In recent weeks, The Federal Reserve has faced a growing dilemma. Janet Yellen, who became Fed chairwoman early this year, has appeared to support the expansive monetary policies that for the last five years have gradually helped the economy regain its footing. But she is under a lot of pressure from inflation hawks on the Fed’s Open Market Committee to raise interest rates. This would be a huge mistake.

Among the most prominent of the inflation hawks are Richard Fisher, President of the Dallas Federal Reserve Bank; Jeffrey Lacker, President of the Richmond Federal Reserve Bank; and James Bullard, President of the St. Louis Federal Reserve Bank. They consistently warn about inflationary pressures and the need for tighter monetary policies, regardless of the state of the economy. They have been wrong for years and they are wrong now.

Unemployment remains historically high, growth rates are still tepid, and what expansion we have had is fragile. And some economists—notably Paul Krugman, Laurence Ball of Johns Hopkins, and the progressive economists at the Economic Policy Institute—have strongly criticized the hawks. But they retain influence, especially because the media quote them frequently.

Since this summer, Fisher, Lacker, and Bullard have been urging the Fed to raise interest rates soon, if not immediately, and to end the program known as quantitative easing. (Quantitative easing involves buying longer-term bonds to push interest rates down, and has been a successful part of Fed policy to help the economy recover from the recession.)

It is far too early to start tightening policy, but to these three Fed presidents, who help set Fed policy, it is never soon enough. The three bankers do not always sit on the Fed’s Open Market Committee, where Fed policy decisions are made, but they are vocal about their hawkish views, and their comments have had wide reverberations in public debate.

It’s instructive, therefore, to examine what they were saying back in 2008, the year the economy slid into the worst recession since the Great Depression. The Fed did not cut interest rates that summer and failed to help save Lehman Brothers that September, in part due to over-optimism about the economy. By the fourth quarter of 2008, the nation’s Gross Domestic Product was falling at an annual rate of more than six percent. Consumer inflation was negative.

At the time, rising inflation should have been the last thing on anyone’s mind. But what were the inflation hawks saying during those calamitous months? Along with the seven governors of the Fed and a few other bank presidents, Fisher, Lacker, and Bullard participated in many of the Fed’s Open Market Committee meetings that year—the meetings at which decisions about interest rates and other policies, such as quantitative easing, are made. The complete minutes of the committee’s 2008 meetings were released earlier this year.

Let’s begin with Fisher, who this July said, “I believe we are at risk of doing what the Fed has too often done: overstaying our welcome by staying too loose too long”—in other words, apparently, we should raise interest rates as soon as possible.

Here are a few comments Fisher made at an Open Market Committee meeting in the summer of 2008 as the economy was collapsing:

The real bad news is that our patient appears to be acquiring a staph infection in this hospital that we have created, and that staph infection is inflation. I believe inflation is upon us. I believe expectations are discounting more inflation. Very importantly —and this is tough to get from the models—I believe that behavioral changes are beginning to manifest themselves. Now, some would argue that this infection is temporary and may well go away. Others will argue that it will be stayed by strong rhetoric. Still others say that it will require —I don’t know if it’s an antibiotic or an antidote—further tightening, lest the infection spread and counteract the good that we have done.

Fisher voted to raise interest rates in the summer of 2008, as the economy was plunging. He said at a meeting, “I think it is important to take a shot across the bow” to halt inflation. “I think we have to put some substance behind our words.”

Many economists have noted that employment is too weak these days to suggest there are inflation pressures. Wages in particular have not risen. To the contrary, they’re down several percentage points after inflation from mid-2009, when the recession technically ended. In a recovery, they should rise sharply.

But in the summer of 2008, Lacker criticized just such thinking as a failure to see signs of inflation ahead.

It is popular, as many have noted around the table, to cite the stability of compensation gains as evidence that we are not seeing a wage-price spiral. I have done it myself recently. But I share the concerns expressed [by some others] around the table about that being a lagging indicator. I am concerned that, if we wait until we see rising inflation expectations showing up as wage pressures, we will have waited too long. I noted in just a casual glance at the data from the 1970s that, although wage acceleration was a prominent component of the acceleration of inflation in the late 1960s, it was largely absent in the accelerations that occurred in ’74 and ’79.

Lacker doesn’t believe that the failure of wages to rise suggests inflation is not a threat. Wrong then, and probably wrong now.

Advertisement

As for James Bullard, he calls himself the “North Pole of inflation hawks,” according to an interview in Bloomberg News. In July of this year he too warned that inflation is coming back. Any unemployment rate below 6 percent will stimulate it, he believes. For him 6 percent is simply full employment. This is despite the fact that the unemployment rate fell below 4 percent in the late 1990s and inflation stayed low.

Times may have changed a bit concerning worker qualifications. Some businesses claim that jobs can’t be filled because of a lack of skills, contributing to a higher natural rate of unemployment. This has hardly been proved, given that wages are not rising. But is 6 percent really the new 4 percent? Surely 5 percent is a more plausible bottom.

Here are a couple of Bullard’s comments from mid-2008: The Committee “has put too much economic stimulus on the table and must think about ways to remove it going forward. Failure to do so will create a significant inflation problem on top of problems in housing and financial markets. Slack might be helpful… but those effects are small compared with expectations effects.”

Bullard did not want to raise interest rates at that moment, but soon enough. The Committee, he said, “has to think carefully about how and when to embark on a path for interest rates that will set us up to achieve price stability in a reasonable time frame. My sense is that this will require more-aggressive tightening of policy than currently envisioned in staff simulations.”

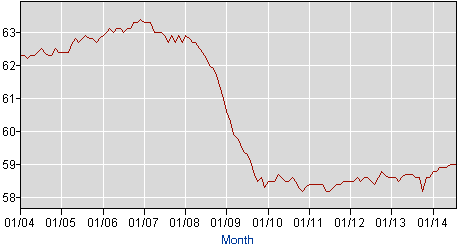

With an unemployment rate that is still above 6 percent and an employment-to-population ratio that has remained stubbornly low since the recession (see the above graph from the Bureau of Labor Statistics), now is no time to raise interest rates, or even suggest a rate hike is on the way soon. In addition, consumer price inflation is well below the Fed’s 2 percent annual target rate. The Fed should wait and continue its quantitative easing policy until there is evidence that the labor market has further strengthened, such as a stabilization, or outright increase, of wages.

As Janet Yellen sets out Fed policy in the weeks to come, it would be useful to remember how wrong these hawks were in 2008. If the Fed had cut rates in the summer of 2008, it’s possible the recession would not have been as punishing. But rates were not cut until October.

Despite a near perfect record of misses, these three economists are making influential public pronouncements again. Economists are entitled to mistakes, but many inflation hawks sound only one note. The public, policymakers, and the media should recognize not merely how flawed their judgment has been in the past, but that their conclusions are the same almost no matter the circumstances. This is hardly economic science and suggests not analysis but simple bias.