, and bribed their enemies to keep them at bay.

Advertisement

In return, he sometimes got his loans repaid on time and in cash, but more importantly the princes protected him from lawyers and political enemies, and he also benefited from noble titles and estates that provided him protection so that if anything went horribly wrong in his business, he would be safe. In the event, however, Fugger never used the noble title given him by the Habsburgs, never retired to his estates, and never even tried to enter the political elite of Augsburg, routes out of commerce taken by so many of his fellow merchants. Throughout his life he concentrated on extending his businesses and increasing his wealth.

In telling this story Steinmetz gets a few details wrong, and sometimes he wildly overstates the case. Augsburg, for example, was indeed an important financial and business center in the sixteenth century but it was not “the money center of Europe”—that title goes to Antwerp. Fugger was not the “first to pursue wealth for its own sake and without fear of damnation”; this could be said of any of the Bardis, almost any Hansa merchant, or any of the English Merchant Adventurers, such as Richard Chancellor, who traveled via deadly northern seas and equally treacherous overland routes to the court of Ivan the Terrible, thus providing the English a foothold in the rich Russian trade and giving birth to the English Muscovy Company. Leuven is not in the county (now the province) of Flanders and in the sixteenth century was never described as being there. Adam Smith may have proposed an economic system that resembles what Steinmetz considers capitalism, but he did not use the word in his Wealth of Nations. It is a huge stretch to say that Fugger developed the “world’s first” news service, although there is no doubt that his courier system was efficient and extensive.

But these are fairly small matters, and Steinmetz deserves praise for charting the progress of Fugger’s amazing career, marking its milestones as he got hold of silver, copper, and mercury mines, as he made a fortune on the pepper trade, as he financed ventures into the New World. He also tells how Fugger apparently persuaded Leo X to issue the bull (Inter Muliplices) that canceled the canonical prohibition of interest, even if it did not, as Steinmetz implies, suddenly release Europeans to charge interest on loans. In fact, they had been doing so for at least a few centuries, either openly under the protection of princes or by means of clever stratagems that hid the interest charges or rendered them something else (such as land rents on what were called rentes in French) in the eyes of the church.

Steinmetz also writes that Fugger has much to do with encouraging the rapacious sellers of indulgences and the resultant attacks by Martin Luther that led to the Protestant Reformation. Along the way, we are told about the horrific Peasants’ War of 1524–1525 that tore Germanic Europe apart and killed hundreds of thousands (in Friedrich Engels’s later telling it prefigured the class wars of the nineteenth century). We are given memorable portraits of the splendid Burgundian court and its last duke, Charles the Bold, of the French king Francis I, and of the Habsburgs Ferdinand, Maximilian, and Charles V, the last the greatest of them. Steinmetz helps us to understand how high politics worked in those days and to witness what we would call outrageous corruption in action. We are told of Fugger’s ruthless maneuvers to cut into the Baltic trade and further weaken the already declining Hanseatic League.

Finally, in the book’s last chapter we are led through the balance sheet compiled two years after Fugger’s death. Steinmetz uses it to illustrate his claim that Fugger brought double-entry bookkeeping to Germany, which is another overstatement, but once again there is truth to it. Fugger did insist on meticulous books and his bookkeeper Matthaus Schwarz prepared them using the methods he had learned in Venice in his youth, probably exceeding the standards elsewhere in the north, although we do not have the evidence to test that claim adequately. What is more interesting are the numbers themselves and the picture of the whole that Schwarz’s books provide. We learn of the hundreds of thousands of florins (at a time when one florin would buy perhaps two weeks of a skilled worker’s time) then invested in mineral rights; and we get estimates of the sums owed to Fugger (which are discounted to reflect the risk of nonpayment just as we hope public companies do today).

Advertisement

On the liabilities side of the balance sheet we find Fugger’s debts, some of them very big but, taken together, not big enough to threaten his huge holdings in the form of minerals, textiles, real estate, and much else. Although this balance sheet does not capture Fugger’s financial situation precisely at the moment of his death, it is close enough to confirm Steinmetz’s claim that he was immensely rich. Not richer than “anyone” of the day, for monarchs like Charles V or Francis I and others drew from much vaster—if nonliquid—resources such as their landed properties, but certainly richer than any other private individual.

Steinmetz’s purpose in writing a book on Fugger is not, however, only to tell his exciting story; it is also to claim that he was “the first capitalist,” a claim that his reviewers have often accepted. Steinmetz provides us no precise definition of capitalism. His notion seems, however, to accord perfectly with the concept elucidated over a century ago by the eminent medievalist Henri Pirenne, who enduringly, if controversially, defined capitalism as the rational pursuit of profit through trade. For Pirenne, capitalism existed in places where “individual enterprise, advances on credit, commercial profits, speculation” were to be found.

Speaking of a Flemish entrepreneurial merchant, formerly a peasant, whom he discovered in the archives, Pirenne identified what he called the spiritus capitalisticus—someone “combining his purchases, reckoning his profits, and…using [them] only to support and extend his business.” The problem with this definition and implicitly with Steinmetz’s is that these traits—profit-seeking, credit, speculation, “reckoning,” and reinvestment—are practically universal. Merchants everywhere, whether in Baghdad, Cairo, Aleppo, Mombasa, Samarkand, or Cordova during the Middle Ages or elsewhere at any other time, certainly sought profit, gave and took credit, speculated on changes in supply or demand, and “reckoned” their financial position. They also reinvested in their businesses even if they, like Fugger and his heirs, also frequently bought land and estates to secure their wealth and cement a newly acquired social standing, made charitable gifts to appease the public (and to help save their souls), and patronized artists to enhance their reputations.

By this measure, there has “always” been capitalism. Yet by combining commerce, production, and politics as he did, Fugger fashioned a new kind of mercantile business, one that can be considered capitalist. He was surely not the “first” to do so—men like the Peruzzis of Florence or Jean Boinebroke of Flanders operated similarly—but he was undeniably the most successful of his age. His career thus exposes a feature that the many iterations of capitalism that have swept Europe and now the globe all share: capitalism is a partnership between governors and merchants that secures the power of both. To understand the capitalism of Fugger’s day we thus cannot use Marx’s definition, which turns on the production of wealth by the exploitation of labor, although there was certainly plenty of exploitation of labor in early modern Europe. With some modifications, however, we can take several things from Marx: one, that money—big money—was made not by producing commodities and trading them for money to buy other commodities as was the usual practice in medieval markets; rather money was used to buy commodities to sell for more money; two, that a capitalist’s only form of social security (material well-being, status, honor, and so on) was money and the only source of money was business; third, and crucially important, that private fortunes made in trade of commodities would give rise to a new social class able to make political elites their partners, even their puppets.

Relevant here is the work of Fernand Braudel, the leader of the Annales school, an immensely influential driver of historical research from the 1950s until at least 1985, when he died. An important precursor to the contemporary study of the global economy and world systems theory, Braudel also provided us with what to my mind is the best description of early modern capitalism. In his Les Jeux de l’échange (translated as The Wheels of Commerce), Braudel defined the capitalism of those days as a distinct sphere of economic life. At the base of the economic whole was the sphere of subsistence production where people produced almost all the goods they consumed as members of households or other social units. The second was what he alternately (and somewhat confusingly) called “economic life,” “the market economy,” “the normal economy,” or “the transparent economy” of traditional European society. Here market exchange typically occurred in face-to-face encounters; production was usually managed in small artisanal shops; there were few intermediaries between producer and consumer; and credit arrangements were highly personal and short-term.

In the fifteenth and sixteenth centuries, however, a third sphere was taking menacing shape, fueled by long-distance commerce in exotic goods, luxury materials, and precious minerals. There practices verged toward what Braudel characterized as early modern capitalism—an alien sphere of accumulation, speculation, and high risk that was as far removed from the practices and norms of the traditional market economy as it was from the agricultural or industrial capitalist world to follow. Others have characterized this as merchant capitalism, thus emphasizing that wealth was made not in production, as Marx thought, but in “arbitrage” trade, where goods like silks and pepper, gold and silver, furs and wax, were bought cheap and sold dear. Monopolies, as Braudel explained, were crucial for success in this sphere—monopolies in the form of exclusive access to information about supply and demand and, in some cases, formal control of the sources of supply, of distribution networks, and occasionally of customers themselves.

These monopolies were formed, protected, or enabled by the state and often by the expectation of purchases by the state. Men who dominated such monopolies operated far outside Braudel’s “normal market,” where agricultural surpluses and craft goods were sold in weekly markets, where old clothes were hawked, where cheese and beer were sold out of kitchens. Fugger was such a man, but he was not the first, and it is very hard to find “the first,” for this new kind of economy had developed slowly and uncertainly. By the late Middle Ages, however, the system was in full view. Here wealth came from long-distance trade, and the longer the distance traveled or the more difficult the journey, the more mysterious the origin, the more rare the goods transported, the more exotic or the more vital to rule the products supplied, the greater the chance for profit.

Fugger was, however, more than just a brilliant example of a sixteenth-century merchant capitalist. By harnessing the state’s power to gather enormous investments in productive assets such as minerals, luxury foodstuffs, and rare textiles, he presaged what would be the most powerful and most virulent form of merchant capitalism—the East India companies of the seventeenth century. These companies were a formal expression of the state–merchant partnership that Fugger had cobbled together, more or less on his own, in an age of chaotic state-building, booming international trade, industrial expansion, and the princes’ unending need for credit to win their offices, fight their wars, and reward their followers.

The East India companies had their birth in a search for direct access to the pepper, nutmeg, mace, cinnamon, and cloves that came from the lands around the Indian Ocean as well as for the textiles, dyes, jewels, gold, glassware, and metal goods produced in the workshops and mines of Central Asia, China, Japan, and India. The Portuguese were the first Europeans to make the sea journey around Africa, not with chartered companies but with state-sponsored (and heavily armed) merchant ships.

They were quickly followed by European competitors. The most successful among them was the Dutch East India Company, or VOC in its Dutch acronym, which became the largest and most profitable megacorporation the world had known. During the two hundred years of its life it paid an 18 percent dividend on average, shipping more than 2.5 million tons of trade goods, some of them purchased, often by forcing the sellers to comply, and many produced at VOC order by enslaved people working under horrific conditions. The fleet of the British East India Company, the VOC’s nearest competitor, was a distant second to the Dutch with one fifth the tonnage of goods.

If Fugger was not the “first capitalist,” the story of his life perfectly exemplifies sixteenth-century capitalism and suggests a fundamental truth about many more forms of capitalism, one that was so monstrously embodied by the Dutch East India Company: wealth is won and preserved with the support of a state that is, in turn, dependent on the riches accumulated by the few who excel in commerce. In some periods, at some moments of technological history, the riches are typically extracted from ever more efficient production, invariably aided by ruthless exploitation of human labor and natural resources. In others the wealth comes principally from control of supplies, manipulation of demand, and management of distribution networks. But always the merchants grow rich because state power protects them or looks away when the time is right—and does so because in a world where commerce reigns, neither the state nor a powerful merchant class can exist without the other. We have Steinmetz’s book to thank not just for telling Fugger’s story so well but also for showing us how the partnership between state and commerce worked in the earliest days of European capitalism.