Donald Trump, Michael Bloomberg, Howard Schultz: all three of these billionaire-politicians began their careers in that semicivilized field of aggression known as sales. Schultz sold Xerox copiers in midtown Manhattan, pounding pavements and making fifty cold calls a day. Bloomberg cut his teeth as a securities trader at the Wall Street firm of Salomon Brothers, where, as one of his former partners put it, you had to come to work “ready to bite the ass off a bear.” And Trump, of course, peddled lifestyle fantasies in the form of “prestige” real estate high in the sky.

They worked so hard, these strivers, and all three have told us many times in many ways that they have lived the American dream. Underlying their shifts from commerce to politics is the premise that the skills one develops in business translate more or less directly to the political realm. Trump is a case in point, demonstrating in the White House the same executive flair he showed in managing his Atlantic City casinos. Similarly, the competence Bloomberg displayed in building Bloomberg LP from “four guys and a coffee pot” to a multimedia empire with $10 billion in revenue has neatly carried over to politics. During his three consecutive terms as mayor of New York (2002–2014), the city became greener, safer, and healthier. The public schools, long a disaster, showed marked improvement. He led the city through the aftermath of September 11 and the financial crash of 2008, and balanced the budget in good times and bad.

In 2008, 2016, and again in the current election cycle, Bloomberg mounted what were perhaps the most strenuous—almost certainly the most expensive—presidential noncandidacies in American history. By late last year, he had his core team and a sophisticated data operation in place for a 2020 run, and was making campaign-style appearances across the country. Politico reported that Bloomberg’s “Plan A” for 2020 envisioned him running for president as a Democrat, while under “Plan B” he would participate only as kingmaker, deploying his considerable resources—staff, data, campaign infrastructure, as well as his heavy checkbook—on behalf of the eventual Democratic nominee. In early March he opted for “B,” and has vowed to spend a “floor” of $500 million to prevent a second Trump term.1

Schultz, like Trump, has eschewed entering politics at the subpresidential level. Only the top job is capacious enough for his vision, a display of hubris seemingly at odds with his belief in humility as an essential component of effective leadership. The rancor that greeted the launch of his precandidacy seemed to surprise him, but he has plunged on, dismissing concerns that his independent candidacy could be the spoiler that delivers a second term for Trump. Earlier this year, Schultz took the standard precandidacy step of releasing a new book, From the Ground Up: A Journey to Reimagine the Promise of America. Around the same time, Bloomberg offered a retread of his 1997 memoir, Bloomberg by Bloomberg, “Revised and Updated.” Each man’s recounting of his life and career comes with an argument for an avowedly “centrist” politics, a proposed happy medium between ideological extremes. The presidency itself is a long shot for Schultz, a nonstarter for Bloomberg,2 but thanks to their money and ambition they will be factors in 2020, attempting to pull the body politic toward their versions of the center. Much rides on whether we buy what they’re selling.

Wall Street, markets, moguls: these are mainstream American culture now, but back in 1966, it was possible for a student at the Harvard Business School to have no clear notion of the business transacted on Wall Street. With twelve weeks to go before graduation and his plan of joining the army blown by flat feet, Michael Bloomberg found himself with no job and no leads.

Go to Wall Street, a worldly classmate advised. Go interview at Salomon Brothers and Goldman Sachs, tell them you’re desperate to be an equity trader.

“Who are they?” asked the middle-class kid from Medford, Massachusetts. “What would I be doing?”

“Don’t worry about it,” said the friend. “Just do it.”

Bloomberg would spend the next fifteen years at Salomon Brothers, a saga he tells to good effect in the chapter “Capitalism, Here I Come,” which, like many of the chapter titles in Bloomberg by Bloomberg—“I Love Mondays,” “We Can Do That,” “‘No’ Is No Answer,” “Money Talks”—could be tunes in an Eisenhower-era Broadway musical of the Horatio Alger story. As an equities trader specializing in the new, highly lucrative market for “block trades” of corporate stock, Bloomberg thrived amid the big egos, sharp elbows, and short tempers of Salomon’s open-plan trading floor.3 He was “the fair-haired boy, the block-trading superstar in the most visible department of the trendiest firm on the Street,” and “more than ‘a legend in my own mind.’” Thus his shock on being passed over for partnership,4 a humiliation that inspires something like poetry in his prose. After sweating out his angst on an evening jog along the East River, the young trader resolved to stay the course. The next day he went to work and closed one of the biggest trades in the firm’s history. “I dotted every i, crossed every t. I focused. I worked. I smiled. I dialed…. I would be as good at not making partner as I was aiming to be one.”

Advertisement

Three months later, with no explanation given, he was voted into the partnership. He would remain at Salomon for nine more years, until 1981, when he was summarily fired prior to Salomon’s merger with the Phibro Corporation (the chapter on his exit, a crucial moment in the Bloomberg self-mythology, is titled “The Last Supper”). After flying high through most of the 1970s—at one point he was head of all stock trading—his career had stalled as the industry changed and in-house rivals gained the upper hand. During his final two years, he was relegated to running the firm’s information systems, the investment banking equivalent of Siberia. Unbowed, Bloomberg agitated for a firm-wide computer system and ambitious upgrades, and insisted to his bosses that he “could run the goddamn company better” than they could. It’s no great stretch to imagine that by 1981, the senior partners at Salomon might well have had a bellyful of Mike Bloomberg.

He admits to being “sad” about his firing, then declares, “I never look over my shoulder,” a somewhat startling assertion to find in the first chapter of a memoir. A $10 million payout from Salomon softened the blow; he deposited $300,000 of that in a corporate checking account (ultimately he’d pour $4 million of his own funds into the new company), and, with the help of several former protégés from Salomon, began building the machine that would revolutionize financial markets.

Bloomberg is at his most engaged and genuine in these chapters, and though the verbiage sometimes trips over itself (“When you start a company, every obstacle is a challenge”), he delivers a vivid account of how “the Terminal,” as the mighty machine came to be known, was developed. From his years at Salomon he knew two things: how financial markets worked, and what technology could do for people buying and selling in those markets. Existing technologies were little more than electronic ticker tapes with few computational features. Bloomberg and his team set out to create a machine that would capture and digest financial information in an ever-expanding database that ordinary people could use to make customized investment calculations. The timing was especially auspicious for bonds. Unlike stocks, no exchange listed the price of a bond in a single place, and the Terminal, aka “the Bloomberg,” was developed just when whipsawing interest rates and exploding government deficits were making bonds every bit as volatile as stocks.

Bloomberg is good at describing what may be the core experience of the entrepreneur: the grind of living on nerves and adrenalin for months or years at a time. He freely cops to the fear, the spasms of panic and hopelessness that come from staring failure in the face all your waking hours, but we get the thrill of it too, the headiness of trying to pull off something daring and new. “Those were the best days,” he says of the scrambling early years of the company. “We improvised everything…. I used a screwdriver as much as a pencil.” From the first delivery of twenty-two relatively crude machines to Merrill Lynch in 1983, the Terminal would eventually become standard equipment on the desks of the people who move and control the world’s money. The Terminal worked, brilliantly. It also had one of the world’s great salesmen pushing it, with Bloomberg aiming to “become the Colonel Sanders of financial information.”

The Terminal and the media empire it spawned have, of course, made Bloomberg a fabulously wealthy man. He is the eleventh (or tenth, or ninth—he keeps moving up) richest person on the Earth planet, with a net worth of some $55 billion, and in turn he has become one of the world’s most prominent philanthropists, having given away, by his count, over $6 billion to date. In the book’s final chapter he narrates the course of a philanthropic career that has supported literally thousands of worthwhile causes. That this chapter is the most “revised and updated” from the 1997 edition makes a certain sense: Bloomberg has made more money and had more years to give it away.

What else has changed from the first edition? Not much. In tacit acknowledgment of past sexual discrimination and harassment suits against Bloomberg LP, he has added a passage advocating gender equality.5 A comparison of his college fraternity to “the classic John Belushi movie, Animal House” has been removed. And as for the twelve years he spent being mayor of New York, a presumably transformative experience that should, more than anything, serve as our guide to the manner in which Bloomberg will continue to influence our national life, we get all of a couple of snoozy, pro forma paragraphs.

Advertisement

“Serving as mayor of New York for twelve years was one of the most rewarding experiences of my life.” This is about as deep as he gets. That rich history of crises, battles, causes, and policy choices, of change and experiment in the country’s biggest and arguably most fractious city—Bloomberg has virtually nothing to say about any of it. Is he above explaining? Or maybe it’s us, the little people—we just aren’t worth the effort of explaining to. There’s more than a whiff of arrogance here, but we do get a passage setting forth what might be called his philosophy of governance, recycled practically verbatim from the 1997 edition:

In a democracy, we need good, smart, hardworking people with management experience to run for executive office and run the government. Society is too complex for us to run things ourselves. Somebody has to bring us to a centrist consensus acceptable to most, with minimal imposition on those at the fringes. That’s what politics is all about.

If this passage coheres toward any discernible point, it seems not to bode well for participatory democracy. Too complex to run things ourselves. Somebody to bring us to a centrist consensus. The center, where might that be? Where we find the, uh, most? And the somebody who’s supposed to “bring us” there, by means of reason? Charm? Forcing it down our throats like a deworming pill for sheep? Might we—the most of us, that is, the center—rightfully claim some role in determining what is “centrist”? Much depends on where you stand, and for those of comfortable circumstance, the “center” is all too easily confused with the status quo.

The actual experience of the largest part of the country: Might this be our true center? The facts of our lives; where the main weight of our collective reality falls. For many years now the experience of the vast majority of Americans is that they’re working harder than ever for a steadily shrinking share of the rewards. The numbers on wages, income inequality, household wealth, and class mobility all show it. The metrics of medical and social science show it as well, in life expectancy, in maternal and infant mortality, in deaths from the “diseases of despair.” It shows up too in opinion polls, the steady boil of anger and resentment across the land. It’s not as if the US has suddenly become a poor country lacking resources, products, skills. There’s more wealth than ever. Productivity has never been higher. By virtually every measure the economy is booming.

Bloomberg’s reality, his experience, is that of a man who made a fortune on Wall Street. For many years his accustomed element has been the world of the very rich in which it’s no big deal to invite George Soros to lunch and ask him to “chip in” $30 million for a charitable cause. Bloomberg was and continues to be a rationalist, a devourer and digester of data who also possesses a robust social conscience, as shown by his tireless philanthropy. But for most of us, there’s a point at which personal identity prescribes the far reaches of our reason and empathy. It’s fair to say that Mayor Bloomberg had hit his limit when he compared living-wage advocates to communists of the late Soviet Union, or opined that whites were subjected to stop-and-frisk in disproportionately larger numbers compared to minorities, or claimed that the sharp rise in the population of the city’s homeless shelters was due to improvements in service, which made life there “a much more pleasurable experience.”

His limits were also on view when he absolved the investment banking industry of blame for the 2008 crash and defended the huge bonuses that bankers resumed pocketing a scant year or two later. Occupy Wall Street utterly bewildered him: he couldn’t fathom why a generation hemmed in by over a trillion dollars in student debt (thanks in part to Wall Street), a political system in many ways the captive of big money (thanks in part to Wall Street), and the worst economy since the Great Depression (thank you very much, Wall Street), couldn’t simply “get out there and…create the jobs that are lacking, rather than just yell and scream.” His development strategy envisioned New York as “a luxury product,” and his policies on zoning, housing, and infrastructure often favored elites at the expense of the working and middle classes.

In 2013, in his final budget presentation, Bloomberg made not a single mention of poverty. As Ken Auletta reported in The New Yorker, when asked why, Bloomberg answered, “No one has done more to help the poor than we have,” and he elaborated: 350,000 new entry-level jobs in tourism, 165,000 new units of affordable housing, and improvements in public education, “one of the keys to getting out of poverty.” Bloomberg’s claim may well be true. During his first and second terms especially, his administrations devoted substantial resources to developing long-term solutions to homelessness and poverty, and Bloomberg himself was said to have given some $320 million toward antipoverty efforts.

Yet by the end of his twelve years of pragmatic, conscientious, determinedly centrist governance, there were more poor people than ever in New York, and the working and middle classes were finding it harder than ever to get by. According to the city’s Center for Economic Opportunity, more than a fifth of New York residents lived below the poverty line, and another quarter were barely above it. The Fiscal Policy Institute reported that the number of people on food stamps in New York had risen by two thirds since 2007. Fifty thousand residents were homeless, up from an estimated 25,000 in 2000. Adjusted for inflation, median family income and the income of poor families had remained flat since 2000, whereas in the city’s eight highest-income neighborhoods, real income rose by 55 percent. Income disparity was greater than ever, and the institute declared that in the past thirty years there had been “no meaningful reduction in poverty” in New York. Between 1975 and 2007, real wages adjusted for inflation rose 1.1 percent in Queens, 1.7 percent in Brooklyn, 2.5 percent on Staten Island, 8.6 percent in the Bronx, and…96 percent in Manhattan.

Bloomberg’s politics promise no great disturbance in the political and economic apparatus that produced these conditions. He has ridiculed Senator Elizabeth Warren’s proposed 2 percent “wealth tax” on assets over $50 million (3 percent on assets over $1 billion), describing it as a “non-capitalistic” measure of the kind that has plunged Venezuela into chaos. He likewise opposes her proposal to break up the big Wall Street banks and has called Dodd-Frank, the financial regulatory law passed in response to the 2008 crash, “really dysfunctional.” “The trouble is if you reduce the risk at these institutions, they can’t make the money they did,” he has observed, a species of “trouble” that many Americans would no doubt welcome. He says that Medicare-for-all “would bankrupt us for a very long time,” skirting the fact that at least several hundred thousand of “us” are bankrupted every year by the current health care system. He fears that these sorts of progressive proposals will “drag the [Democratic] party to an extreme,” ignoring opinion polls that show clear majority support for expanded health care coverage. It’s all about the center for Bloomberg, the center as perceived by a secure, well-nourished, white billionaire. “Candidates who listen to voters in the middle are more likely to reach across the aisle and to get things done,” he advised Democrats at a dinner last fall.

Voters in the middle. The true middle, the center, the broad swath of reality where the largest part of Americans live, consists of flatlining incomes, grossly diminished opportunity, and growing anxiety and alienation. What Bloomberg proposes is not a politics of the center but a politics of the status quo, that of a system that has engineered the biggest redistribution of wealth—upward—in human history.

Halfway through Howard Schultz’s From the Ground Up, we encounter an extraordinary sentence: “In 2013, [Starbucks was] overdue for a new benefit, a new way to let our people know we cared.” At the time, Schultz was chairman and CEO of the specialty coffee company he bought in 1987 and grew into a retail colossus. Starbucks employees—called “partners” in the insistently democratizing idiom of the company—were already enjoying two benefits exceedingly rare in corporate America. Comprehensive health care coverage for part-time as well as full-time employees was part of the package virtually from the start. Within a few years Schultz again did the unheard-of by offering stock options—“Bean Stock” in Starbucks parlance—not only to upper management but to all employees, full- and part-time, at every level of the company.

“We were overdue for a new benefit.” Radical talk from an American CEO! The new benefit was the Starbucks College Achievement Plan, which provided employees with full tuition to Arizona State University’s online degree program. As the plan was being rolled out, a shareholder asked “if Starbucks was in the charity business.” No, replied Schultz, we’re “in the business of investing in people.” Starbucks’ number-crunchers had calculated that the company’s out-of-pocket costs would be recouped thanks to the diminished employee turnover that would result from the benefit. And so along with individual stories of uplift and triumph, Schultz offers hard numbers: employees in the college plan stayed one and a half times longer than average, were promoted at two and a half times the usual rate, and half of those who earned degrees remained at Starbucks despite having no obligation to do so.

We might think we’re in bromide territory of the “doing good is good business” sort, but Schultz is after bigger game. From the Ground Up is the record of a deeply earnest quest for meaning and purpose at the very heart of unapologetic corporate capitalism. In two previous books, Pour Your Heart Into It: How Starbucks Built a Company One Cup at a Time (1997) and Onward: How Starbucks Fought for Its Life Without Losing Its Soul (2011), he has written capably and often movingly of his hard-knocks upbringing in the Bayview housing projects of Brooklyn, and his journey from there to the stupendous success of Starbucks.

Much of that fashionably affirming narrative finds its way into From the Ground Up, but there’s a shadow over this book, a drizzle of malaise that could be called an American strain of existential angst. Nothing so dire as the French or Scandinavian versions—Schultz is too hooked on uplift for that—but the dread is palpable, dread spread thin, a condition he traces back to his chaotic family life in the projects. His father, Fred, a moody World War II veteran, bounced from one menial job to another. Schultz’s parents fought bitterly, usually over money. Bill collectors harried the family. Schultz’s chronically depressed mother called Fred “Mr. Horizontal” for all the time he spent napping on the couch.

Schultz is too alert to the complexity of things to reduce his success to the tale of a son redeeming his father’s failure. Surely that’s part of it, but to his credit he won’t leave it at that. The specter of Fred Schultz haunts this book, his humiliation, his anger, his enduring failure to provide. As a kid Schultz regularly had to bail out his parents by borrowing money from neighbors. When Fred broke his hip and ankle in a workplace accident and was subsequently fired, the family would have gone hungry if not for grocery deliveries from Jewish Family Services. Schultz writes:

Not having money isn’t just about a number in your bank account. It’s a blow to your body and soul. It can translate to a lack of security, a lack of opportunity, a lack of mobility, a lack of health, a lack of information, a lack of time, a lack of dignity. It can be as inescapable and suffocating as the air in our [Bayview] apartment on days when the money was tight and my parents were undone by their own anxiety and humiliation.

Money is never just about money. It’s about dignity, autonomy, the saving grace of self-respect. The existential problem—the problem Fred Schultz was never able to crack—is how to be more than a serf in America, more than a low-cost unit of labor in a system that, with its mandate for profit growth and ever-greater efficiency, seeks to reduce us to that very thing. Schultz recognized that Starbucks could be a different kind of company. Or maybe had to be different, if it was to fulfill his vision, even when it was the mere handful of stores that he bought and merged with his tiny Il Giornale brand. He rejected the “command-and-control” model of employer–employee relations and aimed instead to foster a culture in which workers were treated with “trust, mutual care, and honesty.” The kind of company his father never had the chance to work for. Although critics carped that Bean Stock and health care benefits for all were “overly generous or at least at odds with maximizing profit,” Schultz writes,

they were in fact engines that made our business model work…. We needed people who were invested in and proud of their work, happy to be there, excited to learn about coffee, and eager to serve customers. Investing in our partners and giving them a stake in the success of the business turned them into deeply invested collaborators in the mission of the company.

“Not every decision is an economic decision” is a favorite Schultz refrain. Wise words for living, but a dangerous line for the CEO of a publicly held, for-profit US company. As a matter of corporate law and the long-standing principle of fiduciary duty, management’s decisions must redound to the benefit of a company’s shareholders. This concept hardened during the 1980s with the ascendence of Milton Friedman’s “agency theory,” which directed management to maximize shareholder returns—in hard dollars and cents—to the exclusion of virtually all other considerations. Schultz’s vision for Starbucks put him at the fringe of contemporary orthodoxy, and recalled an earlier era in which the corporation was regarded as “a public trust”—the phrase is Franklin Roosevelt’s—a social construct combining a broad array of stakeholders. Just as employees, customers, suppliers, and communities contribute to the value created by a company, so their interests must be considered alongside those of shareholders.

Schultz takes pains to link Starbucks’ social activism to the well-being of its bottom line. Generous employee benefits serve to get and retain the best workers. Fair-trade sourcing and conservation help preserve the supply chain. Charitable giving and community service boost the company’s “reservoir of trust.” But as the years went by, Schultz’s veer from orthodoxy became increasingly pronounced, and in 2014 he put the issue literally center-stage, presiding over that year’s annual shareholder meeting with these words projected on a giant screen at his back: WHAT IS THE ROLE AND RESPONSIBILITY OF A FOR-PROFIT PUBLIC COMPANY?

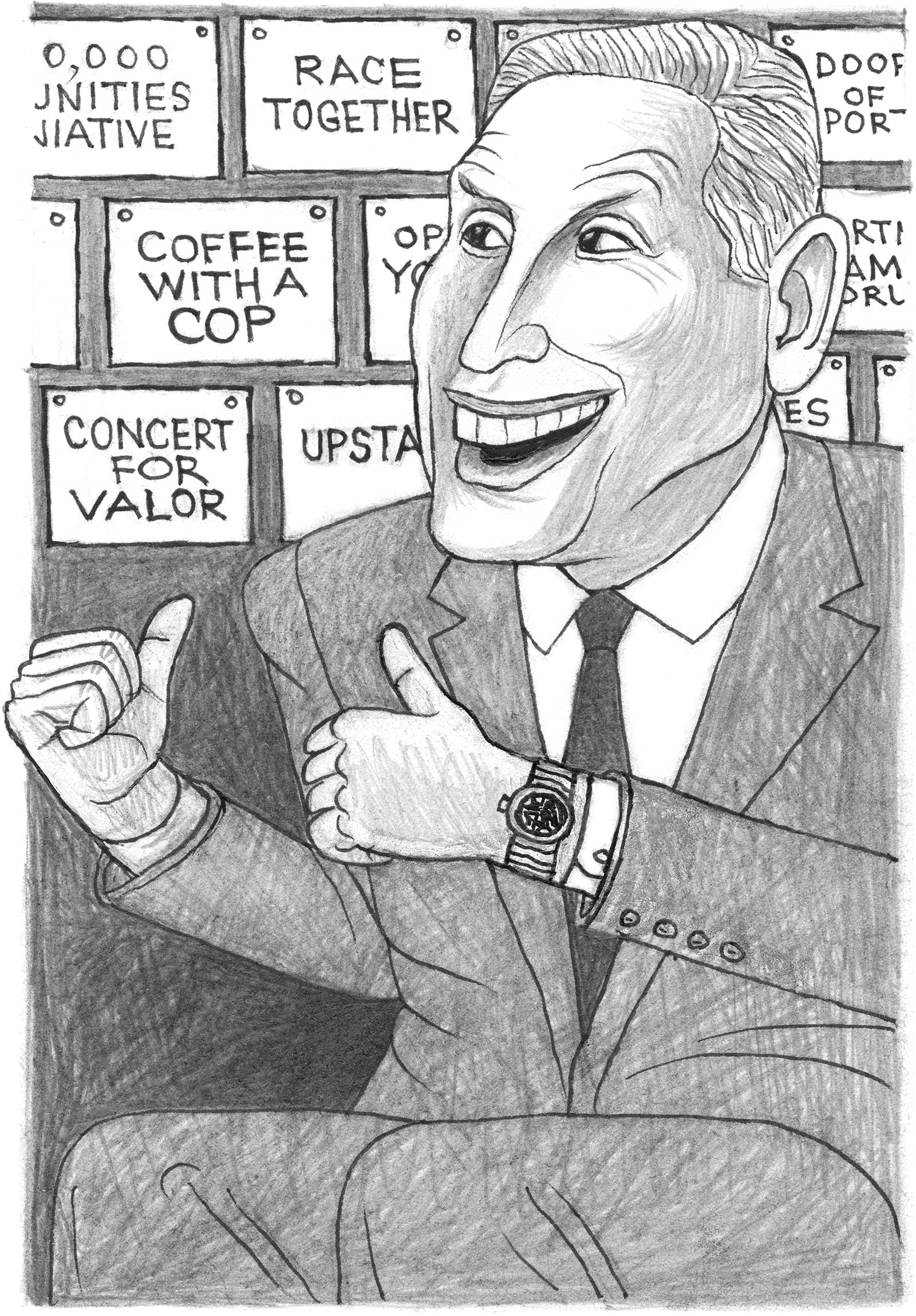

“That question,” Schultz writes, “implied a company’s role in society went beyond making money.” People have been burned at the stake for less. By then Schultz and Starbucks were in full activist mode, a process that started mildly enough on election day 2008, when stores offered free coffee to people who said they’d voted. Schultz’s frustration with the debt-ceiling showdown in 2011 led him to publish open letters and hold a call-in town hall that was streamed online. Then came the Create Jobs for USA program, the petition drive protesting the 2013 government shutdown, and the initiative to hire 10,000 veterans and active-duty spouses within five years. Next up was the Veterans Day “Concert for Valor” fund-raiser on the National Mall, followed by the “Race Together” effort to spark dialogue on racial issues, Coffee with a Cop, the 100,000 Opportunities Initiative (job fairs for “opportunity youth” across the country), the “Upstanders” video series, investigations into economic hardship and opioid addiction in Appalachia, Partner Family Forums and parental health care assistance in China, the drive to hire 10,000 refugees worldwide in response to Trump’s Muslim immigration ban, and more initiatives on racial awareness following the Charlottesville riot in 2017 and the unlawful arrests of two young black men at a Philadelphia Starbucks in 2018.

Employees live at the mercy of their boss’s enthusiasms. One can imagine how Starbucks’s rank-and-file might greet each initiative from their energetic CEO with a certain forbearance; how the directive to write “Come Together” or “Race Together” on dozens of cups during the morning rush, or even to solicit conversations on four hundred years of white supremacy, may be a burden on low-wage workers who are already at their limit just trying to get through the day. For all of Schultz’s management innovations in pursuit of transparency, fairness, respect, and the like, the American corporation is, in the end, a “command-and-control” type of beast. So much power on one side, so little on the other. It’s a model that applies less readily to participatory democracy than our CEO class seems to think.

“America really is the land of opportunity,” Bloomberg gushes in Bloomberg by Bloomberg. “Those doors of opportunity are what the American dream is all about,” he elaborated in a recent speech. “It’s about getting the chance to fulfill your potential, and to accomplish something for yourself.” For Schultz, the “American Dream” is similarly rooted in opportunity—“having access to opportunities like education and good jobs, healthcare and ownership…. Opportunity shows up as luck, but is also embedded into our social, governmental, and corporate constructs.”

By Schultz’s own analysis, that opportunity has become slim to nonexistent for a critical mass of his fellow citizens. Extreme wealth inequality, substandard public education, $1.5 trillion in student debt, uncertain access to health care, widespread opioid addiction, the ghettoization of millions of young people, especially those of color: these are among the opportunity-killers that prompted him to step away from Starbucks in 2018 and seek to make change on a broader scale. Even to seek, perhaps, as an “independent centrist,” the presidency.

And so we arrive at an unhappy irony. The man whose conscience inspired him to run his company as an agent of social change has put forward a retrograde “centrist” agenda that seems lifted off a talking-points memo from the Democratic Leadership Council, circa 1995. “We have to go after entitlements,” said the former CEO who once insisted on access to health care and college for his employees. Entitlements, one presumes, such as Social Security, Medicare, and Medicaid, the kinds of programs that save millions of American families from financial disaster. Schultz believes that Medicare-for-all is “unaffordable,” and has gone so far as to say that Democratic candidates’ proposals for tuition-free college and universal health care are as “false as President Trump telling the American people…that the Mexicans were going to pay for the wall.”

This man whose personal fortune is currently valued at $3.6 billion called Senator Warren’s wealth tax “ridiculous” and “punitive,” and dismissed as “misinformed” Representative Alexandria Ocasio-Cortez’s proposal for a 70 percent marginal tax rate on income over $10 million a year. Schultz has refused point-blank to say whether he favors any increase in taxes on corporations or the wealthy. He does, however, regard the $21 trillion national debt as “the greatest threat domestically to the country.” Debt reduction, and the austerity measures that such a policy necessarily entails, would be a top priority for his White House, and the demands of austerity would naturally limit government’s ability to deal with the very problems that prompted him to consider running for president. To fill the breach, he would appeal to the patriotism of corporate America. “Businesses and business leaders will have to do much more to solve the country’s problems,” he has said, and he vows to persuade CEOs to accept a “moral obligation and responsibility” to do “more” for “employees and the communities they serve.” For anyone wondering if corporate America has suffered a sudden outbreak of social conscience, its use of the billions in windfalls from Trump’s tax cut for huge stock buybacks, as opposed to the investments in people and infrastructure that were the stated justification for the cuts, should put that question to rest.

Schultz, like Bloomberg, mistakes “centrist” for status quo; the disconnect is wide enough to run an interstate through. He tries to fill that gap with a putty of malleable rhetoric about values, leadership, compromise, and consensus-building, embracing country over party and ideology.6 He seems quite taken with the concept of “servant leadership.” He believes “there are common-sense solutions on both sides of the aisle if people would come together and remove their self-interest and their ideology,” but he omits any reckoning with the billions of dollars in dark money that have done so much to corrupt our politics. The lobbying industry and the tremendous power of well-financed special interests are likewise absent from Schultz’s discourse. For all the respect and resources he has admirably devoted to veterans, he offers no thoughts on reining in the profit motive that underlies our relentless war-making, nor on the gargantuan costs the country incurs on behalf of the military-industrial complex. While he has made real efforts to educate himself on the four-hundred-year legacy of white supremacy, he is silent on the profound structural and financial remediation needed to reverse that legacy. His analysis of the economic challenges that working Americans face has so far failed to account for the enormous power of corporate monopolies, and fails as well to grapple with the outsized power of the banking and financial industry that nearly destroyed the global economy in 2008.

But in so many ways, Schultz gets it. He’s alive to what’s happening in the country’s true center, and the crisis he sees there is sufficiently grave that he calls for nothing less than the “reinvention” of America. For inspiration, he travels to Gettysburg, site of the pivotal battle in the war that produced the country’s first reinvention, the abolition of slavery. There, in the company of a Harvard Business School professor—a specialist in “leadership”—he tramps the fields and hills of the old battlefield. He reflects on Lincoln’s Gettysburg Address, which, he and the professor agree, articulated a “reframing” of “the true promise of America,” a promise first expressed in the Declaration of Independence’s assertion that all men are created equal.

The scene triggers another uplift riff for Schultz, proof that societies can “emerge better versions of ourselves,” but when it comes to the hard realities of a new reinvention, he offers sweet nothings. “Shared accountability,” “blending ideas,” consensus and compromise, but precious little by way of reforming our current structures of command and control. The rich, the powerful, and the comfortable would be little troubled by a Schultz presidency. He lionizes Lincoln while managing to overlook just how radical and stubborn the sixteenth president was. The abolition of slavery was hardly a triumph of consensus politics. Consensus had happened a decade earlier: that was the Compromise of 1850, and it was a moral and political failure of the first order.

“We must reimagine the promise of America,” Schultz writes. “How? By using empathy.” Bloomberg, too, plugs empathy throughout his chapter on philanthropy. Like Schultz, he has put a great deal of money where his mouth is, but for all their earnest conviction and social conscience, each man’s politics falls short on its own terms. The habits of identity and ego are hard to tame. Perhaps only radical empathy can do that, a leap of fellow feeling so profound that it shatters the boundaries of identity. Abraham Lincoln made the leap, and was accused—a charge still current in certain quarters—of being a traitor to his race, just as a later radical empathist, Franklin Roosevelt, would be called “a traitor to his class” for the national reinvention known as the New Deal. Traitor. Bloomberg and Schultz have yet to earn that honorable title.

-

1

See Marc Caputo, “Michael Bloomberg’s $500 Million Anti-Trump Moonshot,” Politico, February 13, 2019. To convey the mind-boggling scale of Bloomberg’s intentions, Caputo notes that the $500 million commitment is roughly $175 million more than Trump’s campaign spent for the entire 2016 election cycle. ↩

-

2

Recent reports, however, indicate that Bloomberg is reconsidering his decision not to run. ↩

-

3

“The most commonly heard word above the chaotic cacophony of the trading floor was ‘fuck.’” Chris McNickle, Bloomberg: A Billionaire’s Ambition (Skyhorse, 2017), p. 2. ↩

-

4

Perhaps his colleagues were less surprised. “Mike was snippy, a little bit of a wise-ass kid, smart, knew all the answers,” a senior Salomon partner would recall. See Joyce Purnick, Mike Bloomberg: Money, Power, Politics (PublicAffairs, 2009), p. 31. Bloomberg remembers berating himself at the time of the debacle: “I knew I shouldn’t have been so arrogant.” ↩

-

5

Of the three sexual-harassment lawsuits filed against Bloomberg and Bloomberg LP prior to 2001, one was settled, one was dismissed, and one was withdrawn. More than eighty women joined in a class action lawsuit alleging sexual discrimination against Bloomberg LP in the years 2002 to 2009. This suit was dismissed in 2011. See David Chen, “Discrimination Suit Against Bloomberg LP Is Rejected,” The New York Times, August 17, 2011. ↩

-

6

For example, when asked how he would improve the Department of Veterans Affairs, Schultz offered no specifics, saying instead, “I will fix the VA, because it’s about leadership, it’s about character, and it’s also about the temperament of humility to listen to people who are smarter than you.” ↩