Ever since the 2008 collapse of Lehman Brothers precipitated a global financial crisis, the bank’s dramatic reversal of fortune has been treated as an allegory of the history of American capitalism. It starts as a rags-to-riches fable of bootstrapping success, in which nineteenth-century German-Jewish immigrants thrive in the land of opportunity, a family of hardworking immigrants warmly welcomed to the growing nation, where they build a colossally successful business. But over the years, they lose touch with their mercantile roots, tempted by the lure of speculative wealth: instead of selling real things, they sell only abstracted numbers. The firm’s ruin, in this telling, may foreshadow the nation’s, as inequality and economic stagnation suffocate peoples’ dreams of prosperity; now the Trump administration builds walls to keep out immigrants like the Lehmans. A cautionary tale for our times: the rise and fall of the American Dream.

In 2013, the Italian playwright Stefano Massini turned this exemplum into The Lehman Trilogy, an epic five-hour play that was adapted and condensed last year by the director Sam Mendes and playwright Ben Power for the National Theatre in London. The play received rapturous reviews, and further plaudits after a limited run this spring in New York; it has just returned to London’s West End, where its continued success seems assured. The story begins in 1844, when Hayum Lehman emigrated from Bavaria to Mobile, Alabama. He changed his name to Henry and worked as an itinerant peddler before opening a small dry-goods store upriver, in Montgomery. Soon, two of his younger brothers, Mendel (Emanuel) and Mayer, joined him, and the dry goods store gradually evolved, first into a brokerage, and then into a bank. The play presents this arc as a parable of moral decline, from selling “goods,” to selling financial abstractions. “We are merchants of money,” second-generation Philip Lehman declares in Power’s translation: “our flour is money.”

The drama built around this story is an impressive theatrical experience, but also a deeply partial one, as some critics have noted—for the simple reason that some of the “goods” originally traded by the Lehman brothers, before their spiritual decline into mere merchants of money, were human beings. The play acknowledges, briefly, the company’s origins in the cotton markets of the antebellum South—profoundly underplaying not only the firm’s deep entanglement in the slave economy, but also that of the brothers themselves, who held slaves for at least twenty years. When I was invited by the National Theatre to write for its playbill an essay about the Lehman brothers as exemplars of the American Dream, my original draft mentioned the brothers’ connection to slavery, but this was cut from the final edit. When New York’s Park Avenue Armory asked if they could reuse the essay, I inquired if we could restore the issue of slavery, and offered an expanded draft with more detail. They preferred the National Theatre’s version, citing length.

The elision is not sinister, but it is symptomatic. No one involved in editing the playbills is defending or apologizing for slavery; they were doing their jobs, putting together a program of necessarily brief essays about the play as it has been produced, which does not address slavery. But the erasure of slavery from the play matters: it distorts the history of Lehman Brothers’ beginnings in the antebellum South, allowing the play to evade the question of whether making money out of money is really more reprehensible than making money out of slaves. That erasure is, ironically enough, perhaps the most allegorical aspect of the entire story: a history of American capitalism that disavows the central role slavery played in that history.

It was a problem several American reviewers noted, at least in part. The New York Times observed: “By completely omitting something terribly obvious—that the original fortune was made on the backs of slaves—the play suggests that the real evildoers were not the kindly young men from Bavaria who sold cloth,” but the wizards of Wall Street several generations later. For The Washington Post’s Richard Cohen, it was an astonishing flaw that the play “fails to mention that Henry, Emanuel, and Mayer Lehman were slave-owners.” No American writer today would make such an excision, Cohen argued: “it would be tantamount to writing a play about Germany in 1933 and not even mentioning what was happening to the Jews.” But The Lehman Trilogy is not merely tantamount to a play about Germany in 1933 that never mentions the Jews; it is a play about a dynasty founded in the Nazi era that thinks the family’s role in the Holocaust doesn’t matter.

Advertisement

For a century and more, the conventional wisdom about the evolution of the financial systems embodied in institutions like Lehman Brothers was that modern American capitalism was built not on the slave economy, but on its collapse. That story retains its cultural grip. “The great rise of Northern industry took place after the Southern slave economy was destroyed,” Jonathan Leaf insisted in an April “Dispatch” for the New Criterion defending The Lehman Trilogy against criticisms of its treatment of slavery, “and after the Confederacy’s wealth was obliterated” (his emphasis). But for half a century and more, historians have shown that this neither accurately describes the cotton economy of antebellum Alabama generally, nor the Lehman brothers’ particular role in it.

Since at least as long ago as 1944, with Eric Williams’s groundbreaking Capitalism and Slavery, historians have debated the complex intermingling of slavery and capitalism, while a wave of recent scholarship has argued for the centrality of slavery to the history of American economic development. Edward Baptist, Robin Blackburn, Walter Johnson, Sven Beckert, Calvin Schermerhorn, Michael R. Cohen, and others have contended that mid-century Southern slavery was far from the pre-industrial, agrarian economy of popular wisdom, inevitably defeated by the industrial power and modern financial systems of the North. The two systems were considerably more interdependent and mutually advantageous than that simplistic picture allows. Nor was the Civil War the product of a simple conflict between modern and premodern economies, although it was a conflict between wage labor and slave labor. Rather, between 1830 and 1860, the slave economy itself became increasingly modernized, its growing profits leveraged by the economies of scale afforded by new financial systems.

The cotton economy of the nineteenth century, accounting by most measures for more than half of the total goods exported from the US between 1820 and 1860, helped form many of America’s current economic and social institutions: the carceral system, property laws, insurance industry, modern finance systems—all have roots in the Southern slave economy. The profits created by the cotton business helped fund vast empires of trade and industry, including shipping and railroads. They also enriched middlemen: insurers, brokers, investors, and speculators, which is where the Lehmans enter the story.

Henry Lehman came from a farming family, perhaps one reason he chose to settle in the agrarian South; but he also grew up near the city of Mainz, a center of the German textile trade. He knew the value of cotton, and went straight to Mobile, Alabama, then second only to New Orleans as a cotton trading port. Jews settled less frequently in the antebellum South, and those who did tended to assimilate as fast as they could—indeed, the stark racial hierarchy of the South, divided into its ruthless binary of “black” and “white,” made it easier for Jewish immigrants to assimilate as “white.” (That said, antebellum anti-Semitism is another question that The Lehman Trilogy sidesteps.)

The American economy of the 1820s and 1830s was undergoing a transformation thanks to the development of new debt instruments secured by the use of slaves as collateral. The value of chattel slaves could be transferred into mortgages, securities, and bonds, like any other financial asset that could then be sold to investors nationally and internationally. The financialization of slave-assets thus allowed profiting from slavery even in places that had formally outlawed the slave trade—as had the United States, in 1808. The complex, sophisticated commercial systems that had developed along with colonial slave economies did not die when the slave trade was abolished; they merely operated from a greater distance.

All this easy credit helped fuel an American slave-asset and land bubble in the 1830s, driving an economic boom backed by Southern state governments that collapsed in the panic of 1837, the country’s worst financial crisis of the nineteenth century. Between 1837 and 1842, banks failed, credit disappeared, and the economy stagnated. The Lehmans arrived in the 1840s, just in time to capitalize on the cotton economy’s desperate need for investment and credit, quickly establishing themselves as cotton factors, a factotum role that combined brokerage with financial and marketing advice, insurance, transportation, logistics, and sometimes the supply of enslaved laborers. Cotton factors sold to farmers on credit, often accepting cotton as payment, which they could sell directly to Northern manufacturers. Some cotton factors, in turn, acquired financing from Northern banks, recycling profits from the Southern slave system back to those Northern and international financiers. Every link in the financial chain profited.

Between 1840 and 1860, the American cotton crop expanded hugely for several reasons, including improvements in seeds, while the industrial revolution, powered by immigrant labor, was taking hold in the North. By the middle of the nineteenth century, much of the American economy was entangled in networks of capital that were profiting from enslaved people. The prosperity created by enslavement extended far beyond cotton, as world capital markets leveraged the collateral held by enslavers; but so did the financial and commercial structures those markets helped develop and perfect. Slave-traders, for example, as Calvin Schermerhorn has shown, created integrated systems of supply and credit that anticipate concepts like vertical integration and supply-chain management a century later. Small merchants like Lehman Brothers repackaged credit and debt, selling it on to other investors; like plantation owners, they also borrowed against human collateral, thus profiting not only from the slaves they personally owned, but from the system’s shared mortgaging of human property.

Advertisement

The Lehman brothers’ own possession of slaves has long been part of the historical record, though not as central to critiques about the firm’s cultural symbolism after its collapse as it should have been. When, in 2003, descendants of slaves sued Lehman Brothers (and other firms, including R.J. Reynolds) for reparations, Lehmans was “forced to admit,” it was reported at the time, that the founding brothers “bought a slave in the 1850s” named Martha. A further affidavit acknowledged, though only provisionally, that the Lehman brothers “may have personally owned other slaves,” making the firm reportedly the first American bank to admit, however grudgingly, a role in institutional slavery. (Two years later, J.P. Morgan acknowledged that it had accepted some 13,000 slaves as collateral, and taken possession of 1,250 more as capital.) A year before Lehmans’ collapse, the House Judiciary Committee conducted a hearing on the legacy of the transatlantic slave trade, noting some of the historic companies that had benefitted from that trade, including Lehman Brothers, among others such as Aetna Casualty insurance, New York Life Insurance, Brooks Brothers, and J.P. Morgan Chase.

As far back as 1996, Roland Flade’s study The Lehmans noted that the 1860 census identified Mayer Lehman, the youngest of the brothers, as the owner of seven slaves in Montgomery. In partial mitigation, Flade remarked that people living in antebellum Alabama could not easily oppose slavery, which is quite true. But failing to combat, or even merely censure, slavery is one thing; purchasing one’s own enslaved humans, or trading in their enslavement, is another. The Lehman brothers did both. Two of their former slaves traveled with Mayer’s family when they moved to New York in 1868, a fact sometimes offered by the family’s defenders on the grounds that it would suggest the Lehmans treated their slaves with comparative decency. Not only a low bar for moral exculpation, this also avoids any account of the complex reasons freed slaves sometimes chose to stay with families that had formerly held them in bondage.

*

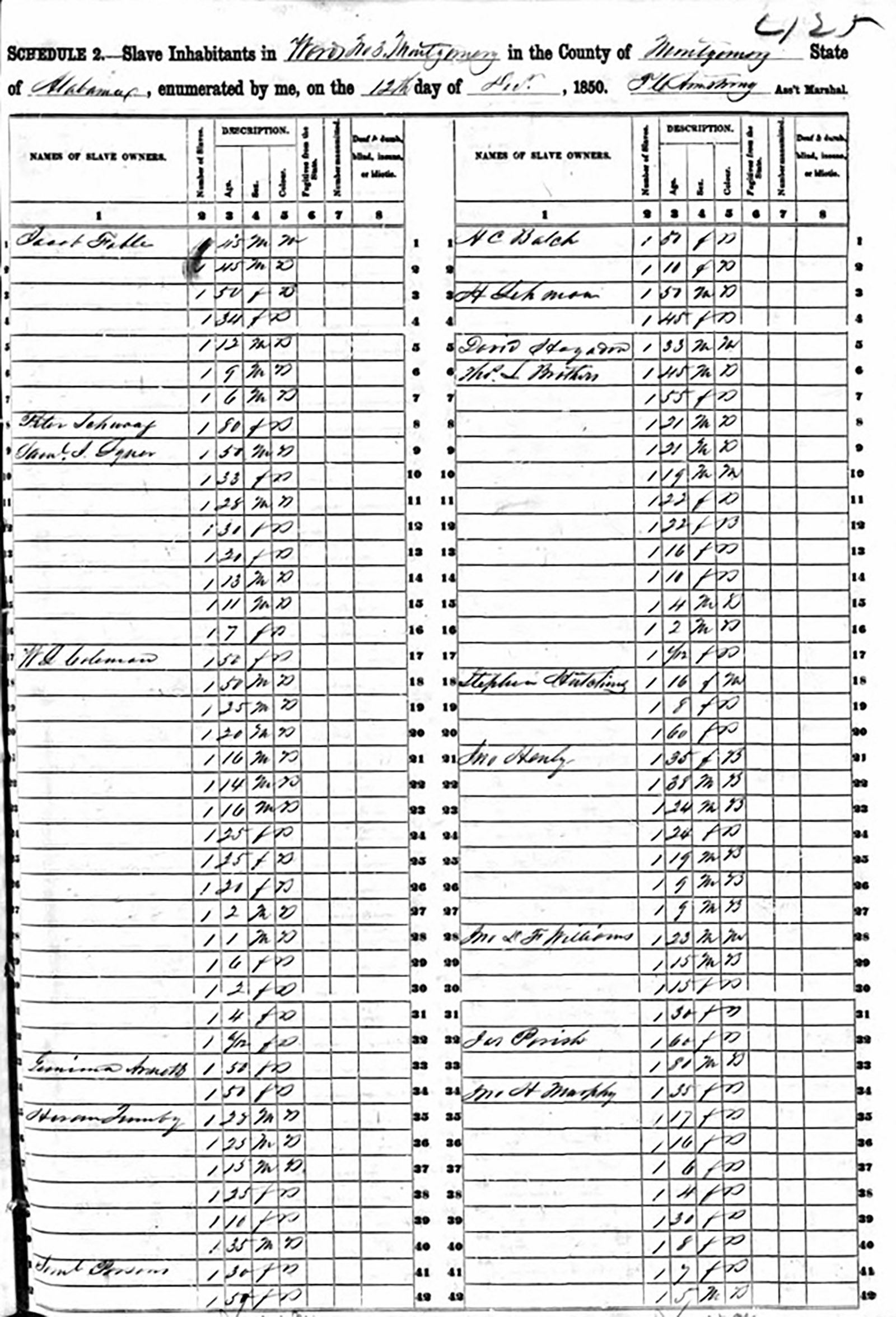

The question of how to include slaves in the American record has plagued the nation since its founding. The Constitution’s notorious “three-fifths clause” was a function of the agreed provision for a decennial census, for purposes of political apportionment. Representatives in Congress would reflect “the whole number of free Persons” and “three fifths of all other Persons” in each state, excluding natives (who were treated as separate nations). This construction does not, in fact, grant slaves any humanity, even fractionally; it merely counts a proportion of them as bodies for the census. As the size of both slave and immigrant populations grew, so did problems in census-taking. For the 1850 and 1860 decennial censuses, the government decided for the first time to count all slaves held in the United States in separate “slave schedules.” Following the Constitution’s logic, slaves were enumerated—by age, sex, and color (black or mulatto)—but only slave-holders were named.

According to the 1850 slave schedule, “H. Lehman” had already purchased two slaves within six years of arriving in Alabama: a fifty-year-old black man, and a forty-five-year-old black woman. In his 2006 history of the Lehmans, Peter Chapman noted that family archives show the Lehman family also bought a fourteen-year-old slave in 1854 (the one named Martha); the deed of sale, for $900, bound her as a “slave for life.” Six years later, the 1860 slave schedule identifies Mayer Lehman in Montgomery as the owner of four slave houses and seven slaves: two adult males, a fifty-year-old listed as black and a nineteen-year-old listed as mulatto; three adult females, all black, aged forty-five, thirty-five, and twenty-eight; a nine-year-old mulatto girl; and a five-year-old black boy. But even this inadequate record is vexed, implying, as it does, that slaves always knew their ages with certainty; some did, but the system was designed to keep them from all such sense of self-possession. The historical ironies are intense: the slave schedules reflect a society struggling to identify Americans from whom it had systematically stripped identity, while granting new immigrants like the Lehman brothers the status of free citizens.

Slave-holding was the most direct, but hardly the only, way in which the Lehmans were implicated in the slave economy.It was not simply that the Lehmans profited from the labor of those they had enslaved, or that their firm depended on the sale of cotton produced by other slaves, but that their entire business was imbricated in institutionalized slavery from start to finish. Contemporary accounts record the brothers’ accepting profits from slaves traded as chattel in lieu of debts—in 1859, a newspaper in Troy, Alabama, reported that a sheriff had sold “one negro woman, Beckey, about twenty years old, and her child Gus, about two years old,” to “satisfy a fifa in my hands in favor of Lehman Brothers.” (“Fifa” stood for fieri facias, a legal instrument that empowered a sheriff to levy the possessions of a defendant to make good a debt.) From such seemingly routine transactions an entire political economy arose.

Thus, while it is perfectly true that the Lehman brothers’ embroilment in slavery was commonplace in their time and place, that makes it all the more problematic to suggest that slavery can be marginal to their story. The embedded ordinariness of slavery is the point: to efface that, as the play does, is to miss everything. The triumphalism of the classic American immigrant success story here works to occlude the question of complicity in slavery, fashioning a familiar myth of hard work rewarded by social mobility that is superimposed over the actual system, in which the total deprivation of the rights of citizenship and humanity for some enabled others to enjoy precisely the rewards and mobility that slaves were so violently, and absolutely, denied.

Henry Lehman died in 1855, but when the Civil War came, the two surviving brothers were staunchly on the side of the Confederacy. Mayer Lehman was a committed Southern Democrat, friendly with the governor of Alabama, and knew Jefferson Davis socially. In October 1861, Lehman Brothers, “Merchants of Montgomery,” advertised in local papers that they had stockpiled “almost every article of necessity” during the war. Promising to “be reasonable as to prices,” they added that “owing to the hardness of the times, they are compelled to demand the cash.” Cash, appropriately, was italicized. During the war, the firm successfully ran blockades while issuing the Confederacy with free credit; the Governor of Mississippi sent a public note of thanks in 1864 to “Messrs. Lehman & Brothers,” for accepting “Confederate Treasury notes,” while “charging nothing for their trouble,” to supply the army with cotton and wool for uniforms—despite the blockade that “prevented a larger supply.” In October 1865, “Lehman & Brothers, rich Jews, and merchants,” were pardoned by President Andrew Johnson for doing so, one of the raft of pardons Johnson issued to white Southerners after the war in the name of restoring the Union, but in fact easing the cost of defeat for the embittered white South (and contributing to his eventual impeachment).

The latitude Johnson granted the South enabled the outrages of Reconstruction, as “black codes” establishing segregation replaced slavery in all but name. Southern lands and assets were restored to prewar owners; once again, the Lehman brothers benefited along with the system they upheld, their property reinstated after the war. The Lehmans had not only survived the conflict, they had profited directly from it, without paying any penalty for their support of the Confederacy. The moral exemplum about capitalism and the American Dream to be found in the story of Lehman Brothers is primarily the way in which the South’s investment in the cotton economy profoundly shaped American history from the antebellum period onward, particularly in the slave economy’s legacy of white wealth and black impoverishment, white privilege and black disenfranchisement.

Within two decades, the Lehmans had quit cotton factoring and the South, transforming themselves into a Northern finance powerhouse on Wall Street. They continued to broker deals between Southern cotton planters and the merchants and exchanges of the North after the war, while expanding their business to other commodities, before taking a seat on the newly formed New York Stock Exchange in 1887. It is that process of transformation—leaving slavery behind but banking its profits—that is the story not only of Lehman Brothers, but also of the formation of modern American capitalism. The Lehman Trilogy wants its audiences to agree that an “abstracted” economy is somehow more morally objectionable than a “real” one, but this fable requires actively repressing the source of the “real” wealth. The Lehmans always traded in “derivative” capital; there was no golden age in which they traded innocent “goods” that became degraded by late capitalism into mere financial tools of decadent speculation.

If The Lehman Trilogy holds up a mirror to our moment, it is by registering slavery in a peripheral glance only to look away. Early in the play, Emanuel tells Henry, “I don’t want to sell buckets and spades to slaves.” Henry responds: “We sell to whoever will buy. Here in America, everything changes.” As an instance of the disavowal so often at work in popular accounts of slavery’s influence on modern America, this exchange is staggering. Slaves did not buy and sell; they were bought and sold. In endorsing the great American myth of transformation, the play implies that capitalism itself is emancipatory, that it might magically transform chattel into customers—and just as magically transform a dubious refusal to talk about slaves into a virtuous refusal to sell to slaves. The play thus succumbs to the abstraction it deplores, evading the material conditions that produced wealth to focus on capitalism as a transcendent promise of freedom and empowerment, endorsing the logic of a consumerist political economy.

Similar mechanisms of disavowal run throughout our cultural mythologies. Proslavery propaganda in the antebellum South insisted that Northern wage slaves were worse off than Southern chattel slaves. As wage slavery was conflated with an emerging trope of white slavery, bondage was rewritten as a universal condition. In the nineteenth century, even antislavery white writers were apt to suggest that capitalism made all Americans into slaves, rather than admit that American capitalism was partly made from slavery. Ishmael famously demands in Herman Melville’s Moby-Dick (1851), “Who ain’t a slave?” Henry David Thoreau agreed, declaring in Walden, “It is hard to have a southern overseer; it is worse to have a northern one.” In 1863, the year in which American slaves were emancipated, Emily Dickinson likened an author in the marketplace to a slave at auction: “Publication—is the Auction / Of the Mind of Man,” her poem begins; it ends by urging: “reduce no Human Spirit / To Disgrace of Price—.” In Mark Twain and Charles Dudley Warner’s 1873 The Gilded Age, the slave trade is just another market for the speculator Beriah Sellers to try to exploit, while Stewart Denison argued in his 1885 novel An Iron Crown: A Tale of the Great Republic that monopoly capitalism was trapping all Americans into economic bondage:

When four or five railway kings can steal one hundred and sixty millions in twenty years; when an oil company can pile fabulous millions on millions in ten years; when a Wall-street pirate can steal from the American people one hundred millions in twenty years by wrecking railroads… when the rich daily grow enormously rich, and the poor daily grow poorer; when all these things can occur, under the sanction of law, in a great republic, is it not time to stop and think? Having reflected, is it not time to act, before our slavery is complete and irremediable?

While scholars painstakingly examine the interconnections of slavery and capitalism, showing the complex traffic between Northern industrial and Southern cotton economies, too many of our popular accounts still view slavery as the South’s “peculiar institution” and treat it as a discrete, if horrifying, historical anomaly. This is how disavowal manages cognitive dissonance: it means conceding the existence of slavery, while refusing to believe that it has anything to do with the story you are telling; it means willfully pushing slavery to the edges of your consciousness and being saved by the logic of exception. The musical Hamilton does the same thing in its ambivalent dynamic of denouncing slavery’s iniquities while suggesting that its own protagonists were exempt from them. Anyone who didn’t know better would finish Hamilton innocent of the fact that George Washington owned slaves, much less that Alexander Hamilton himself bought and sold them on behalf of his wife’s family. Such stories try to have it both ways: for their heroes to be representative Americans, while erasing the vicious ways in which they truly were representative. The fact that everyone was doing it is not a defense, it merely measures the scale of the crime.