Even without LBJ’s death, January would have been a month of epitaphs for the Great Society. First the White House announced an unprecedented freeze on appropriated funds for public housing and sewage treatment. Then it proposed a budget liquidating the most ambitious social projects of the 1960s—a Republican version of the withering away of the state. Although total federal spending in the new budget will actually increase by $19 billion, that figure hides the degree of implicit retrenchment. Large increases would be necessary just to cover inflation. And most of the new money reflects no social priorities: $4 billion more for the military, $3 billion for debt servicing and veterans’ benefits, $10 billion for mandated Social Security increases (much of which the Administration had opposed).

Few domestic programs escape unscathed. Some are slated for outright extinction: community action, model cities, housing and hospital construction subsidies, local mental health centers, public works for depressed regions, direct subsidies to universities and libraries. Other programs will be weakened by fund cuts, revised administrative procedures, or diffusion of responsibility. Medicare patients will be forced to pay more for a day in the hospital. Federal education funds will be siphoned through state and local agencies; ceilings will be imposed on manpower training programs.

Liberals in Congress have attacked not merely the budget but the motives behind it. The President, they argue, has taken advantage of public irritability to create a spending package that is antiblack and antiurban. He has used the excuse of revenue shortages to unravel liberal programs, while squandering even more than the habitual billions on needless military hardware. But many liberal critics who have no use for Nixon’s motives have a more complex reaction to his plan to dismantle federal social programs. During the past few years a group of serious social scientists and technocrats, many of them former advisers to Kennedy and Johnson, have been finding fault with the spending programs of the Sixties. Their work, far from being an opportunistic response to a perceived public drift to the right,1 reflects a growing skepticism about the notion of meeting social problems with bureaucratic remedies.

The annual publication of the Brookings Institution study Setting National Priorities summarizes these discontents. Its authors are a sort of liberal cabinet in exile—Charles Schultze, for example, was Budget Bureau Director under LBJ, and Alice Rivlin was an Assistant Secretary at HEW. Their short essays on federal programs ranging from child care to strategic defense provide the single most authoritative guide available to the effects of federal programs.

The sober budget projections of the most recent volume received more attention than its muted criticism of liberal social programs. But the two are connected. Ten years ago projections of continuing economic growth promised an annual fiscal dividend of between $10 and $20 billion in the form of automatically rising federal revenues. That projected dividend was considered the best hope for Executive attempts to blunt conservative congressional opposition—new programs without new taxes. But two-thirds of the fiscal dividend was never collected because of tax reductions (notably the Kennedy tax cut of 1963); the other third was vastly overcommitted, not just to Vietnam but to increases in social security payments, welfare, Medicaid, and a dozen Great Society programs.

The dividend is likely to be equally elusive in the 1970s. Money saved on Vietnam—even if we cut off Thieu without a piaster—will be trivial compared to the cost increases built into business-as-usual at the Pentagon. Military planning is still based on the notion that we need strategic bombers as well as an enormous missile stockpile and a conventional armed force big and mobile enough to intervene in two wars simultaneously. What we save on Indochina will be spent twice over next year on the new Navy jet fighter, seventy-seven more F-15s for the Air Force, a new long-range missile, and a submarine to launch it. Add expected federal salary increases, Medicare inflation, and money for mandated programs including merchant marine subsidies, antipollution subsidies, transportation subsidies, and revenue sharing, and the painless growth of $120 billion in additional federal revenue by 1977 turns into an inevitable tax increase. Unless, that is, politicians have the will and courage to cut back drastically on military spending.

Against this background, the 1973 Priorities has been seen as a requiem for New Deal liberalism.2 Social programs designed by congressional committees and managed by the federal bureaucracy have proved to be very expensive; some of the new candidates—child care, comprehensive medical insurance—promise to be the most expensive of all. While Democrats may still be running for president with a shopping list, their prospective advisers are beginning to count pennies.

Ten years ago the answer to social problems seemed obvious—kiss it where it hurts. Not enough houses? Build some or provide tax incentives to those who will. Unemployed workers without skills? Train them to repair refrigerators. Polluted rivers? Subsidize municipal sewage plants. Billions of dollars later these problems haven’t begun to be solved. San Francisco’s new rapid transit system—featuring not merely spectacular cost overruns, but trains that overrun their tracks as well—is a model. You don’t have to be Lockheed to know how to waste money.

Advertisement

What went wrong? In some cases the failure can be traced to nothing more complicated than economic naïveté compounded by political opportunism. The simplest notions of economic efficiency have never been part of the intellectual tradition of public spending. When conservatives talked of efficiency they meant merely lower budgets; liberals avoided talk of efficiency altogether. The result, too often, has been a compromise: medium-size budgets and no results.

Federal water pollution programs provide a useful illustration. From 1956 to 1969, Congress poured over $1.2 billion into politically expedient subsidies for municipal waste treatment plants, making it even more attractive for industries to dump their waste free of charge. Dumping increased and rivers got worse.

Congress responded to the failure of small subsidies by voting larger ones. Then, prodded by the increasingly muscular environmental lobby, it voted some tough but grotesquely expensive regulatory standards. By 1985, the law says, all industrial dumping should cease. This is estimated to cost $316 billion (to be passed on to the public in higher taxes and product prices), while reducing pollution by 97 percent would cost only a third as much. And the result of enforcing the new standards will not be swimmable and drinkable water everywhere: fertilizer run-offs from agricultural lands will muck up the act’s industrial purism.

The year 1985 is a long way off, and the new legislation calls for interim goals in halting pollution. By 1977 all water polluters will be required to use the “best practicable” pollution control devices, and by 1983 the “best available” equipment. The Environmental Protection Agency is thus charged with setting and maintaining standards for what the Brookings study authors estimate are 40,000 types of water pollutants. For each, the EPA will have to determine the most effective control device and what cost the producer should be forced to bear. In short, more feeble “regulation” of the kind we have learned to expect from the FCC, the CAB, the ICC, and the FPC.

An earlier strategy was incorporated in proposals independently offered by Senator Edmund Muskie and the Nixon Administration. Rather than bog down the fight against pollution in regulatory battles over feasibility and equity, why not get everyone to cut the volume of dumping by a fixed percentage—say 90 percent? Such an approach has the advantage of being at least possible, but it is needlessly expensive. Some industries could virtually eliminate effluents cheaply; but others would require major technical innovation to reduce polluting discharges by as little as one-half. Hence the cheapest way to achieve any over-all goal is to cut wherever surgery is least painful. One study of the Delaware River puts the cost of across-the-board pollution reductions at twice that of other programs that would emphasize low cost solutions.

The water pollution proposals are not only drearily familiar, they also illustrate what public policy analysts have found offensive about federal economic programs. First, the goals of the water pollution program have never been weighed against other priorities—$316 billion would buy a lot of railroad cars for commuters, or, for that matter, a lot of protein for South Carolina textile workers. Then, Congress calls for measures that are politically expedient, pleasing to powerful corporations, but almost invariably inefficient—such as across-the-board discharge reductions. Finally, the enforcement mechanism is left cumbersome and vulnerable to political sabotage. The history of federal regulation makes it seem highly unlikely that a big EPA bureaucracy would represent the public interest any better than the Federal Communications Commission.

The Brookings proposal, which has long been supported by professional economists, is to get around the problems of waste and regulatory failure by taxes. Specific charges per volume of effluent would force polluters to clean up, or pay the bill for the damage inflicted on society. The higher the public standard for water-ways, the higher the tax. The Brookings authors estimate that a ten-cent tax per pound of Biological Oxygen Demand (a standard measure of effluent damage) would reduce Delaware River pollution to the levels imposed on the treatment of municipal sewage. Of course consumers will have to absorb the cost of this tax in the form of higher prices but the cost will be lower than with other schemes.

Reducing water pollution is a “new priority,” hastily adopted as the nation grew suspicious of the war on poverty. But programs to solve many of the “old priorities” suffer from similar defects. One of the Brookings economists, Henry Aaron, has written a lucid, analytical survey of federal housing programs since the 1949 congressional pledge to provide “a decent home for every American.” Housing has improved in recent years: only one house in twenty was without plumbing in 1970 as compared to one in seven in 1960. Blacks have gained as well as whites: 35 percent of nonwhites lived without running water in 1960, but only 14 percent suffer those conditions today.

Advertisement

These statistics are, however, poor measures of the success of federal housing programs. The current melange of construction programs, mortgage guarantees, rent and mortgage subsidies, and tax breaks cost the federal government about $8 billion annually. At present most of that sum consists of tax incentives for homeowners, who are permitted to deduct mortgage interest payments from their taxable incomes, a break unavailable to renters. Homeowners benefit from the virtually arbitrary notion in the tax laws that services they provide themselves aren’t income. If a man leases his house to a neighbor he would pay taxes on his income. But if he lives there himself the “rent” is tax free.

Aaron estimates that these two implicit tax subsidies have increased the amount of housing purchased by about one-fifth. Yet the distribution of these benefits brings into question why we have a housing program at all. Tax subsidies increase with the income of the recipient. By Aaron’s calculation, a typical homeowner earning $15,000 saves about $600 a year, while the really poor save nothing at all. About 63 percent of the total subsidy goes to families earning more than $10,000 a year; less than 10 percent goes to families earning below $5,000. Thus most of the federal housing program consists of gifts to middle- and upper-income families, whom we assume were never in danger of being left out in the cold. Low-income housing is surely better than before, but mostly because the poor are not so poor any more.

Indeed, the major tax benefits for housing are not a recent liberal innovation; they have always been in the Internal Revenue Code. Politicians who would challenge income tax favoritism for homeowners do so at their peril—as George McGovern found when he merely hinted at such a heresy while also promising federal billions for homeowners’ property tax relief. But if liberal legislators need not answer for the old tax breaks, they have more recent ones to account for. “Social partnership” with private industry became a major theme of New Frontier and Great Society legislation; the idea that corporations could earn a buck while providing social welfare services coincided with the influx of construction and savings and loan money into the Democratic party and the relaxation of big business scruples about the welfare state. Urban renewal in the 1950s showed big city Democratic mayors, downtown businessmen, and corporate real estate developers working together to clear slums and build high rises for the middle class.3 During the Sixties Kennedy and Johnson conceived new programs that would create a harmonious alliance of New Dealers, Fair Dealers, and wheeler-dealers.

One program begun in 1961 attempted to buttress support for low-income housing by spreading the benefits to the near poor and adding some cash for the real estate industry. Subsidized loans were made to “civicminded” businessmen, labor unions, and nonprofit corporations to build apartments for families with incomes of less than $8,000 a year. Banks took a small and safe cut by negotiating the mortgages; thanks to tax sweeteners, real estate operators, though in theory limited to token profits, were able to convert tiny investments into substantial windfalls. Alert to the potentially profitable relationship between public need and private enterprise, Congress followed the subsidized loan program with a plan to subsidize private home ownership. Section 235 of the National Housing Act authorized payments for families in the $4,000-$8,000 range to cut interest rates on home mortgages. Possibly no other federal program has proved so corrupt. Speculators sold houses to unsophisticated beneficiaries at inflated prices. New units that were nearly uninhabitable still managed to pass the FHA inspection needed to qualify for the subsidy.

These programs have, of course, done some good. Better housing has been provided to some families with low incomes. And some would argue that corruption and inefficiency are solvable problems, though perhaps by someone more competent than George Romney. Surely, as the variation on the well-worn argument goes, a roof over everyone’s head is a modest enough goal for the richest nation on earth.

But apart from questions of technical feasibility, the strategy has both ideological and practical faults. Social service programs are based on the suspicion that the beneficiaries are incompetent. Otherwise, why would they need government-provided goods? We give poor people houses to live in rather than money to buy them for the same reason the Salvation Army gives derelicts hot meals instead of dimes and quarters. From the viewpoint of the taxpayer, $10 billion is $10 billion whether it is spent on housing or given out as cash. But ask a poor family which they would prefer, $1,000 in cash or a $1,000 housing allowance, and they will probably opt for the former. After all, better housing may not be the most pressing need for a family that also lacks clothing, bus fare, and an occasional trip to McDonald’s. By this reasoning, it is wasteful for the government to supply money for specific services (or the service itself) when the same amount of resources could be better used if given directly to the beneficiaries themselves.

This argument against the “services strategy” makes sense when it comes to housing and a great many “welfare programs,” but there are some exceptions. A thousand dollars spent on an OEO health clinic, or a legal assistance program, might purchase services that would cost the beneficiaries several times more on the open market. Doctors who would normally never even split a fee in the South Bronx might be lured by clean quarters, energetic colleagues, and large budgets. For these reasons, many OEO professional services programs have worked well enough to justify pilot attempts to supply such complex services as day care and early childhood education.

Another justification for services programs is more oblique. Extravagance and scandal, goes this Hegelian argument, are often a precondition for reform. The bloating of welfare rolls during the Sixties convinced conservatives that there was a “crisis” in the welfare system; truckloads of Brookings studies could not have been so persuasive. The Medicaid program may prove a success along just these lines. Doctors have guarded their privileges as much as the most conservative craft unions. They prevent more efficient delivery of medical care by refusing to allow paraprofessionals to help with treatment and they resist cost-control incentives.

Medicaid does not directly challenge these rules—it merely adds another layer of bureaucracy. To the cost accountant or middle-class voter, Medicaid seems the model of everything that has gone wrong with the Great Society: runaway budgets, immeasurable fraud (far more by providers than by recipients), second-class services given in an atmosphere of ugly bureaucratic charity. Nevertheless the program has accomplished two things: it has delivered some medical services to millions of poor people who would otherwise have gone without any; and by the sheer visibility of waste it has weakened the power of the doctors’ lobby to resist reforming the organization of health care.

In California, for example, Governor Ronald Reagan is perpetrating every “bolshevist” horror upon the medical establishment: he is subjecting doctors’ decisions to administrative review and herding physicians from their private practices into prepaid group practices. Reagan does this not because he loves doctors less but, because he loves his budget more. California’s Medicaid program now costs over $1.2 billion a year, and only half of it is picked up by the federal government. Reagan’s reformed medical system is, of course, designed to provide few services to the poor. One of the new prepaid group plans for the poor has tens of thousands of welfare families and not a single pediatrician. But it is at least conceivable that the group plan organization could be taken up by a more liberal future state administration and used to extend medical care to the entire population. As Blue Cross premiums spiral upward, middle-class voters are likely to be attracted to health care reform that promises cost reduction. But they will have to organize politically around such issues.

The lesson of the Sixties is not that big government is bad, but that it often is, and so needs watching. Both economics and politics suggest that wrong services will be delivered to the wrong people at much too high a cost. The liberal rationale for expensive social programs is both to redistribute income and to encourage the kind of social mobility that would reduce poverty to a matter of choice or bad luck. Since federal services programs have accomplished neither, it would make sense to undertake them more cautiously while making efforts to give money directly to the poor.

That kind of critical judgment, however, is the last thing congressional liberals are used to exercising. It is very easy to say that we should be building hospitals instead of bombers, and very disconcerting to hear that most parts of the United States suffer from an oversupply of hospital beds. Unused hyperbaric chambers and empty college dormitories have never caught on as symbols of warped priorities.

Of course, big federal budgets are here to stay, and one suspects that Nixon’s current attack on the welfare state will not help the Republicans at the polls. A little something for everybody is, always, good politics. But the price of continuing to fight for social programs that don’t work is to evaporate funds, and tolerance, for the ones that do.

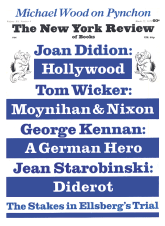

This Issue

March 22, 1973

-

1

Indeed, polls show the ambiguity of public opinion on federal spending. Ask the voters what they think of welfare mothers and the response is predictable. But ask whether the federal government has the responsibility to provide decent housing, education, medical care, and food for everyone and the majority will say yes. For an even more dramatic response, ask whether Medicare should be abolished.

↩ -

2

See, e.g., Jack Rosenthal’s perceptive New York Times article, April 16, 1972.

↩ -

3

For the relationship between business and the Democrats see G. Domhoff, Fat Cats and Democrats (Prentice-Hall, 1972). On urban renewal, Leonard Chazen, “Participation of the Poor: Section 202 (a) (3) Organizations under the Economic Opportunity Act of 1964,” Yale Law Journal (March, 1966).

↩