What is a human life worth? That is an impossibly abstract question, so let’s ask a more concrete one. Suppose that while walking home at night, Mary Jones, a forty-year-old doctor, was killed by a negligent driver who was texting and not looking at the road. Suppose that Jones’s widower and children sued the driver, claiming that he committed the tort of “wrongful death” and seeking damages. How much money should they get?

The legal system offers some answers: Jones’s family should receive an amount to compensate for the “pain and suffering” that she experienced before her death; the cost of any medical treatments she may have had as a result of the accident; funeral expenses; and the earnings that the family would have received as a result of Jones’s “lifetime income.” The last amount is often the largest. Because Jones was a doctor and only forty years old, she would likely have earned a lot of money over the rest of her life, and her survivors would be entitled to it.

The wrongful death award would be a lot lower if Jones were seventy years old, with many fewer earning years left. It would also be a lot lower had she been a construction worker. From the standpoint of the legal system, that isn’t unfair. A doctor usually earns far more than a construction worker, and the point of the tort system is compensatory justice: to put people in the position they would have been in had the wrongful act not occurred. If Jones had not been killed but hurt, and had to take four months off to recuperate, she would have been entitled to receive lost pay for those months.

Some of these issues received a great deal of attention in the aftermath of the terrorist attacks of September 11, which killed nearly three thousand people. In response, Congress created the September 11th Victim Compensation Fund, which was overseen by Kenneth Feinberg, a highly respected arbitrator and lawyer. Feinberg came up with a compensation formula based on three factors: noneconomic value, dependent value, and economic value. The noneconomic value was equal for all: $250,000. The dependent value was also equal for all: $100,000 for a spouse, supplemented by an additional $100,000 for every dependent. Drawing on the approach in wrongful death actions, Feinberg based the economic value on the victim’s expected income, which meant that it varied with age and anticipated earnings. To avoid what some people might see as unjustly large payouts, Feinberg imposed an annual income cap of $231,000.

Turn now to government regulation. Suppose that the Environmental Protection Agency is deciding whether to impose more stringent limits on levels of arsenic in drinking water. It is considering two main options; let’s call them More Stringent and Much More Stringent. More Stringent would prevent thirty annual deaths and would cost $200 million. Much More Stringent would prevent forty annual deaths and would cost $600 million. Should the EPA stick with the current limits? If it should raise them, which option should it select?

According to long-standing US government practice, it should select More Stringent. The reason is that regulators value a life at about $10 million. More Stringent provides “net benefits” (benefits minus costs) of $100 million, so it is a clear winner. The benefits of Much More Stringent are $200 million lower than the costs, so it is a clear loser. (I am assuming, for the sake of simplicity, that Much More Stringent does not have any other benefits, such as reduced nonfatal illnesses.)

It’s necessary to clarify that regulators are at pains to say that they are not really valuing a life at $10 million. Instead, they are valuing a “statistical life,” and more precisely assigning a monetary value to the elimination of a mortality risk. Suppose, for example, that because of the current level of arsenic in drinking water, most Americans face an annual mortality risk of 1 in 100,000. Suppose that with more stringent regulation, we could eliminate that risk completely. How much should we pay to do that? If the answer is $100 per person, then the value of a statistical life is $10 million ($100 multiplied by 100,000).

But how do we know that the answer should be $100 rather than $10, or $1,000, or $10,000? Regulators use two kinds of evidence. The first involves “stated preference” studies. You can ask people how much they would be willing to pay to eliminate a mortality risk of 1 in 100,000, and you might get a median answer in the vicinity of $100. But stated preference studies have a host of problems. The questions are purely hypothetical, and people may not give serious or thoughtful answers to hypothetical questions. Even if they do, many people do not have the easiest time with probabilities and with the concept of an annual mortality risk of 1 in 100,000.

Advertisement

With this problem in mind, US regulators prefer what are called “revealed preference” studies, which investigate economic markets and try to figure out how much people are actually paid to face various mortality risks. Such studies include research on “wage premiums,” which assesses how much American workers receive, in extra salary per year, when they face an annual mortality risk of 1 in 100,000. Suppose that, on average, the answer were $100. If workers demand and get that amount of money to face that kind of risk, maybe that’s the right number for regulators to use. Yet a worker’s decision to take or refuse a job depends on a large number of factors, and if construction workers choose to take a job with a low-probability risk of death (such as 1 in 100,000), does it really make sense to say that they are consenting to that for a specific amount in return? If the aggregate evidence shows that American workers usually get $100 for a risk of 1 in 100,000, can we also assume they are adequately informed? Maybe not. After all, no one is likely to hand them a piece of paper stating, in bold letters, “WE ARE PAYING YOU AN EXTRA $100 BECAUSE THERE IS A 1 IN 100,000 CHANCE THAT YOU WILL DIE ON THE JOB. IS THAT ENOUGH?”

Many regulators are aware that revealed preference studies are far from perfect. They emphasize that we have to start somewhere—and that the figure of $10 million per life is at least consistent with the imperfect evidence we do have. They might add that whenever they decide on the right level of stringency, they are at least implicitly assigning a value to a human life. If arsenic regulators, for example, choose the status quo, More Stringent, Much More Stringent, or anything else, they are inevitably making some judgment about how much should be spent to save lives.

Turn now to a different kind of question, involving not regulation but expenditures, funded by taxpayers. Suppose that in recent years about seven hundred people died annually in road accidents in Ohio. Suppose too that by relocating and improving the roads in various ways, officials could cut that number down to about five hundred. If the relocation and improvement project would cost $200 million, is it worth doing? What if it would cost $800 million? Does it matter if most of the people who die in road accidents are young? Does it matter if most of them are poor? Questions of this kind have very much come to the fore during the Covid-19 pandemic. Restrictions reduce deaths, but they also impose costs. What are the right tradeoffs? Does human life have a price? And if it does, who gets to decide what it is?

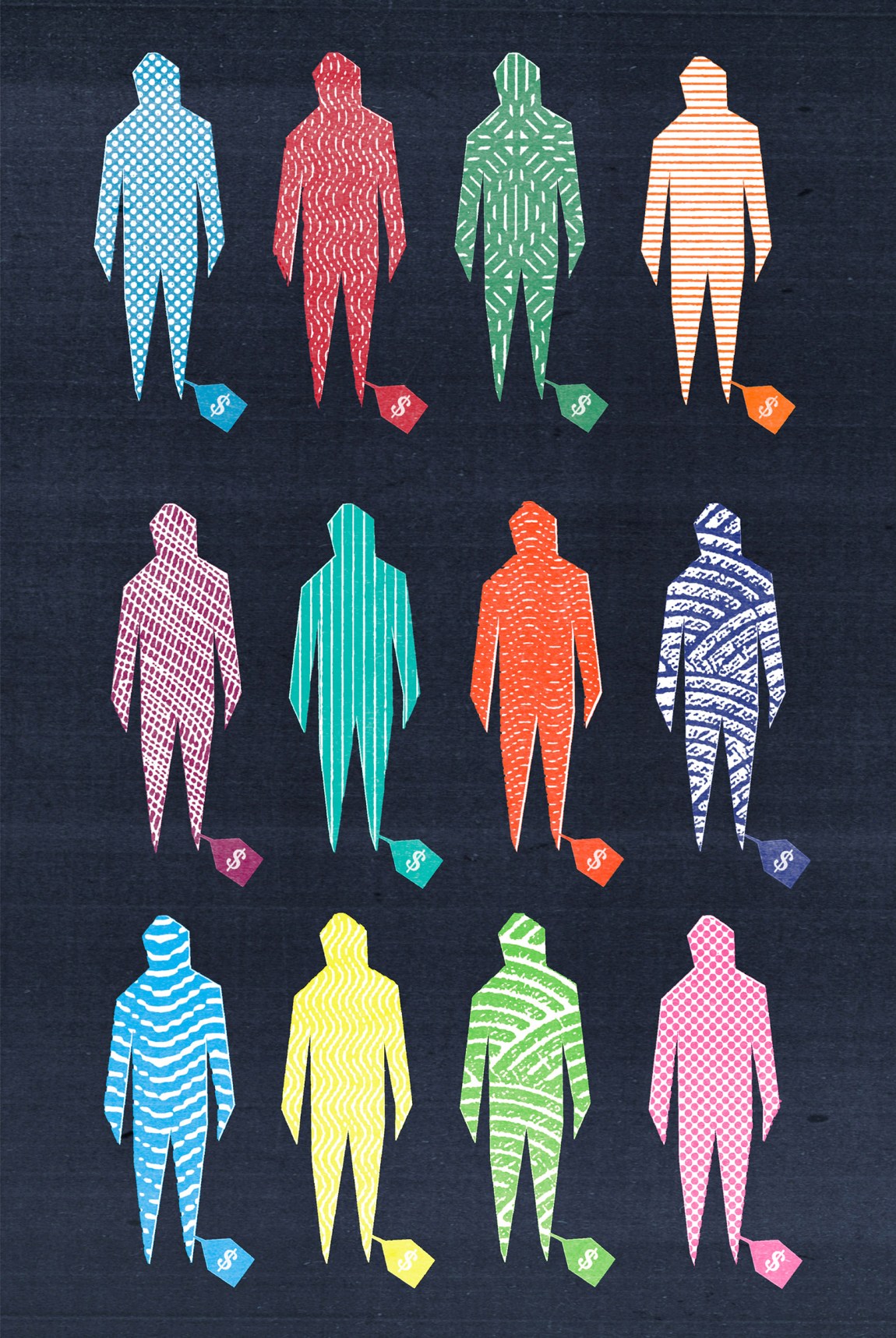

In Ultimate Price, Howard Steven Friedman evaluates the diverse efforts in the US to assign a monetary value to human lives. Written before the pandemic, the book turns out to be unexpectedly timely. Friedman’s first goal is to promote transparency. He wants people to understand that even if we insist that human lives are priceless, public and private institutions do in fact put a price on them, and they do so very differently in different circumstances. Friedman’s second goal is at once critical and constructive. He believes that the price is often too low and arrived at unfairly, and that “this lack of fairness is critical since undervalued lives are left underprotected and more exposed to risks than more highly valued lives.” He argues that our practices “are infused with gender, racial, national, and cultural biases,” which means that we “often value the lives of the young more than the old, the rich more than the poor, whites more than blacks, Americans more than foreigners, and relatives more than strangers.”

The September 11th Victim Compensation Fund is one of his defining examples. In Friedman’s view, the best compensation formula would have been based on a judgment that is simple and easy to apply: “Value all lives the same.” “Murder is murder,” he writes. The Declaration of Independence proclaims that “all men are created equal,” while the Fourteenth Amendment guarantees “the equal protection of the laws.” As he sees it, equal protection means that every claimant should have received the same amount, and the victim’s expected lifetime income should have been deemed irrelevant.

With fairness as a central goal, Friedman likes the idea of a value of a statistical life insofar as it is the same for everyone: the $10 million figure does not vary whether you are young or old, rich or poor, black or white. At the same time, he does not think there is much evidence for that particular number. He doubts that surveys tell us much, and he is deeply skeptical about revealed preference studies, emphasizing that when workers take jobs, they are not making informed tradeoffs about mortality risks.

Advertisement

More broadly, Friedman objects to the standard practice in wrongful death cases of emphasizing lifetime earnings. He rejects the idea that the spouse of a wealthy executive who was in his fifties should get much more money than the spouse of someone who was unemployed and elderly. He notes that to the extent that women are paid less than men and people of color less than whites, use of lifetime income in wrongful death actions will embed inequalities. As Friedman puts it, “The courts’ reliance on economic losses suggests that a person’s life is limited to a simple cash flow analysis,” which is, in his view, “inconsistent with basic principles of fairness and human dignity.”

The criminal justice system is different from the tort system, in that it aspires to treat everyone the same. If you kill a poor person, you are not entitled to more leniency than if you kill a rich person. Friedman is of course aware that prosecutors are seeking to punish wrongdoers, not to give economic compensation to the families of victims, but he rightly suggests that by investigating how murders are treated, we can learn a lot about how human lives are valued in practice. In fact, he shows, “some lives are more valued, and consequently more protected, than others.” If you kill a white person, you might be punished more severely than if you kill someone of color. And if you kill a homeless person, you might be treated more leniently than if you kill a wealthy businessperson. Considering a series of hypothetical examples, Friedman shows that we can test whether we really do have “equal protection of the laws” by asking whether some victims’ lives matter more than others.

He is also interested in private-sector decisions. As he points out, companies frequently must decide how to handle known risks and whether to spend money to try to eliminate them. In his account, automobile companies, pharmaceutical companies, food manufacturers, and others tend to focus on how much they might lose in court if they were sued for harm caused by their products, which means that they project likely judgments in civil suits in order to put their own price tag on human life. Survivors often do not sue at all, and when they do, they may get a lot less than $10 million—which means, in Friedman’s account, that the private sector ends up doing far less than it should to protect lives. He does not offer a lot of data on what companies are actually doing or a clear sense of appropriate reforms here, but he has no enthusiasm for the status quo: “Brutal pursuit of profits, unfettered by legal and moral restraints, can lead to unnecessary suffering and deaths, destruction of the environment, and a pathologically short-term perspective.”

His basic conclusion is simple: “Estimates of the value of human life are riddled with injustices.” He respects the work of economists who seek to come up with such estimates—Friedman himself is a data scientist and health economist at Columbia University—but he thinks that the methods they use “are not unimpeachably scientifically objective but rather are highly subjective.” He contends that the various prices assigned to human lives should be high enough to provide sufficient protection and that, too often, they are fundamentally unfair: “No situation should exist where unequal valuing of human life leads to the denial of basic human rights.”

Friedman deserves a great deal of credit for exploring a wide range of situations in which public and private institutions assign a value to human life, and for analyzing the complex issues clearly. Many people have pointed to the problems with current methods for valuing statistical lives, but his discussion is unusually crisp, and it is illuminating to link regulatory issues with those raised by wrongful death actions and the criminal justice system. He is certainly right to say that some private companies give insufficient weight to the mortality risks associated with their products, and that we need regulatory safeguards to respond to that problem.

But to assess any particular set of practices, it is important to have some larger understanding of what, exactly, the legal system is trying to do. Friedman organizes much of his discussion, and much of his critique, by reference to large and abstract ideals: equal dignity, equal protection, human rights, and nondiscrimination. No one should doubt the importance of those ideals, but it is not at all clear how they can be brought to bear on the specific controversies he is exploring.

Consider wrongful death actions. You can believe in human dignity and the equal protection of the laws while also insisting that in such actions, dependents should receive (among other things) economic damages that are equivalent to what would have been the remaining lifetime income of the deceased. To be sure, the consequence is to give more to a family that has lost a forty-year-old breadwinner than to a family that has lost a seventy-year-old breadwinner. But that does not discriminate against old people; it simply reflects the goal of compensatory justice, which is to restore plaintiffs, to the extent possible, to the status quo ante. There’s nothing unfair, or discriminatory, about compensating people for their lost income. You might well also want to redistribute income from rich to poor, but wrongful death actions in court are not a sensible place for trying to do that.

In deciding how to regulate mortality risks, public officials are not working toward the goals of compensatory justice at all. Their task is risk management, and their goal is to promote social welfare. That goal can of course be understood in many different ways, but if regulators keep it in view, they will focus on the human consequences of various options and see that tradeoffs are inevitable. When considering new regulations to prevent traffic deaths or to make workplaces safer, public officials often ask: How many people would be helped, and how many people would be hurt? How much would people be helped, and how much would they be hurt? If they insisted on entirely eliminating deaths from automobile accidents or in the construction industry, they would save a lot of lives, but most people would agree that the price would be too steep; we might have to ban cars, and there might not be a construction industry at all.

One advantage of the $10 million figure is that it often spurs aggressive regulation. If an initiative would save five hundred lives, we’re speaking of $5 billion in benefits, which would justify a major expense. Still, Friedman is right to raise questions about whether $10 million is the correct number; among other things, it does not even try to capture the profound impact on family and friends of losing someone they love. But he offers little guidance about what would be a better number, or even about how we could go about identifying it. He appears to think that for the value of life, a higher number is generally preferable—but if we care about the human consequences of what government does, the issue is more complicated than that. Suppose that in the United States, regulators valued a mortality risk of 1 in 100,000 at $10,000 rather than $100. If so, we could end up spending an enormous sum of money on relatively low mortality risks, when we might do better to spend it on reducing poverty, combating climate change, or improving education.

With respect to the valuation of human life, a great deal of theoretical and empirical research is needed to investigate existing practices and to see how they might be improved. In the meantime, there is some urgent practical work to do. The death toll from preventable illness and injury is far too high. In recent years, more than 450,000 Americans died annually from smoking, more than 120,000 from not taking medicines as directed, more than 35,000 from road accidents, more than 18,000 were murdered, and more than 5,000 died on the job. We do not have to answer the hardest questions about the value of a human life in order to insist that both private and public institutions take bold steps to reduce those numbers.