In response to:

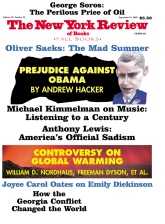

The Question of Global Warming from the June 12, 2008 issue

The New York Review received many letters concerning “The Question of Global Warming” by Freeman Dyson [NYR, June 12]. Following are comments by William D. Nordhaus, whose book A Question of Balance: Weighing the Options on Global Warming Policies, was reviewed in the article, as well as letters from two other readers, along with a reply by Freeman Dyson.

—The Editors

I have little to quarrel with in Freeman Dyson’s review of my study A Question of Balance: Weighing the Options on Global Warming Policies. However, his review provoked a small eruption of letters that complained in equal measure about my study and his review, and these comments provide an opportunity to revisit some of the major controversies.

1.

The economics of climate change is straightforward. Virtually every activity directly or indirectly involves combustion of fossil fuels, producing emissions of carbon dioxide into the atmosphere. The carbon dioxide accumulates over many decades and leads to surface warming along with many other potentially harmful geophysical changes. Emissions of carbon dioxide represent “externalities,” i.e., social consequences not accounted for by the workings of the market. They are market failures because people do not pay for the current and future costs of their actions.

If economics provides a single bottom line for policy, it is that we need to correct this market failure by ensuring that all people, everywhere, and for the indefinite future are confronted with a market price for the use of carbon that reflects the social costs of their activities. Economic participants—thousands of governments, millions of firms, billions of people, all making trillions of decisions each year—need to face realistic prices for the use of carbon if their decisions about consumption, investment, and innovation are to be appropriate.

The most efficient strategy for slowing or preventing climate change is to impose a universal and internationally harmonized carbon tax levied on the carbon content of fossil fuels. The carbon content is the total amount of carbon dioxide emissions that are emitted, for example, when people use a kilowatt-hour (kwh) of electricity or burn a gallon of gas.

To understand a carbon tax, consider an average American household, which consumes about 12,000 kwh of electricity per year at a price of about $0.10 per kwh. If this electricity were generated from coal, that would lead to about three tons of carbon emissions. If the carbon tax were $30 per ton, it would increase the annual cost of coal-electricity purchases from $1,200 to $1,290. By contrast, the costs of nuclear or wind power would be unaffected by a carbon tax because these forms of energy use no carbon fuels.

Raising the price on the use of carbon through a carbon tax has the primary purpose of providing strong incentives to reduce carbon emissions. It does this through four mechanisms. First, it will provide signals to consumers about what goods and services produce high carbon emissions and should therefore be used more sparingly. Second, it will provide signals to producers about which inputs use more carbon (such as electricity from coal) and which use less or none (such as electricity from wind), thereby inducing them to move to low-carbon technologies. Third, it will give market incentives for inventors and innovators to develop and introduce low-carbon products and processes that can replace the current generation of technologies.

Finally, a market price for carbon will reduce the amount of information that is required to do all three of these tasks. Ethical consumers today, hoping to minimize their “carbon footprint” (the amount of carbon they use), would have serious difficulties making an accurate calculation of the relative carbon emissions that result from, say, driving versus flying. With a carbon tax, the market price of all activities using carbon would rise by the tax times the carbon content of fossil fuels. Many consumers would still not know how much of the market price is due to the carbon content, but they could make their decisions confident that they are paying for the social cost of the carbon they use.

Some would argue that a carbon tax is just another sad example of a “tax and spend” economic philosophy. This argument fundamentally misunderstands the economic rationale. Those who burn fossil fuels are enjoying an economic subsidy—in effect, grazing on the global commons and not paying for the costs of their activities. A carbon tax would improve rather than reduce economic efficiency because it would correct for the implicit subsidy on the use of carbon fuels.

However, the major economic question remains: What is the appropriate price of carbon? It is at present infeasible (or at the least ruinously expensive) to prevent any and all future warming; yet unchecked warming poses serious threats to human and especially natural systems. We need therefore to strike a balance between the competing objectives of preventing climatic damage, maintaining economic growth, avoiding catastrophic risks, and not imposing undue hardships on poor people or future generations.

Advertisement

Calculations of climate damages include not only impacts on market outputs like food and forestry but also estimates of losses from nonmarket impacts. The most comprehensive damage studies include such factors as the greater intensity of hurricanes, impacts of changes in temperature and precipitation on food production, recreation, and amenities, and the increased burdens of disease. The estimates also include adjustments for the risk of low-probability, high-consequence events such as abrupt climate change. It has proven challenging to provide reliable estimates of many uncertain future impacts, but it is obviously essential that they not be omitted from the estimates of the damages from climate change.

My economic studies, reported in A Question of Balance, suggest that a balance would be achieved with a price on carbon in the range of $30 to $50 per ton, rising over time. The low end of this range is the pure economic cost-benefit optimum. The high end adds an additional constraint that global temperature or atmospheric concentrations of carbon dioxide should not exceed “dangerous” levels.

For the US, such taxes would lead to tax revenues of around $50–80 billion per year. To put this in terms of the average household, a carbon tax of $30 per ton of carbon would involve a tax on gasoline of about seven cents a gallon; it would increase the price of fossil fuels and goods dependent on such fuels by about 5 percent, an increase that is significantly smaller than those experienced over the last five years.

2.

With this background, I will comment on two questions raised in Freeman Dyson’s review and in letters and comments I have received about it: first, regarding the discount rate, and second regarding low-cost technologies to reduce carbon emissions.

One of the deepest issues in climate-change policy involves the appropriate discount rate to use in comparing present costs and future benefits. This becomes important because society would incur today, through reducing the use of fossil fuels, the abatement costs of reducing emissions, while most of the damages avoided lie far in the future. (Recall, as noted above, that damages are a comprehensive concept including market, nonmarket, and ecological impacts, along with adjustments for high-consequence risks.) Even The Stern Review on the Economics of Climate Change, by Lord Stern, which took a pessimistic view of damages, found that there would be relatively little damage from climate change over the coming century and that most damages would occur after 2200. We need therefore to find an appropriate discount rate to balance present abatement costs with the reduced damages that would occur a century or more from now.

We can illustrate the question posed by discounting with the following example. Suppose someone of sterling character approaches you with the following proposition. He is establishing a trust that will confer a $100 million benefit (corrected for inflation) to your heirs in two hundred years in return for a current contribution of a certain sum of money, x dollars, today. The $100 million return might be the benefit of reduced climate damages. Alternatively, it might involve owning part of Manhattan Island. What is the maximum amount that you would be willing to contribute?

A person relying on arithmetic intuition might reason as follows: “I know that money invested will accrue interest and grow over time. If I take an interest rate of 5 percent times two hundred years, that would total 1,000 percent, or growth by a factor of ten. So, by this calculation, to get $100 million in two hundred years, I would need $10 million today. In other words, if I assume that money invested over the time period will grow ten times in value, I would contribute to the trust no more than $10 million today. Perhaps the interest rate would be higher. If the fund grows one hundred times in value, I should contribute no more than $1 million.” Thus might our arithmetic intuition proceed.

In fact, this approach is not even close to the right calculation. The intuitive calculation forgets that interest is compounded—that is, interest is paid on the total amount, not just the original amount. A financial consultant would advise you to calculate the appropriate current contribution by taking the $100 million and “discounting” it to the present using an appropriate interest rate or discount rate. That discount rate should reflect the amount you could earn on your investments over the period.

Moreover, in our example, the $100 million is inflation-corrected, so we are in effect getting paid in future goods. For this reason, we want to use the discount rate on goods in making the present-value calculation. (Again, recall that we are using a comprehensive measure of goods in this analysis; also, goods whose prices are rising relative to the average will have a lower discount rate.) A discount rate on goods is the rate we would apply when converting the inflation-corrected values of goods consumed in the future into today’s values. The rate should reflect not only the underlying return on social investments but also risk factors such as that the “sterling character” might be Freddie Mac rather than Uncle Sam, or that we might have no heirs, or that part of Manhattan Island might be under water.

Advertisement

Based on historical studies and projections, the inflation-corrected return on investment has been in the range of 3 to 6 percent per year depending upon time period and risk. In my modeling, I have used a 4 percent discount rate. Applying this discount rate to the trust would lead you to propose a present payment of x = $39,204. Over two hundred years, as the interest on that sum is paid and compounded, the value of the trust would reach $100 million.

Many people are shocked that anyone would propose such a small sum. How can we care so little about the future? Are we not shortchanging future generations? The answer is not that we are indifferent to the future but that we have a vast array of productive investments in an economy with rapid technological change. The power of compound growth turns tiny investment acorns into giant financial oaks over a century and more. It is always a useful reminder about compound interest that at a 6 percent money-interest rate, the $26 paid for Manhattan in 1626 would yield $120 billion today, an amount approximately equal to the entire land value of this most valuable real estate.

Some would argue that it is unethical to discount the future and that we should apply a very low discount rate to calculate the present value of future goods or climate damages. While the low-discounting approach is plausible in some circumstances, it seems implausible in the context of the economic growth assumed in most climate-change studies. The Stern Review, for example, assumes that global per capita real income will rise from $10,000 today to around $130,000 in two centuries. At the same time, it argues that we should take urgent steps today to reduce damages in the distant future based on its argument for near-zero discounting. While there are plausible reasons to act quickly on climate change, the need to redistribute income to a wealthy future does not seem to be one of them.

The effect of low discounting can be illustrated by a “wrinkle experiment.” Suppose that scientists discover that climate change will cause a wrinkle in the climate system—perhaps it might be a small perturbation in the track of ocean currents—that will cause damages equal to 0.1 percent of consumption starting in 2200 and continuing at that rate forever after. How large a one-time investment would be justified today to remove the wrinkle that only begins in about two centuries?

If we use the discounting methodology of The Stern Review, the answer is that we should pay up to 56 percent of one year’s world consumption today to eliminate the wrinkle. In other words, using the logic of low discounting, it is worth a one-time consumption hit of approximately $30 trillion today to fix a tiny problem that begins two centuries hence. This example shows why the implications of using near-zero discounting—suggesting that the current generation is ethically obliged to make large sacrifices now to prevent relatively small climate damages for wealthy future generations—can be truly bizarre.1

The logic of market discounting is not that we should consume all our income, as the United States does today. Rather, I would suggest that there are many high-yield investments that would improve the quality of life for future generations at home and abroad. Such a portfolio would include investing in health systems at home, cures for tropical diseases, education around the world, basic research on new energy and low-carbon technologies, and infrastructure in war-torn countries like Afghanistan. It is hard to sustain an argument that relatively small changes in consumption in the period after 2200 should take priority over these pressing needs today.

3.

The major uncertainty in climate change involves the evolution of energy technologies over a period of a half-century and beyond. To succeed in slowing and even reversing climate change, our economies will need radically new technologies that are economical, environmentally benign, and virtually carbon-neutral.

Dyson notes that the discussion of future technologies in my book is limited to a general reference to different possibilities. He does have his own proposal for a solution, writing, “I consider it likely that we shall have ‘genetically engineered carbon-eating trees’ within twenty years, and almost certainly within fifty years.” While this might indeed remove much carbon, I shudder at the prospect of vast parts of the globe devoted to growing subsidized plantation trees. The danger is that a massive subsidized afforestation program would absorb vast tracts of agricultural land, use large quantities of water and fertilizer, and cause a worldwide food crisis on an even larger scale than the current one caused in part by the ill-conceived US ethanol subsidy program.

The history of technology suggests that we should avoid trying to pick the winners in our search for revolutionary energy technologies. Radical invention is fundamentally unpredictable. Who could have predicted the nature of modern electronics, biotechnology, or communications a century ago? Similarly, it is a safe bet that we have only the foggiest ideas about the technologies that will save the globe from climate change a century hence. We should avoid thinking that we need a climate Manhattan Project to develop the key technology. It seems likely that new climate-friendly technologies will be the cumulative outcome of a multitude of inventions, many coming from small inventors, and originating in unrelated fields.

The best way to encourage the process of radical invention is to ensure an economic environment that is supportive of innovation and entrepreneurship. Above all, this requires that carbon prices be sufficiently high so that investments in low-carbon technologies have a tangible and secure financial payoff. Governments should provide a level playing field among technologies, so that no one technology has favored treatment through subsidies, regulation, or intellectual property protection.

Climate change is a complex phenomenon, subject to great uncertainties, with changes in our knowledge occurring virtually daily. Climate change is unlikely to be catastrophic in the near term, but it has the potential for very serious damages in the long run. There are big economic stakes in designing efficient approaches to slow global warming and to ensure that the economic environment is friendly to innovation. The current international approach in the Kyoto Protocol will be economically costly and have virtually no impact on climate change. In my view, the best approach is also one that is relatively simple—internationally harmonized carbon taxes. Economists and environmentalists will undoubtedly continue to debate the proper level of the carbon price. But all who believe that this is a serious global issue can agree that the current price—zero—is too low and should be promptly corrected.

William D. Nordhaus

To the Editors:

As one of the authors of The Stern Review on the Economics of Climate Change I must respond to Freeman Dyson’s misleading review of William Nordhaus’s latest book in “The Question of Global Warming.” The economic evaluation of the effects of greenhouse gas emissions is based on (1) the expected events resulting from rising global temperatures, like floods, droughts, migration, and conflict, and (2) the values attached to these current and future events. Dyson failed to identify shortcomings in Nordhaus’s approach on both counts, which underlie his call for lower emissions cuts than those in The Stern Review.

On the first question, Nordhaus consistently understates the threat from global warming. In a perplexing paragraph, Dyson writes:

[Nordhaus] is not concerned with the science of global warming or with the detailed estimation of the damage that it may do…. His conclusions are largely independent of scientific details.

This remark is grossly misleading. Nordhaus’s model is driven by his assumptions about the science. The problem is that his projections of events seem inconsistent with the latest science. He argues, astonishingly, that under unchecked emissions growth, the world will attain the same level of output by 2100 that would have been attained in 2099 without global warming—a “trivial” 2.5 percent difference in GDP.

The most recent report of the Intergovernmental Panel on Climate Change (IPCC) shows significant risks of global temperature increases of above 5 degrees Celsius, relative to pre-industrial times, by the next century if we do not act to curb emissions. The last time the world was five degrees warmer was 35–55 million years ago when it was characterized by swampy forest and there were alligators close to the North Pole. The last time the world was five degrees cooler was during the last ice age around 10,000–12,000 years ago when giant ice sheets stretched as far south as New York and central England. The argument here is not about crocodiles or ice sheets. It is about redrawing at unprecedented speed the geography of how and where people live. If temperatures were to rise by four degrees or more over the next century, the level of GDP probably would be set back decades, not years, with billions of people suffering from hunger, water stress, mass migration, and conflict.

Yet Nordhaus somehow gets from IPCC temperatures of 3 degrees Celsius by 2100 and 5.3 degrees Celsius by 2200, to impacts of only a couple of percent and 8 percent of GDP respectively. He casually notes that “the submodels used in the DICE model cannot produce the regional, industrial, and temporal details that are generated by the large specialized models,” but it is at the regional level where the real human damage is estimated. There is some mention of hurricanes in the book, but the words “flood” or “drought”—the main sources of human and environmental hardship—barely get a look-in. Nordhaus systematically underplays the regional and local risks and derives very minor economic impacts as a result: even by 2200, world GDP is set back a mere four years relative to a baseline without climate change damages.

On the second question, Dyson considers the policymaker’s central question of how to value the array of expected future events resulting from rising global temperatures. He correctly identifies “discounting” as lying at the heart of the question. “Discounting” when applied to consumption is the process of defining the present value of a unit of consumption at some future date. The reduction in the value of a unit’s consumption from one year to the next is determined by the appropriate annual “discount rate.” From an individual’s point of view, we all prefer jam today to jam tomorrow, and at some point we expect to die so we discount heavily. But from society’s point of view, the question of how the policymaker should value the consequences of today’s actions on future generations needs to move beyond the innate impatience of individuals.

There have traditionally been two reasons why economists and philosophers apply a discount rate to society’s future income. Dyson correctly identifies the first and most important. He writes:

Future costs are discounted because the future world will be richer and better able to afford them. Future benefits are discounted because they will be a diminishing fraction of future wealth.

The loss of “happiness” from a dollar of forgone income (for example from reduced access to water or coastal flooding) will, in general, be smaller for rich people than those struggling to make a living. The intuition is simple to grasp: the “happiness” loss from a dollar’s worth of lost consumption to Bill Gates will be less than the same loss to a hungry street child, where it could mean the difference between life and death. So, if future generations will be richer, then taking action now to save them from nasty impacts will hold a lower claim on current resources than taking action now to avoid the very same affects on poorer people today. Consequently, we need to “discount” away future impacts in our assessment of the “present value” of climate change damages.

What Nordhaus seems to forget is that scientists tell us that particularly destructive impacts such as large-scale flooding, widespread droughts, and intense storms could render some future generations poorer than current generations, wiping out the benefits of economic growth: to evaluate this effect would require negative discounting. The choice here is between uncertain paths with radically different implications for the planet. Yet Nordhaus mistakenly applies the same high discount rate of 5.5 percent regardless of whether he is assessing trivial or devastating losses, thus systematically undervaluing the latter.2 Nordhaus’s discount rate is so high that a dollar’s worth of lost consumption in 2150 is valued as akin to only 0.02 cents lost today, regardless of the scale of the catastrophe. By trivializing future losses in this way, Nordhaus predetermines his policy prescription of more limited action and a low carbon price.

Failure to apply systematically the concept of diminishing extra “happiness” from every extra dollar also illuminates the deficiencies of Nordhaus’s assessment of risk. We apply greater weight to the worst outcomes precisely because we worry more about nasty extreme events. Our aversion to catastrophic events that can render us poorer is why most of us insure our houses, even though we know the insurance companies make money from the odds they offer us. By applying a greater weight (i.e., less discounting) to nasty events, the Stern approach will reflect this automatically; Nordhaus’s does not.

Dyson writes: “Stern rejects the idea of discounting future costs and benefits when they are compared with present costs and benefits.” This is patently false. The Stern Review applied discounting precisely on the principle that future generations may be richer or poorer as outlined above. In fact, The Review went further by applying additional discounting to cover extreme risks such as the world succumbing to asteroids, plague, or “nuclear Armageddon.” If future generations cannot be guaranteed to exist, it seems inappropriate to value them on a par with the current generation, which clearly does exist.

What The Review did reject was additional discounting to discriminate against future generations purely on the basis of birthdates—a process known as pure time discounting. This is the second reason for discounting: the passage of time itself. This is distinct from discounting because of income differences, or discounting because of the risk of future extinction, both of which can be expressed quantitatively as in The Stern Review. Pure time discounting is rooted in the economist’s desire to reflect people’s preferences, and people seem to be impatient in many of the things that they do. But climate change is such a long-term social problem that it is inappropriate to use personal telescopic preferences as the basis to determine policy. Why should we treat the well-being of current generations on an equal basis, but apply a different treatment to the well-being of generations born next year, or the year after?

Dyson compounds his inaccuracy when he writes, “Nordhaus, following the normal practice of economists and business executives, considers discounting to be necessary for reaching any reasonable balance between present and future. In Stern’s view, discounting is unethical because it discriminates between present and future generations.” The implication here is not only that Stern fails to discount—which is false—but that he unilaterally departs from the normal practice of economists.

To be clear, Nordhaus proposes pure time discrimination in part because he assumes that market rates of return reveal social preference for future versus present rewards.3 A century of mainstream economic literature from Marshall and Pigou to Arrow and Mirrlees has recognized that this logical link is wrong, except under implausible circumstances, including that all markets work perfectly and all consumers are represented.4 Other economists from Ramsey to Solow, Keynes, and Sen reject pure time discounting as arbitrary, holding no ethical basis for long-term public policy choices.5 It is Nordhaus who departs from “the normal practice” of some of the most distinguished economists and philosophers,6 not Stern.7

Finally, if we did invest conventionally at market rates and later tried to “buy off” future environmental damages, the costs of action will have risen sharply because stocks of greenhouse gases—based on current IPCC estimates—would be so large they could tip the global climate into dangerous and irreversible changes. Similarly, consumers would place a higher value on the environment so that compensating them for a given environmental deterioration would be more costly than it would today.

Attempts to quantify the case for action on climate change must reflect the full array of climate risks as determined by the latest science and use economics that consistently reflects these risks.8 Future generations deserve nothing less. The approach adopted in Dyson’s article and Nordhaus’s book unfortunately falls some way short of this mark.

Dimitri Zenghelis

Senior Visiting Fellow London School of Economics

Associate Fellow Royal Institute of International Affairs

London, England

To the Editors:

Freeman Dyson’s excellent review of William Nordhaus’s and Ernesto Zedillo’s books on global warming took the authors to task for not addressing “low-cost backstop” methods as viable climate policy. Dyson elegantly argues that the genetic development of “carbon-eating trees” with the ability to “convert most of the carbon that they absorb from the atmosphere into some chemically stable form and bury it underground” would place in our hands the fate of the carbon in the atmosphere that causes global warming. Dyson considered that the advent of such carbon-eating vegetation is likely within the next twenty years, and certainly within the next fifty years, by which time our understanding of the plant genome should be sufficiently advanced to command plant biochemical processes.

However, I would like to point out that we do not need to wait even twenty years to use “carbon-eating” vegetation to mitigate global warming. We have the necessary biotechnology available today (see, for example, Jeffrey F. Parr and L.A. Sullivan, “Soil Carbon Sequestration in Phytoliths,” Soil Biology and Biochemistry, Vol. 37 (2005), pp. 117–124). Natural vegetation communities have for millennia been securely removing hundreds of millions of tons of carbon dioxide from the atmosphere every year by entrapping carbon within microscopic balls of silica in their leaves as they grow. These plant silica balls—called “phytoliths” or “plantstones”—are highly durable, persisting long after other carbon compounds in plants have been decomposed and returned to the atmosphere. As a result, the carbon entrapped within these phytoliths is very stable against decomposition.

Many of our main agricultural crops (for example, grass-based crops such as wheat and sugar cane) have carbon-eating abilities many times greater than those of these natural vegetation communities (see, for example, www.gold schmidt2007.org/abstracts/A985.pdf). This affords agriculture the potential to play an important role in the control of atmospheric carbon. Moreover, different cultivars within single crop species also vary considerably in their ability to sequester carbon in plant silica, so adoption of this very low-cost biotech solution need involve only minimal changes to current land use. Remarkably, it follows that the relatively simple everyday crop choice decisions made by farmers in their paddocks and fields cumulatively have considerable impact on the amount of carbon securely sequestered in our global agricultural soils.

In short, we do not have to wait decades for the deciphering of the plant genome to develop carbon-eating vegetation to mitigate climate change: our current understanding of the plant phenome is sufficient. Somewhat perversely, given frequent political argument on the imperative to mitigate climate change, a major obstacle hindering the adoption of carbon-eating vegetation is the lack of national and international policy frameworks necessary to provide incentive to landowners to select and grow more effective “carbon-eating” vegetation.

Leigh Sullivan

Director, Southern Cross GeoScience

Southern Cross University

Lismore, New South Wales, Australia

Freeman Dyson replies:

1. To all the authors: These letters are representative of many others, some disagreeing vigorously and some expressing qualified agreement with my review. I apologize to the authors of letters that are not reprinted here. My replies are addressed to those that are reprinted, but apply equally to the others. As a scientist I know that all opinions, including my own, may be wrong. I state my opinions firmly because I believe they are right, but I make no claim of infallibility. I beseech you, in the words of Oliver Cromwell, to think it possible you may be mistaken. One principle that we might all accept is that the future is uncertain.

2.To Dimitri Zenghelis: Your letter is a statement of the Stern doctrine, with which I fundamentally disagree and concerning which I refer readers to William Nordhaus’s arguments above. His doctrine is based on a gloomy view of the future. The main reason why I oppose it is that the first decade of the twenty-first century has changed the world irreversibly in a hopeful direction. In that decade, China and India decided that money is more important than ideology. They decided to become rich. This was a decision similar to one made by Britain in the eighteenth century. The rulers of Britain decided that money was more important than religion.

The intellectual background of these decisions is described in a book, The Passions and the Interests, by the economist Albert Hirschman, who was my colleague for many years at the Institute for Advanced Study. In the eighteenth century, “the passions” meant the theological beliefs that drove religious wars in the seventeenth century. In the twenty-first century, “the passions” mean the ideological beliefs that drove nationalistic wars in the twentieth century. Through all these centuries, “the interests” meant the ascendancy of commerce and manufacturing that make countries rich.

The decision to become rich did not mean that poverty disappeared in Britain, or that it will disappear in China and India. It means that China and India, like Britain three hundred years earlier, will become rich countries, with a dominating influence on the rest of the world. Asia, which is the center of gravity of the world population, will henceforth be rich rather than poor. That is why the discount rate of 4 percent per year assumed by Nordhaus for the world economy in the twenty-first century is reasonable.

The difference between Lord Stern’s view of the future and mine is the difference between passion and interest, between ideologically imposed stagnation and free growth. Lord Stern would have us obedient to his passion. I would have us following our interest. I do not believe that stagnation, which would result from the costly controls proposed by Lord Stern to reduce greenhouse gas emissions, makes sense, either in economics or in climatology. Both in human societies and in climates, periods of stagnation have always alternated with periods of drastic change. A future of permanent stagnation is neither feasible nor desirable. China has recently endured centuries of stagnation, and is rightly determined not to endure more. I commend to your attention the last sentence of Hirschman’s book: “This is probably all that one can ask of history, and of the history of ideas in particular: not to resolve issues, but to raise the level of the debate.”

3. To William Nordhaus: I am delighted that you agree with most of my review and do not consider yourself to have been badly misrepresented. Your main complaint, in the last section of your letter, is that I considered only the large-scale growth of carbon-eating trees as a possible “low-cost backstop” to harmful effects of global warming. You object to large-scale tree plantations because they use up agricultural land and interfere with food production, besides having other undesirable ecological effects. I chose to discuss carbon-eating trees because they were one of the possible alternatives that you mentioned on page 19 of your book. I chose to assume that only one quarter of the land vegetation would be replaced by carbon-eating varieties of the same species, so that the replacements could be made without involving agricultural land or commercially valuable forests. The replaced vegetation could be scrub forest and abandoned farmland, not presently being used for producing food or timber. I also remarked that the carbon-eating replacements would support the same ecological variety and the same wildlife habitat as the plants that they replace. They would not resemble the corn plants diverted from food production to ethanol production by the government ethanol subsidies that you rightly abhor.

Two possible “low-cost backstops” that I did not mention in my review, since you did not mention them in your book, are carbon-eating phytoplankton in the oceans and snow-dumping in East Antarctica. Either of them might be a preferable alternative to carbon-eating trees. Phytoplankton is the official name for the microscopic floating plants that live in the sunlit layer of the ocean. Carbon-eating phytoplankton could be genetically engineered to absorb carbon dioxide from the ocean and to convert the carbon into little pellets that would sink to the ocean bottom and stay there. They would remove carbon dioxide from the ocean, to be replaced by carbon dioxide from the atmosphere. Genetically engineered phytoplankton might be cheaper and politically more acceptable than genetically engineered trees. Engineered phytoplankton could also serve two other useful purposes: to increase the population of commercially valuable fish and to decrease the acidity of the ocean.

Snow-dumping in East Antarctica would be a good way to stop sea levels from rising. Sea levels have been rising since the end of the most recent ice age 12,000 years ago. Most of the rise had nothing to do with human activities, but a further catastrophic rise by fifteen meters is a possible worst-case consequence of human activities in the next two centuries. A fifteen-meter rise would be the result of a complete meltdown of the ice in Greenland and West Antarctica caused by global warming. Such a meltdown is unlikely but not impossible. Fortunately, East Antarctica is much colder and larger than Greenland and West Antarctica, and the ice cap on East Antarctica is not in danger of melting. A permanent high-pressure anticyclone over East Antarctica keeps the air over the continent dry and the snowfall meager. The same anticyclone keeps a strong westerly flow of moist air circling around the southern ocean.

To dump snow onto East Antarctica, we must move the center of the anticyclone from the center to the edge of the continent. This could be done by deploying a giant array of tethered kites or balloons so as to block the westerly flow on one side only. The blockage would cause a local rise of atmospheric pressure. The center of the anticyclone would move toward the blockage, and a fraction of the circulating westerly winds on the opposite side of Antarctica would move from the ocean onto the continent. The kites or balloons might also be used to generate massive quantities of electric power for use in other projects of planetary engineering. With or without electric generators, the onshore flow of moist air at a rate of a few kilometers per hour would produce an average snowfall equivalent to a few meters of ice per year over East Antarctica. All the ice added to the continent would be subtracted from the ocean. This would be enough snowfall to counteract the sea-level rise produced by a complete meltdown of Greenland and West Antarctica in two hundred years. Year by year, we could raise or lower the kites and adjust the flow of moist air across the continent so as to hold sea levels accurately constant.

Carbon-eating phytoplankton and snow-dumping are fanciful projects. Like other engineers’ dreams in the past, they will probably be superseded by better ideas and newer technologies long before they are needed. They are illustrations of the general principle that antidotes to even the worst-case consequences of climate change will be available if we allow economic growth to continue. The future of technology beyond fifty years from the present is totally unpredictable. That is another good reason for applying your recommended discount rate of 4 percent per year to the costs of future disasters.

4. To Leigh Sullivan: I am delighted to learn that carbon-eating plants already exist and do not need to be invented. But you do not say, in your letter or in the papers that you cite, how much carbon these plants are capable of eating. The crucial question is quantitative. Natural plant communities fail by a large factor to sequestrate as much carbon as they absorb. I know very little about agriculture or plant physiology, but I estimate that the best of the natural carbon-eaters fall short by at least a factor of ten. If this estimate is true, then a great deal of genetic engineering must be done before we have carbon-eaters sequestering carbon in sufficient quantity to counteract the burning of fossil fuels. The same remark also applies to carbon-eating phytoplankton. To counteract fossil fuel–burning, phytoplankton too must sequestrate a large fraction of the carbon that it absorbs.

5. To all authors and readers: Thank you for giving me this opportunity to discuss the problems of global warming without polemics and accusations. To reach reasonable solutions of the problems, all opinions must be heard and all participants must be treated with respect.

A further exchange on “The Question of Global Warming” will be published in a subsequent issue.—The Editors

This Issue

September 25, 2008

-

1

The analysis of discounting is developed at greater length in chapter nine of my book, A Question of Balance (Yale University Press, 2008). This chapter is also available on-line at nordhaus.econ.yale.edu/Balance_prepub.pdf. ↩

-

2

5.5 percent is the figure derived formally by Nordhaus in his model for the next fifty years. He also states that he presumes an average discount rate of 4 percent over the next century, but he does not make clear how he arrives at that calculation, which would presumably require a much lower rate—averaging close to 2.5 percent—for the second half of the century. Even at 4 percent continuous discounting, a person’s well-being in the middle of the next century would be valued at around 1/40 of a person’s well-being today, thus favoring policies which benefit current generations at the expense of those in the future. ↩

-

4

In fact, capital markets are full of distortions. Cameron Hepburn, in “Discounting Climate Change Damages: Working Note for the Stern Review” (Oxford University, 2006), and Simon Dietz, Cameron Hepburn, and Nicholas Stern, in “Economics, Ethics, and Climate Change” (London School of Economics, 2007), argue that it is hard to find any markets that can reveal clear answers to the question “how do we as a generation value benefits to collective action to protect the climate for generations a hundred or more years from now?” For a more detailed discussion, the reader is directed to Lord Stern’s recent Ely lecture at the American Economic Association Meetings, January 2008: American Economic Review, Vol. 98, No. 2 (May 2008). ↩

-

5

See, for example, Frank Ramsey, “A Mathematical Theory of Saving,” The Economic Journal, Vol. 38, No. 152 (December 1928), pp. 543–559; Arthur Pigou, The Economics of Welfare, fourth edition (London: Macmillan, 1932), pp. 24–25; Roy Harrod, Towards a Dynamic Economics (London: Macmillan, 1948), pp. 37–40; Robert Solow, “The Economics of Resources or the Resources of Economics,” American Economic Review, Vol. 64, No. 2 (May 1974), pp. 1–14; James Mirrlees and Nicholas Stern, “Fairly Good Plans,” Journal of Economic Theory, Vol. 4, No. 2 (April 1972), pp. 268–288; Sudhir Anand and Amartya Sen, “Human Development and Economic Sustainability,” World Development, Vol. 28, No. 12 (2000), pp. 2029–2049. ↩

-

6

Professor Mohammed Dore of the Climate Change Lab at Brock University, St. Catharines, Ontario, puts this succinctly in A Question of Fudge: Professor Nordhaus on Global Policy for Climate Change (forthcoming) when he remarks, “It is strange how the whole Cambridge welfare economics tradition—from Ramsay, de Graaff, to Mirrlees—has not made any difference to Nordhaus; he claims that climate change is the mother of all public goods and then forgets about the public good in his optimal policies!” ↩

-

7

Lord Stern is currently the IG Patel Professor of Economics and Government, London School of Economics, and has a lifetime of work on public economics behind him. He has published more than fifteen books and one hundred articles and from 2000–2003 was World Bank chief economist. He has recently been elected president of the European Economic Association by European academic economists, and advises a long list of world leaders. ↩

-

8

See Simon Dietz, Chris Hope, Nicholas Stern, and Dimitri Zenghelis, “Reflections on the Stern Review (1): A Robust Case for Strong Action to Reduce the Risks of Climate Change,” World Economics, Vol. 8, No. 1 (2007), pp. 121–168; and also Dennis Anderson, Simon Dietz, Nicholas Stern, Chris Taylor, and Dimitri Zenghelis, “Right for the Right Reasons: A Final Rejoinder on the Stern Review,” World Economics, Vol. 8, No. 2 (2007), pp. 229–258. ↩