In response to:

Free Markets, Besieged Citizens from the July 21, 2022 issue

To the Editors:

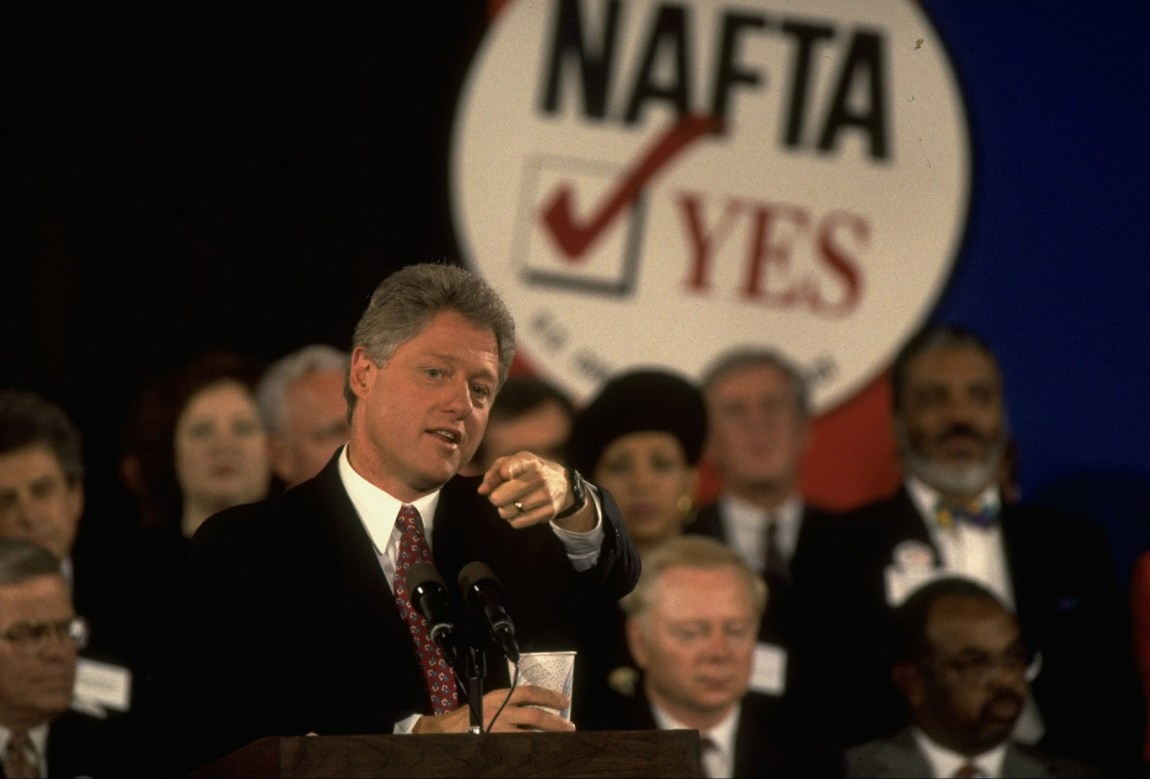

Robert Kuttner portrays much of recent Democratic Party governance, especially the Clinton administration, as “neoliberal,” an epithet for policies that he and the author under review, Gary Gerstle, consider a short step from laissez-faire in service to oligarchy [“Free Markets, Besieged Citizens,” NYR, July 21]. By so doing, the reviewer promotes a common meme on the left that Clinton’s “New Democrat” program (and later, most of Barack Obama’s policies) shortchanged growth, social spending, environmental protection, and just about everything important to middle- and lower-income Americans. These claims are demonstrably false.

For starters, Kuttner claims that growth under such neoliberalism has been “far less” than “between the 1940s and the early 1970s, when the economy was governed by principles of managed capitalism.” Kuttner is entitled to favor “managed capitalism” (never defined) but not to misstate the record. The real GDP data issued by the Bureau of Economic Analysis show that the US economy grew at inflation-adjusted average annual rates of 4.2 percent in the 1950s, 5.2 percent in the 1960s, 3.7 percent in the 1970s (including under the proto-neoliberal Jimmy Carter), 3.6 percent in the 1980s—and 4.0 percent during Clinton’s two terms from 1993 to 2000.

Similarly, the reviewer insists that “earnings and job security for most people stagnated or declined.” That happened under George W. Bush and for several years following the financial collapse. But it wasn’t the case under the “neoliberal” Clinton: real median household income in 2020 dollars increased from $55,263 in 1993 to $63,292 in 2000, or 14.5 percent after inflation, and unemployment fell from 6.9 percent to 4.0 percent. Similarly, the net worth of the median American family, adjusted for inflation, increased 41 percent from 1992 to 2001.

Kuttner also claims that “Clinton…made budget balance the centerpiece of his economic program, at the expense of social spending and needed fiscal stimulus.” Given the strong growth in the Clinton years, when precisely was more fiscal stimulus needed? The data also show that most social spending under Clinton increased at rates far in excess of inflation. The GDP deflator rose 15.2 percent over Clinton’s eight years, in which federal spending increased by 34 percent for transportation and 24 percent for the environment and natural resources.

On the environment, the reviewer also dismisses Democratic environmentalism as “neoliberal” for allegedly promoting market-oriented mechanisms that favored polluting companies. America’s most rigorous, nonpartisan environmental group, Resources for the Future, saw Clinton’s record differently, stating that “national evironmental targets were made more stringent” and “natural resource policy was heavily weighted toward environmental protection.” Kuttner also fails to mention that the Clinton administration proposed the first carbon (BTU) tax and negotiated and signed the Kyoto Protocol, the world’s first serious step to address climate change. (He also ignores Obama’s strenuous efforts on climate, including negotiating and signing the Paris Agreement.)

The reviewer further suggests that health care policies under “neoliberal” Democrats have favored corporations at the expense of middle-class and lower-income Americans, ignoring that Clinton proposed and fought for sweeping health care reforms built around universal coverage. Kuttner also doesn’t mention that Clinton passed federally subsidized insurance coverage for children (the CHIPS program) and increased Medicare spending by 65 percent and other federal health care spending by 56 percent, mainly Medicaid for lower-income people.

Similarly, the reviewer insists that Clinton favored “market incentives” over federal protections for retirement and income security. Yet under Clinton’s budgets, spending for Social Security increased by 34 percent, and benefits under the Earned Income Tax Credit, the federal government’s most important income support for working-poor Americans, increased by more than 50 percent.

Clinton’s only serious spending cuts came in defense: Pentagon spending remained flat at $291 billion in 1993 and $292 billion in 2000, and given the 15.2 percent inflation over those eight years, defense spending in real terms fell sharply.

Clinton’s policies, including substantial increases in discretionary domestic and entitlement spending, led to four years of budget surpluses because federal revenues increased sharply. Clinton’s tax changes raised the top income tax rate on high-income people from 31 percent to 39.6 percent and the top rate for the most profitable corporations from 34 percent to 38 percent. With those changes and the strong economy, annual federal revenues jumped 92 percent, from $674 billion in 1993 to $1,292 billion in 2000, including a 90 percent increase in corporate tax receipts from $102 billion to $194 billion.

However, the reviewer’s most fantastic claim around deficits and surpluses is that Clinton and Alan Greenspan had a secret bargain: “With major spending programs stymied [sic], Federal Reserve Chair Alan Greenspan offered [to] cut interest rates if Clinton cut the federal budget deficit.” Once again, the data totally refute Kuttner’s story: from 1993 to 2000, the Federal Reserve raised the federal funds rate fourteen times and lowered it just five times. On an annual basis, that rate averaged 3.0 percent in 1993, rose to 4.2 percent in 1994 and 5.8 percent in 1995, fell to 5.3 percent in 1996, rose again to 5.5 percent in 1997, fell again to 5.4 percent in 1998 and 5.0 percent in 1999, and then rose again to 6.2 percent in 2000.

The Clinton economic record includes its share of mistakes, most notably its agreement to leave financial derivatives unregulated. There is also a legitimate debate about the costs and benefits of trade liberalization under Clinton. As for the rest, the data tell the real story that your reviewer ignored.

Robert Shapiro

Undersecretary of Commerce for Economic Affairs, 1993–2001

Chairman, Sonecon Senior Fellow

McDonough School of Business

Georgetown University

Washington, D.C.

Robert Kuttner replies:

Robert Shapiro contends that the critique of Bill Clinton’s neoliberalism by Gary Gerstle and me is myth, a mere “epithet”; and in any case, Clinton’s policies were good for the economy. But as Gerstle demonstrates with precision, neoliberalism is a coherent ideology and set of deliberate policies intended to destroy the New Deal legacy of managed capitalism. Nor can this critique be dismissed as just “a meme on the left.” This history and Clinton’s central part in it have been well documented by scholars and journalists with no ideological agenda.

In a wonderful lapse, Shapiro writes, “The reviewer’s most fantastic claim around deficits and surpluses is that Clinton and Alan Greenspan had a secret bargain…: ‘Federal Reserve Chair Alan Greenspan offered [to] cut interest rates if Clinton cut the federal budget deficit.’” What’s astonishing is that Shapiro somehow missed this widely reported grand bargain, described in detail by Bob Woodward in The Agenda (1994) and Maestro (2000), confirmed in numerous other accounts, and not challenged by Greenspan or in Clinton’s own 969-page memoir, My Life. This deal was a centerpiece of Clinton’s entire economic strategy. How could Shapiro not have known about it?

Though Clinton delivered on his part of the bargain and made deficit reduction a central aspect of his program, Greenspan soon had other challenges. The main cause of Greenspan’s quirky monetary gyrations was the raft of economic problems created by Clinton’s other policies. That history is at the heart of what Shapiro misrepresents.

Shapiro excuses Clinton’s role in making budget balance the new Democratic credo, and in letting rapacious finance have its way with the economy, by pointing to the prosperity of the 1990s and crediting Clinton. The economy did grow rapidly, especially in the late 1990s. That in turn led to tighter labor markets and (temporarily) rising wages.

However, as extensive autopsies by reputable economists and journalists have revealed, this brief episode of prosperity was built on financial speculation and asset bubbles followed by crashes—the consequences of extreme financial deregulation. Clinton’s second term conveniently ended just before the reckoning came.

The asset bubbles included an unsustainable stock market boom, especially in tech. High asset prices led households, corporations, and banks to borrow more, increasing consumption. The dynamics of 1990s bubble prosperity have been well documented, including in “Disentangling the Wealth Effect,” a widely cited 2001 research paper by two senior (and non-leftist) Federal Reserve economists, Dean Maki and Michael Palumbo.

Clinton’s neoliberal policies also created foreign crises, further limiting Greenspan’s room to maneuver. The administration’s pressure on weak overseas economies to open themselves to a flood of speculative dollar inflows led to international credit bubbles followed by crashes. This damaging syndrome was well documented by the Nobel laureate Joseph Stiglitz in The Roaring Nineties (2003), and by numerous financial writers, notably in two authoritative books by Paul Blustein, formerly of The Wall Street Journal and the Brookings Institution—no purveyor of leftist memes. Greenspan was torn between his need to contain what he famously termed “irrational exuberance” by raising rates, and his need to bail out overextended banks, speculators, and entire countries by cutting rates.

Shapiro’s one token concession is to write, “The Clinton economic record includes its share of mistakes, most notably its agreement to leave financial derivatives unregulated.” But there was a great deal more to Clinton-led financial deregulation than credit derivatives. And contrary to Shapiro’s dissembling, Clinton, Robert Rubin, and Larry Summers did not passively agree “to leave credit derivatives unregulated.” They led the charge to liberate them and hobbled existing law. Shapiro’s strategy is praise by faint damnation.

Shapiro is selective with statistics to put the Clinton record in the most favorable light. Using Congressional Budget Office numbers, domestic discretionary spending fell from 3.4 percent of GDP in 1992 to 3.1 percent in 2000. Income security spending fell from 1.8 percent of GDP in 1992 to 1.4 percent in 2000. “Other programs” in mandatory spending fell from 0.6 percent of GDP in 1992 to 0.4 percent in 2000. More broadly, if you pull out Social Security, Medicare, and Medicaid, mandatory spending fell from 2.7 percent of GDP in 1992 to 2.2 percent in 2000. The growth record of the Kennedy–Johnson years in the 1960s, when real GDP grew by 5.0 percent, before neoliberalism infected the Democrats, was far superior to Clinton’s.

Shapiro is also selective when he mentions the Earned Income Tax Credit but doesn’t acknowledge Clinton’s deal with Republican House Speaker Newt Gingrich to drastically reduce welfare aid, which led to the protest resignations of three subcabinet officials. Clinton’s strategy of “triangulation”—making bargains with Republicans and bankers at the expense of what was once a Roosevelt party—destroyed the credibility of Democrats with working-class voters, a descent that ended with Trump.

Bill Clinton had an uncanny ability to survive personally, despite policies that were disastrous for his party and the country. I once described Clinton as the Typhoid Mary of American politics. He stayed healthy; those around him got sick. I urge readers to consult Gerstle, who is far more credible than Shapiro.